Stefan Shaffer shares the latest US Private Capital Report for February 2023. Most private market participants still anticipate a sustained credit “down-cycle” and continue to underwrite in part with an expectation of a recession by Q4 2023 or Q1 2024. However, over the course of the last month, there seems to be a growing chorus arguing that things may be Not So Bad after all. SPP’s anecdotal experience exhibit that there is overwhelming interest in transactions that contain some. Read the full report below.

Tone of the Market

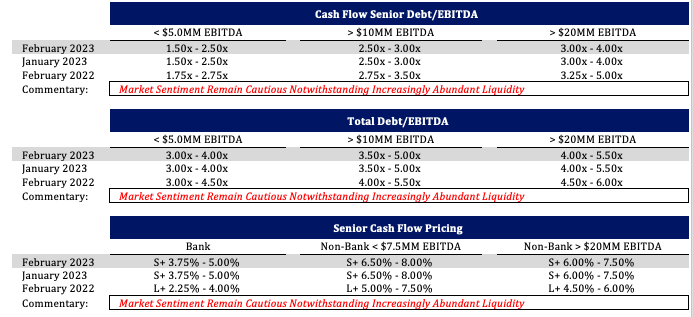

While we are not making any specific modifications to credit spread or leverage multiple indications for the month of February, the combination of excess liquidity among investors (i.e., accumulated dry powder and reduced deployment in 2022), weaker than anticipated current deal flow, and growing optimism respecting underlying macroeconomic conditions have coalesced to provide subtle, but genuine, pressure to current pricing and leverage metrics. Though lenders are still reluctant to drop spreads across the board, transactions undertaken by well-capitalized issuers in non-cyclical sectors, supported by well-regarded sponsors, will receive substantial competitive interest, and unsurprisingly, markedly discounted pricing. Additionally, there seems to be a fair amount of confusion in pricing overall. The run-up in both (i) base SOFR rates (from .05% in Q2 2022 to more than 4.50% Q1 2023) and (ii) non-bank senior/unitranche spreads (from SOFR + ~6.00% in Q1 2022 to ~7.50% in Q1 2023) has created somewhat of a dislocation in pricing. For instance, the “all-in” cost of capital for senior and unitranche pricing on a floating rate basis is presently higher than the fixed rates charged by SBICs and other mid-market mezzanine lenders (i.e., ~11.00% – 13.00%). This anomaly in pricing suggests that traditional bifurcated debt structures (i.e., separate senior bank debt facilities combined with mezzanine notes) will provide substantially tighter “all-in” pricing than one-stop unitranche structures, ultimately reversing a decade long trend

Private Market: Not So Bad After All

What Comes Next?

Since the new year began, the recurrent theme in the private market has been “things are going to get worse before they get better.” Our most recent survey of senior professionals at commercial banks, non-bank direct lenders, BDCs, credit funds, finance companies, insurance companies, and SBICs concluded that most private market participants still anticipate a sustained credit “down-cycle” and continue to underwrite in part with an expectation of a recession by Q4 2023 or Q1 2024. However, over the course of the last month, there seems to be a growing chorus arguing that things may be not So Bad after all.

There is no lack of support for the proposition that the U.S. and global economies are still spiraling toward a recession. The key findings of the Chief Economists Outlook, at the Davos World Economic Forum, noted “a majority of the World Economic Forum’s Community of Chief Economists expect a global recession in 2023, see geopolitical tensions continuing to shape the global economy, and anticipate further monetary tightening in the United States and Europe.” Bankrate.com’s most recent survey of leading economists similarly noted, “the U.S. economy has a 64 percent chance of contracting in 2023, according to the average forecast among economists. Just two experts (or 15 percent) said the financial system could avoid a downturn, putting the odds of a recession at 40 percent. Meanwhile, one economist arrived at 100 percent odds — signifying he was absolutely certain of a recession.”

The most recent Longview Economics “Recession Warning Scoreboard,” which tracks categories of leading economic indicators of a potential recession, has eight of its ten key economic indicators indicating a recession in 2023. This is the highest level since 2007-2008, which ultimately foreshadowed the start of the Great Recession. Even assuming a “soft landing” where the U.S. economy averts recession, the forecast for a robust economic rebound is minimal. S&P and Moody’s each predict a palpable increase in the ratio of credit downgrades to upgrades, heightened default rates, and a rise in bankruptcies through 2023.

