Stefan Shaffer shares the latest US Private Capital Report for June 2025. Private credit remains steady and issuer‑friendly in 2025, even as M&A activity lags and public markets swing wildly. This report explores why deal flow is stalled, how abundant dry powder shapes lending, and what these trends mean for dealmakers ahead. Read the full report to prepare for what’s next.

The Waiting Game

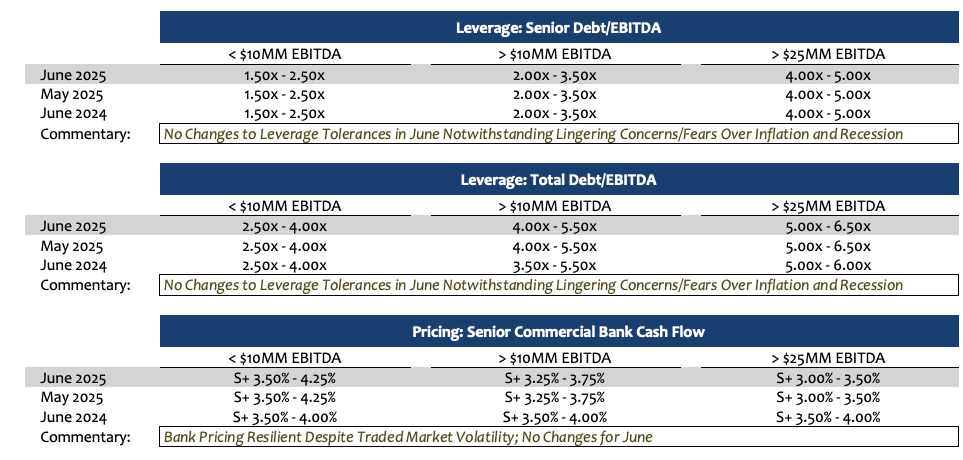

For the fifth consecutive month in 2025, we see no changes to its Market-At-a-Glance metrics, a striking contrast to the volatility roiling public and syndicated debt markets. Despite geopolitical tensions, tariff uncertainties, and fluctuating recession odds, private market conditions remain steadfastly issuer-friendly; leverage multiples, pricing, and terms in June mirror January’s levels, which were among the most competitive since 2007. Consistency in pricing, leverage, and liquidity is not a reflection of market confidence, however, but rather a symptom of inertia. The long-anticipated resurgence in M&A activity remains elusive; deal flow continues to underwhelm, with new money transactions (acquisitions, growth capital, and leveraged recaps) still lagging historical norms. For market professionals this June, “the waiting is the hardest part.”

Public Markets Volatility Versus Private Market Stability

The public markets tell a different story. The ICE BofA U.S. High Yield Index Option-Adjusted Spread (OAS) spiked to 485 basis points on May 15th before settling at 325 basis points by June 5th, a 33% swing in just three weeks (source: FRED). Investment-grade bonds (ICE BofA U.S. Corporate Index) saw spreads climb from 93 basis points to 130 basis points and back to 95 basis points over the same period, reflecting a 40% fluctuation (source: FRED). Recession odds, per Polymarket, peaked at 60% in early May but have since moderated to 35% by mid-June. These gyrations correlate with ongoing trade policy uncertainties, yet the private market remains unmoved.

Ample Liquidity, Limited Opportunities

The resilience of private market liquidity stems from two persistent drivers: an unprecedented $570 billion in private credit dry powder (source: PitchBook, June 2025) and a continued scarcity of new money deal flow (M&A, leveraged buyouts, and growth capital). PitchBook notes that private debt dry powder grew by 0.6% from May’s $566.8 billion, with fundraising holding steady despite a sluggish M&A environment. New money issuance in Q2 2025 accounted for just 12% of leveraged loan volume, compared to a five-year average of 30% (source: Bloomberg). This imbalance—abundant capital chasing limited opportunities—keeps lenders aggressive, offering competitive pricing and terms.

