Stefan Shaffer, our New York Partner, shares the first Private Capital Report for 2022. After a year marked by excess liquidity conditions, with leverage multiples and pricing schemes among their most competitive levels in history, 2022 starts with an almost identical dynamic. Read the full report below.

State of the Private Market

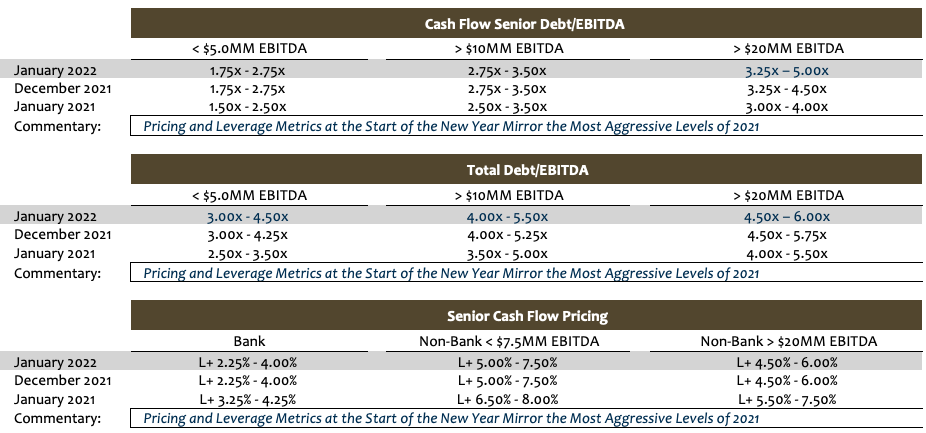

To begin 2022, liquidity conditions in the U.S. private Capital Markets remain as overwhelmingly robust as last year’s levels. Accordingly, we are kicking off the new year by expanding leverage tolerances for middle-market issuers (Sr. Debt/EBITDA and Total Debt/EBITDA).

All the traditional drivers for enhanced liquidity seem to be aligning this January, including:

- underlying macroeconomic conditions

- capital available for deployment (i.e., capital competing for deals), and

- investors’ desires to expand their portfolios.

However, unlike 2021, the likelihood of continued excess liquidity is much more tenuous, and the Fed’s strategy for the economy (as expressly stated in the most recent minutes of its FOMC Meeting on December 14th), suggests that monetary policy in the U.S. could likely change dramatically in 2022. Between the taper currently underway, three planned upticks in interest rates starting as early as March, and potential reductions in the Fed’s balance sheet, private market liquidity conditions could quickly deteriorate. For the immediate future, however, liquidity conditions remain very issuer friendly; specifically:

Continued Underlying Economic Strength/Credit Upcycle:

The Conference Board forecasts that U.S. Real GDP growth will rise to 6.5 percent (annualized rate) in Q4 2021 (vs. 2.1 percent growth in Q3 2021), and that full year 2021 GDP will hit 5.6 percent (year-over-year). Recent data published by Loomis Sayles shows that, relative to history, U.S. corporate health is strong, and we are experiencing a credit “upcycle” as U.S. companies remain in an “expansion phase.” The most recent default data also supports this credit upcycle. The number of bankruptcies of U.S. large- and medium-sized firms went from over 200 in 2020 to less than 60 in 2021. This data suggests that, from a credit perspective, lenders will be more quickly stretch on leverage, and potentially pricing, as EBITDA generation will improve consistent with macroeconomic growth. For example, average leverage outstanding for U.S. leveraged loans peaked in Q2 of 2020 at ~6.4x. However, because of improved income generation, average leverage outstanding dropped to less than 5.0x by Q3 of 2021.

Unprecedented Capital Available for Deployment:

Private Debt Investor (“PDI”) states that ~$1.3 trillion in private capital was raised in 2021. According to PDI, “this is a ground-breaking figure which has been achieved despite the COVID-induced difficulties…,” and with respect to future fundraising, “the appetite for the asset class does not appear to have eased in the slightest, and this year’s trillion-busting total is well in excess of the $880 billion figure recorded at this time last year.”

