Stefan Shaffer shares the latest US Private Capital Report for September 2024. As 2024 progresses, the U.S. private capital markets are bracing for a potential resurgence after a relatively slow start. Following a dip in M&A activity throughout the first half of the year, a significant post-Labor Day surge is expected to ignite the deal market. Market participants are forecasting a busy end to the year, fueled by expectations of lower interest rates, pent-up demand, and easing economic uncertainties. Read the full report below.

M&A Activity in 2024: A Slow Start, But Change Is Coming

In a year punctuated by one major geopolitical or macroeconomic report after another, one consistent theme has been the relative lackluster deal flow in the U.S. private capital markets. The majority of deal flow in 2024 has been comprised primarily of repricing and refinancing activity, as M&A deal activity has continued to languish in the first half of the year. The global value of M&A activity in the first half of 2024 was ~$1.0 trillion. Although this figure is 4% higher than that of the same period last year, it is below the ten-year average of $1.5 trillion. That may be beginning to change; expectations for a post-Labor Day rebound in capital market activity are so rampant that market participants report it’s “About To Get Crazy!”

Post-Labor Day Surge: Is the Deal Market About to Heat Up?

As reported by Bloomberg, “Companies are expected to sell between $55 billion to $65 billion of junk bonds and leveraged loans this month. That is a pickup from August’s low levels, when bankers and buy-siders typically head to the beach, and before the burst of sales that usually follows the Labor Day holiday.” Specifically, leveraged loan finance volumes this September are anticipated to exceed $60.8 billion, the highest post-Labor Day surge since 2016’s highpoint of $57.7 billion. The two primary drivers for the anticipated increased deal flow dynamic are lower interest rates, deal corollary, and M&A demand. The CME’s FedWatch Tool forecasts that the fed funds rate will likely end 2024 at 4.25% – 4.50%, a full percentage point lower than the current rate of 5.25% – 5.50%, which has remained unchanged since the beginning of 2024. As of this writing, SOFR sits close to the middle of that range at ~5.32%, suggesting SOFR rates by the end of the year will be closer to 4.30%. Lower rates translate into greater debt capacity, which in turn translates to higher enterprise values—which all drive increased M&A activity.

Why M&A Demand Is Poised to Rise in Q4

As noted in a recent Bloomberg article, “The pipeline for M&A is robust,” said Cade Thompson, head of U.S. debt capital markets at KKR & Co. “While lately this hasn’t translated into increased transaction volumes, expectations of upcoming rate cuts could catalyze activity.” This year the anticipated uptick in M&A is expected to be exaggerated due to the fact that sellers have been sitting on the sidelines for the last year as a combination of higher interest rates, global geopolitical instability, and recessionary fears contributed to a virtual M&A stagnation. That logjam is expected to break loose in the second half of 2024. The EY-Parthenon Deal Barometer, which incorporates the latest EY macroeconomic outlook, estimates corporate US M&A deal volume will rise 20% in 2024, following a 17% contraction in 2023. This would represent a return to near pre-pandemic levels of activity, with the number of deals in 2024 only about 4% below the average number of deals in 2017–2019. As recently articulated by Scott Nuttall, the co-head of KKR, “The deal market is back. This year, we not only have an open market, we have pent-up supply of deals… coming to markets. So, we are optimistic.” Private equity firms are sitting on more than $2 trillion of dry powder — capital that has been committed but not yet deployed in investments, according to data provider Preqin.

