Stefan Shaffer shares the latest US Private Capital Report for December 2024. 2025 offers middle-market issuers unmatched opportunities with historic lows in credit spreads, rising leverage multiples, and improved terms. With economic optimism and a ripe M&A environment, now is the time to act. Read the full report to prepare for what’s next.

A Promising Environment for Middle-Market Issuers in Q1 2025

It is hard to imagine a more favorable environment for financing middle-market issuers than the private market in Q1 2025. Credit spreads have compressed to their lowest levels in years, and leverage multiples for larger issuers have expanded to levels not seen since just before the Great Recession. If there is one unifying theme in the market today, it is the lack of quality deal flow and the incapacity to get money to work. From an issuer’s perspective, that translates to better pricing and terms; if you are planning to undertake a capital raise in 2025, “Get Ready!”

Market Dynamics in 2024: Fed Rate Cuts and Adjusted Leverage Metrics

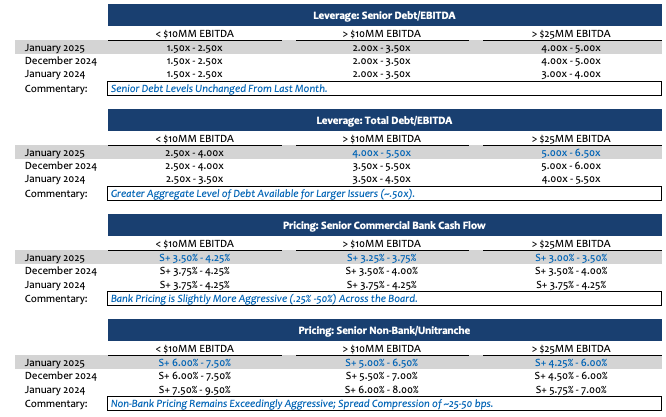

During 2024, the Fed reduced the Fed Fund rate three times (in September, November, and December) for a total of 100 basis points. During the same period, SPP reduced its indicative credit spreads five times and expanded leverage tolerances on three occasions. Going into 2025, the process continues. We are making a slight tweak to our leverage metrics, bringing the high end of the leverage multiples for issuers with greater than $25 million in LTM EBITDA to 6.50x (a half turn pop from 6.00x in Q4 of 2024). Pricing is another story; SPP is tightening indicative commercial bank cash flow pricing by 25 basis points across the board and non-bank senior, unitranche, and junior capital indications by as much as 50 basis points.

Recent reductions in pricing are certainly not unique to the private market; credit spreads for leveraged loans, investment-grade and high-yield issues have all compressed over the course of the last quarter. To put this in perspective, credit spreads for corporate issuers, from the highest-quality investment-grade issuers to the lowest-rated high-yield borrowers (and all credit qualities in between), are all currently at levels not seen since 2007, prior to the Great Recession.

Compressed Credit Spreads Across Markets

What distinguishes the private market from the larger traded markets (including the leveraged loan syndication marketplace) is that while issuance exploded in the last 12 months in these public, traded, less parochial markets, issuance still remains suppressed in the private market. As noted in a recent report from PitchBook, “U.S. private credit market activity increased at a slower pace than the syndicated loan market this year. Direct lenders faced dwindling credit spreads and renewed competition from banks.” Interestingly enough, new deal activity in the private market really tracks more to the commercial banking market than the public, 144A, and syndicated loan market. Like the traditional private placement market, during the last half of 2024, new deal activity among commercial banks was also lackluster. Data generated by MarketDesk Research shows that since the Fed started tightening monetary policy (i.e., “quantitative tightening” or “QT,” a monetary policy that central banks use to reduce the money supply and liquidity in an economy), loan growth in the U.S. banking system has been relatively weak, specifically only 2.4% in 2024 vs. ~13.0% in 2023.

Public Market Activity: Refinancing Over M&A

Finally, it should be noted that while the public, 144A, and syndicated leveraged loan market deal activity did grow precipitously in 2024, the overwhelming majority of transactions executed were not for accretive purposes such as acquisitions and capital expansion but rather driven overwhelmingly by refinancing and repricing transactions. In short, all markets, public, private, and syndicated loans were characterized by a- distinct absence of M&A activity, and it is likely that new deal activity in 2025 will also be suppressed unless there is a dramatic pick-up in M&A.

Factors Favoring a Resurgence in M&A Activity

However, conditions are clearly ripe for the long-anticipated resurgence in M&A activity:

- Sponsor “hold periods” have become attenuated, and sponsors are eager to return capital to LPs (in 2024 the median exit hold period and average existing hold period have increased to 6.4 years and 5.3 years, respectively, up from 5.1 years and 4.9 years, respectively in 2021);

- The “all-in” cost of capital is about 150+ basis points lower than it was in January of 2024 (SOFR down ~1% and spread compression of another 50+ basis points);

- Macroeconomic data remains robust (see below), and;

- Expectations are that the new administration will be more “business friendly” (i.e., less regulatory impediments).

By the same token, there remains a significant concern about the impact of the new administration’s proposed tariff policy, and ongoing geopolitical conflicts (Ukraine and the Mideast at the forefront) pose a persistent threat of global uncertainty and volatility.

In short, all indications suggest that 2025 is going to be a very exciting time. “Get Ready.”

Tone of the Market

Initial pricing and leverage metric indications point to a particularly aggressive private market start to 2025; bank and non-bank lenders are flush with cash and hungry to book new assets in January. After an unusually long holiday and very little new deal activity for the last 30 days, bank and non-bank lenders, private credit funds, SBICs, BDCs, and insurance companies are all vying for a limited inventory of new assets. 2024 was a “meh” to “ok” year for most market participants, the clear bulk of transaction activity dominated by refinancing and repricing amid a dearth of M&A activity, especially in the middle market. Expectations are that M&A deal flow will finally break open in 2025 as sponsors seek to harvest long-held assets and return capital to LPs (especially those seeking to raise new funds later in the year). Conventional wisdom suggests that enterprise valuations should be enhanced by (i) greater leverage capacity across the board; (ii) credit spread compression (pricing is ~50-75 basis points tighter than January of 2024); (iii) lower base rates (SOFR today is ~4.30%, ~110 basis points below where they started the year in 2024); (iv) a perceived more business-friendly political/regulatory environment; and (v) hopes for a potentially less volatile geopolitical atmosphere (with a focus on the Mideast and Ukraine). While the jury is still out on the deployment and magnitude of a tougher new tariff policy and its potentially adverse consequences on macroeconomic activity, there is little doubt that presumptive issuers in Q1 of 2025 will have among the most competitive issuance conditions since 2022.

Minimum Equity Contribution

The level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders remain fixated on a minimum 50% LTV (i.e., equity capitalization of 50% of enterprise value), and actual new cash in a deal should also constitute at least 75% of the aggregate equity account. While lenders will certainly give credit to seller notes and rollover equity, the cash equity quantum continues to be an essential and primary underwriting consideration. The good news is that non-bank lenders, private credit funds, insurance companies, BDCs, and SBICs are all potential sources of equity capital as well as debt capital, and in many cases, are more than happy to shore up and backfill the equity account directly.

Equity Investment

Liquidity for both direct equity investments and co-investments is robust in the new year, and in most cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Importantly, equity investment can take a variety of forms (preferred, common, warrants, even HoldCo notes) depending on the unique requirements of a given deal. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real “skin in the game” (i.e., a meaningful investment of their own above and beyond a roll-over of deal fees). While family offices remain the best source of straight common equity, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing combined debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502