Investors in Asset Expansion Mode:

2021 was a year punctuated by record-setting transaction volumes. Almost every single lender constituency was in growth mode. U.S. leverage issuance topped $1.8 trillion in 2021, comprised of ~$463 billion in high yield volume, ~1.3 trillion leveraged loan volume, and ~$537 million of pro-rata leveraged loan volume. As of mid-December 2021, middle-market syndicated loan M&A volume posted a record ~$43 billion. While non-bank direct lenders account for the majority of private deployed in 2021, other lending constituencies have also continued to aggressively grow assets under management. Total asset growth in both public and private Business Development Companies set new records in 2021. As of Q4 2021, total assets in BDCs have climbed over $180 billion from ~$120 billion in 2020. Even commercial banks, after peaking in 2020 and experiencing declining loan volume through most of 2021, have turned the tide and have recently rebounded in commercial and industrial loans.

Stated simply, after a record-setting 2021, just about every lending constituency in the private market is aggressively seeking new opportunities for both well-established credits and more challenged issuers. Whether the use of proceeds is for a refinancing, acquisition, recapitalization, or combination thereof, there is likely to be no better time for an issuer than Q1 2022.

While it remains to be seen what the Fed’s most recent strategies will have on the private capital markets, we know it will ultimately have some adverse impact on liquidity. Tighter monetary policy is specifically crafted to defuse asset bubbles. While private middle-market investing is a far cry from crypto-currency speculation, providing leverage of 4.5x for a lower middle market issuer with less than $5 million of LTM EBITDA is relatively high on the risk spectrum. The Fed’s asset purchase program of $120 billion a month was unprecedented and clearly facilitated deployment into riskier asset classes. Similarly, while anticipated interest rate increases will likely be initially modest, these rate increases will also raise the cost of capital for leveraged non-bank direct lenders. It should not be forgotten that these same non-bank direct lenders currently constitute the largest single lending constituency in the private capital markets.

In sum, if an issuer is contemplating an offering in 2022, there is little doubt that Q1 may be the most advantageous time to execute.

We are not making any changes to our pricing metrics this month, as our published pricing indications are already among their most aggressive levels since the inception of the SPP Private Market Update in 2008.

Tone of the Market

After a year marked by excess liquidity conditions, with leverage multiples and pricing schemes among their most competitive levels in history, 2022 starts with an almost identical dynamic. However, this dynamic is altered by virtue of a dramatically different monetary policy context; the Fed’s new hawkish approach to inflation may have a profound impact on the cost of, and access to, capital for many middle-market issuers. Most private market participants report that deal flow for the start of the year is light, though it will likely accelerate as the new year engages in earnest. The first wave of deal flow will likely be comprised of two types of deals; (i) rebalancing/refinancing transactions for deals that were initially closed in 2021 by sponsors on all an equity basis to conform with more traditional leverage metrics, and (ii) offerings by smaller and more “storied” credits that were essentially locked out of the private market during the hectic months of November and December. Though the final data for 2021 has yet to be published, there is little doubt that deal activity for the full year 2021 broke prior volume records as the expanded access to capital ignited M&A activity, refinancing, recapitalizations, and restructuring.

Minimum Equity Contribution

Minimum equity contribution levels required in leveraged buyouts have remained relatively consistent since 2017, ranging from a low of 44.5% in 2018 to a high of 44.8% in 2021. As a general proposition, lenders remain wary of thinly capitalized deals and that is especially true for 2021 vintage financings where enterprise multiples were elevated. Minimum aggregate base level equity of 50% (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack, including cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Equity Investment and Co-Investment

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

Have questions?

If you have a current or prospective liquidity need, please reach out to our Private Debt team. You can book a call here.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +61 412 778 807