Why M&A Activity Remains Slow

M&A activity, or more correctly stated, the lack of M&A activity, continues to be the prime culprit for the current private market doldrums. Bloomberg reports that Q2 2025 saw only 350 private equity exits valued at $160 billion, down from Q1’s 402 exits at $186.6 billion. The backlog of unsold portfolio companies now exceeds 12,500, with 4,000 held for over five years (source: PitchBook). Since 2019, the average hold period (i.e., years to exit from date of first investment) has increased from 7 years to 8.2. According to E&Y Parthenon, “For U.S. deal volume over $100m, Q1 [2025] showed early positive signs relative to 2024, surpassing last year’s levels by about 9% in total (6% for corporate M&A and 16% for PE). However, slower monthly momentum in dealmaking activity at the end of Q1 along with slower expected GDP growth, persistently elevated policy uncertainty and heightened financial market volatility, will challenge dealmaking through the rest of the year. We estimate that total US deal volume (PE plus corporate M&A) will only rise 1% in 2025, following a 19% advance in 2024… In our pessimistic scenario—where GDP growth and corporate profits are weaker, inflation hotter and interest rates higher—deal volume is expected to contract by 6% in 2025.” Getting more granular, there is an increasing body of data supporting even a sharper decline in M&A activity through year-end:

- Q1 2025: Deal counts declined sharply (down -19%) from Q4 2024, despite an increase in announced deal values

- April 2025

- US M&A activity declined overall.

- Deal volume exceeding U.S.$100 million fell 18.7% from March.

- Deal volume is down 24.8% year-over-year (YoY) for deals exceeding US$100m.

- Corporate M&A deal volume (>$100 million) dropped 30.5% YoY.

- Private equity deal volume (>$100 million) fell 3.6% YoY.

- U.S. M&A deal activity decreased 1.6% from March.

- February 2025: Saw the fewest monthly deals announced in the past four years (3,208 deals).

Leveraged Recaps Gain Ground

This scarcity of actionable financings amplifies opportunities for leveraged recapitalizations, as sponsors seek liquidity without exiting at depressed valuations. Lenders are responding with leverage tolerances up to 4.75x LTM EBITDA for issuers above $25 million in EBITDA and pricing and terms typically reserved for accretive transactions. Even lower middle market issuers (EBITDA < $10 million) can achieve aggregate leverage multiples of 4.0x in a leveraged recap scenario. But the foundation underpinning these market conditions is fragile. Should inflation re-accelerate or recession fears materialize, the private market will not be immune. Lenders are already preparing for a potential down-cycle, with greater scrutiny of covenant structures, increased diligence, and a renewed focus on cash equity contributions.

Conclusion: A Fragile Standstill

In short, the private market is in a state of suspended animation—waiting for clarity, waiting for deals, and waiting for the next macroeconomic shoe to drop. Until then, the music plays on, but the tempo is slowing… and “The waiting is the hardest part.”

Tone of the Market

As we hit the halfway mark of 2025, the private market remains a bastion of stability in a world of economic turbulence and geopolitical volatility. Despite tariff tantrums, recession whispers, and traded market rollercoasters, private credit spreads and leverage multiples are as steady as a metronome. Private credit dry powder, still at a record $566.8 billion, continues to fuel aggressive terms, while a drought in new money deal flow—acquisitions, LBOs, and growth capital—keeps lenders hungry for opportunities. M&A deal flow in particular has gone from weak to downright anemic, with the deal count down 35% year-over-year. Pricing, leverage, and terms in June are virtually identical to January’s and among the most issuer-friendly since pre-Great Recession days. Yet, to many market participants, this issuer-friendly environment feels like a calm before the storm; interest rates have “been higher for longer,” and cyclical sectors struggling under the combined burden of inflationary tariffs and increased capital costs could face an inflection point leading to increased defaults. Though such a situation may not precipitate a full-blown “credit meltdown,” at the very least, it could lead to a more pronounced “risk-off” issuance environment.

Minimum Equity Contribution

The level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders remain fixated on a minimum 50% LTV (i.e., equity capitalization of 50% of enterprise value), and actual new cash in a deal should also constitute at least 75% of the aggregate equity account. While lenders will certainly give credit to seller notes and rollover equity, the cash equity quantum continues to be an essential and primary underwriting consideration. The good news is that non-bank lenders, private credit funds, insurance companies, BDCs, and SBICs are all potential sources of equity capital as well as debt capital, and in many cases, are more than happy to shore up and backfill the equity account directly.

Equity Investment

Liquidity for both direct equity investments and co-investments is robust in the new year, and in most cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Importantly, equity investment can take a variety of forms (preferred, common, warrants, even HoldCo notes) depending on the unique requirements of a given deal. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real “skin in the game” (i.e., a meaningful investment of their own above and beyond a roll-over of deal fees). While family offices remain the best source of straight common equity, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing combined debt and equity tranches.

Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502