Challenges for Issuers: Navigating Aggressive Market Conditions

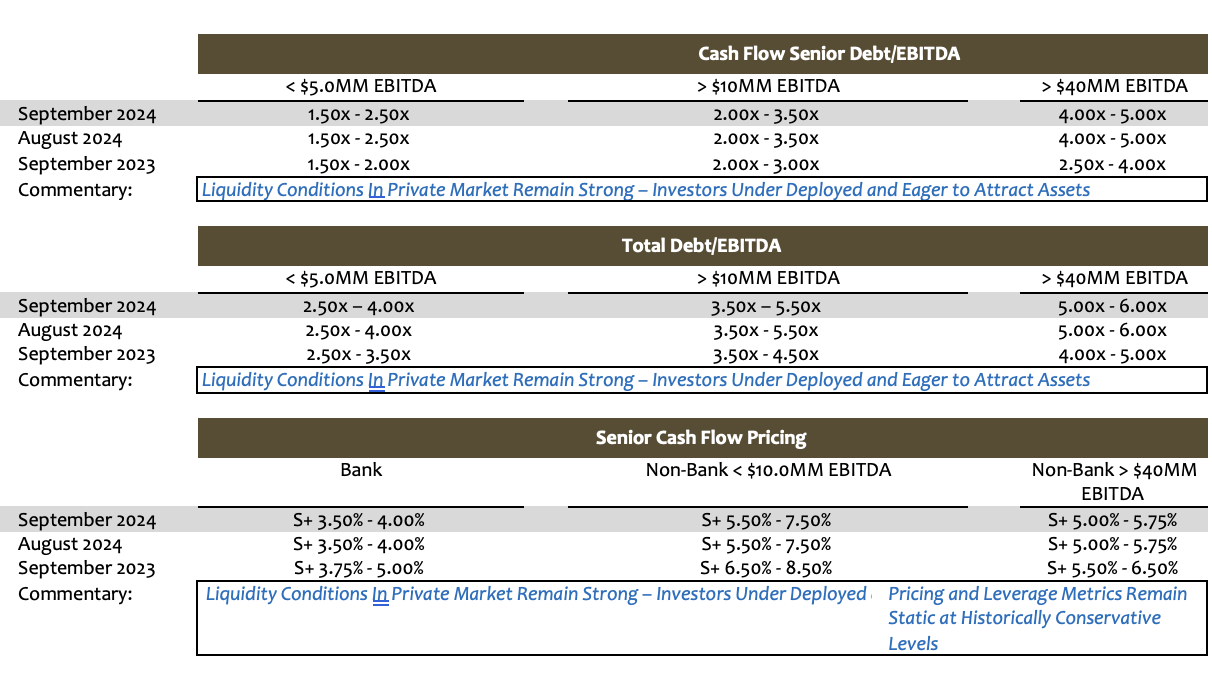

While higher reported deal flow is of course good news for buyside players, that does not necessarily mean that liquidity conditions for issuers will necessarily be impaired. To date 2024 has seen market activity characterized as “overly aggressive, driven by a clear supply demand imbalance” (HIG Whitehorse), driving credit spreads and leverage multiples to their most aggressive levels since the fall of 2021. To be a little more granular, SPP has tightened credit spreads five consecutive months in 2024 (100 to 150 basis point reduction) and widened our leverage guidance multiples (0.5x to 1.5x LTM EBITDA). While we are not tightening pricing or expanding our leverage tolerance for the month of September, even with the anticipated “deluge” of post-Labor Day transaction activity, we are not increasing pricing or reducing leverage metrics either.

A Historic Q4 Awaits: M&A Primed for a Big Finish

While it still remains an open question as to whether the post-Labor Day surge will materialize, and if so, the magnitude of the pickup, historically speaking, Q4 is consistently the single most robust quarter of the year. This year will likely be no exception and given the potential for up to three interest rate reductions igniting a rebirth in M&A activity, the one thing we do know is that it’s “About to Get Crazy!”

Tone of the Market

Not surprisingly, market activity is light going into September but expected to pick up precipitously after Labor Day. Investors report that deal flow levels year to date have been consistently below average. Drilling down further, what activity exists is comprised primarily of repricing and refinancing as M&A deal flow continues to lag. Consensus expectation is for a 25-basis point reduction (potentially 50 bp) at the September Fed Open Market Committee (“FOMC”), which will trigger an equivalent reduction in SOFR rates (currently hovering at ~5.33%). With rates coming down and a corresponding enhanced capacity for higher leverage, there is staunch support for a sharp uptick on the M&A front. Nevertheless, currently the supply-demand curve weighs heavily for the benefit of issuers, especially with non-bank direct lenders. In the private non-bank lending sector, credit spreads have stratified in a barbell-like fashion, with higher-quality issuers garnering credit spreads in the SOFR + 5.25% – 5.75% range, while lower middle market and “story” credits routinely price in the SOFR + 7.50% – 8.00% range.

Minimum Equity Contribution

Notwithstanding otherwise aggressive metrics across the market, the level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. Most lenders remain reticent to provide aggregate leverage in excess of 4.0x LTM EBITDA with only 20% to 25% new cash equity. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum continues to be an essential and primary underwriting consideration.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502