Capitalization is key

Accordingly, we are not making any modifications to its pricing or leverage guidance for the month of February, and maintaining the metrics published in our January Update. The takeaways from last month include:

- For the foreseeable future, this will be a fully priced market with credit spreads ~150 basis points higher and leverage multiples ~1/2 turn lower than last year at this time.

- Capitalization is key; cash equity contributions will need to be at least 40% of the capital stack for LBOs and leveraged recapitalizations with greater than 40% debt to enterprise value will be suspect.

- Delay draw facilities will be harder to arrange as investors will be loath to commit to facilities in an ostensibly declining credit environment.

- General aversion to highly cyclical sectors and storied credits.

SPP’s continued “risk-off” guidance is consistent with Federal Reserve’s most recent Senior Loan Officer Opinion Survey, which addresses changes in the standards and terms on, and demand for, bank loans to businesses over the past three months (which generally correspond to the fourth quarter of 2022). Among the Survey’s conclusions were:

“Over the fourth quarter, significant net shares of banks reported having tightened standards on C&I loans to firms of all sizes. Banks also reported having tightened all queried terms on C&I loans to firms of all sizes over the fourth quarter. Tightening was most widely reported for premiums charged on riskier loans, spreads of loan rates over the cost of funds, and costs of credit lines. In addition, significant net shares of banks reported having tightened loan covenants and collateralization requirements to firms of all sizes… Similarly, a significant net share of foreign banks reported having tightened standards for C&I loans over the fourth quarter. Major net shares of banks that reported having tightened standards or terms on C&I loans cited a less favorable or more uncertain economic outlook, a reduced tolerance for risk, and the worsening of industry-specific problems as important reasons for doing so.”

Pent-up demand for transactions

However, given the strength of significant recent macroeconomic reports (i.e., non-farm payrolls added more than half a million jobs in January, the housing market showing signs of stability, and the latest University of Michigan Consumer Sentiment Index at 66.4%), there seems to be an increasing dialogue of private market participants questioning the opinion that a recession is inevitable or even likely in 2023. In addition, there is significant pent-up demand for transactions as investors feel the need to deploy capital after a relatively anemic 2022 that saw (i) M&A activity at its lowest point since Q2 2010, and (ii) PE exit activity declining by 28% from 2021.

In short, despite the consensus of a sustained retreat in the lending markets, there is an increasing sense of urgency from institutional investors to get fresh capital to work, and to the extent it can be deployed in a sector that is not correlated to macroeconomic volatility, exceedingly compelling pricing and terms can be achieved. While there isn’t reportable empirical data published yet, SPP’s anecdotal experience exhibit that there is overwhelming interest in transactions that contain some, if not all, of the following characteristics:

(i) sectors that are deemed recession resistant, or counter cyclical,

(ii) transactions supported by well-regarded or “marquis” private equity sponsors,

(iii) issuers with consistent and reliable historical EBITDA generation, and (iv) “market leverage” of less than 4.5x LTM EBITDA.

To provide real-time support for this proposition, in a recent deal marketed by SPP with the characteristics noted above, more than 80% of our initial outreach (~ 75 lenders) expressed interest and signed NDAs within the first three days of the transaction launch. We anticipate a robust oversubscription on terms from a broad cross section of lending constituencies including commercial banks, non-bank direct lenders, insurance companies, and credit funds spanning senior, subordinate and unitranche structures.

Minimum Equity Contribution

Conservative capitalization structures are a primary focus for lenders going into 2023. In fact, the level of new cash equity in a deal may be the most crucial factor for not only determining pricing, but whether a deal even gets done. Lenders report that a minimum of 50% equity capitalization is critical for most LBOs, and new cash equity should constitute at least 40% of the cap table. Correspondingly, lenders will also focus on how much of an equity sponsor’s initial capital contribution remains in its investment; if more than 60% of the initial equity contribution has been recapped or returned through dividends, additional debt capital will likely be subject to substantially more restrictive leverage metrics (i.e., below 3.0x).

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502