Whether to finance acquisitions, discharge restrictive or unfavourable debt terms, to fund growth or recapitalise borrowers in the mid-market globally should consider corporate debt options sourced from the US where lending conditions eased slightly in June 2020.

With banks globally restricting new funding during COVID as recession bites, the US bank and non-bank lender market are of a scale that offers debt solutions in a competitive environment to mid-market sponsors.

Here’s the latest June 2020 Corporate Debt report from our New York office, SPP Capital:

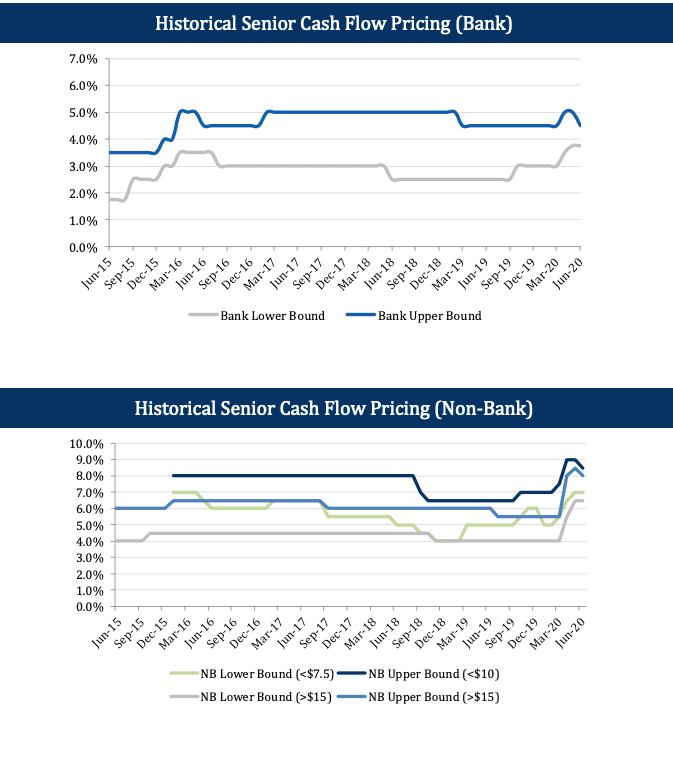

- Liquidity conditions in the US are steadily improving. Most private capital markets are actively processing new transactions. While the market is still a far cry from the competitive pricing and leverage metrics that characterized the early pre-COVID months of 2020, we are witnessing a definitive shift to lower spreads across the credit spectrum.

- Most US lenders are actively competing for new business. Most US lenders have moved on from the “putting out fires” stage and making remedial modifications to legacy portfolio assets to actively competing for new business. Importantly, the market is becoming increasingly acclimated to a fully “virtual” deal process where transactions are reviewed, processed, completed due diligence, documented, and closed without the principals ever meeting face-to-face.

- Transaction timing is also improving. During the height of the COVID crisis, closing timetables had extended from ~8-10 weeks to ~12-15 weeks; increasingly, timing for most “vanilla” financings have contracted to near pre-pandemic levels.

- Normalised COVID-19 EBITDA. Almost every deal brought to market for the next few months will be “storied” in some way or another, and investors have already begun to discuss the concept of “Normalized EBITDA” (i.e. – pre-COVID-19 annualized EBITDA, or other creative approaches). Accordingly, if the “story” is simply the impact of COVID-19, there will be more than sufficient liquidity for most issuers except those in the truly most hard hit of sectors (hospitality, restaurants, brick and mortar retail, event planners, etc.).Liquidity for issuers that were already credit-challenged going into the COVID-19 onset will experience a different course and raising capital for these entities will be particularly burdensome. This does not mean that the markets will be closed or that liquidity will be unavailable; however, it is likely that the cost of capital will be high and, in many cases, will require some equity upside.

There has been an abundance of capital raised for private market distressed financing over the course of the last three years in anticipation of a more traditional recession, and these funds combined with the influx of capital from traditional control equity sponsors now seeking minority positions will provide a much needed escape valve for issuers in need of liquidity.

If you have a current or prospective liquidity need, please book a call with any of our Private Debt team here.

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

[email protected]

Ph: +61 412 778 807