Stefan Shaffer, our New York Partner, shares the latest Private Capital Report for April 2022. It looks as though the war in Ukraine, the global economic uncertainty the conflict has precipitated, and continued inflationary pressures may have finally caught up with the U.S. private capital markets. Read the full report below.

Private Debt Market Defying Gravity in Q1

During the first quarter of 2022, it seemed like the private debt markets were defying gravity. While public equity markets corrected (S&P 500 Index down ~7.75% YTD, NASDAQ down ~14.3% YTD), high yield prices dove (High Yield 100 down ~6.27% YTD), and even high-quality corporate bonds got hammered (AA-rated bonds down ~11.09% YTD, BBB rated bonds down ~10.76% YTD), the private market ticked along seemingly unaffected. In contrast, year to date, we have increased our leverage multiple guidance twice, (January 2022 and February 2022), and made no modifications to our indicative pricing guidance through March. However, due to changing macroeconomic and geopolitical conditions, we are modifying our pricing metrics for April. Macroeconomic and geopolitical volatility seemed to have finally caught up to the private debt markets.

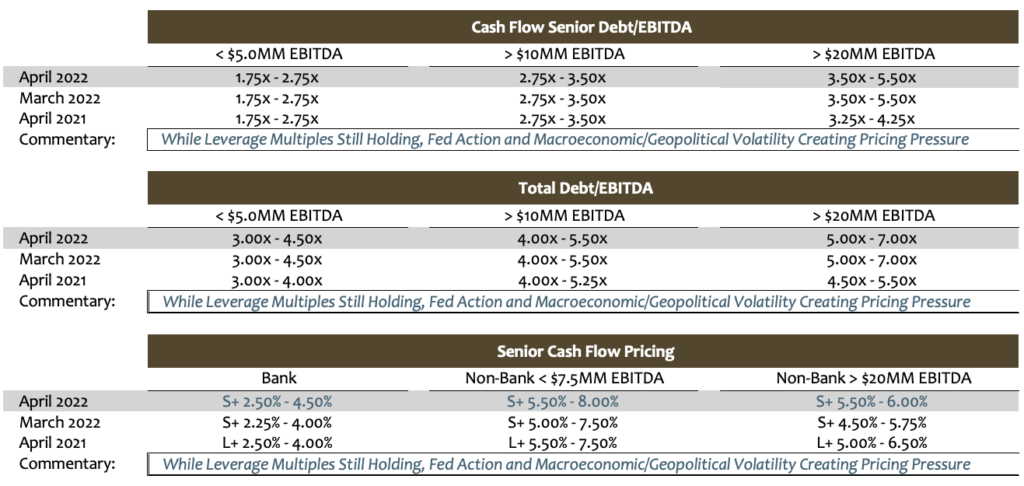

We are raising our pricing guidance across the board for April, lifting spreads by approximately 50 basis points for both commercial bank and non-bank direct senior cash flow financings, uni-tranche and second lien structures, and subordinated debt. Indicative cost of capital guidance is of course case-specific, and most of the initial pricing pressure will be felt by lower middle-market issuers (sub $10 million in LTM EBITDA), “storied” or more challenged credits, or issuers in highly cyclical sectors. Use of proceeds will also be a major consideration; pricing for non-accretive uses of capital such as dividend recapitalizations or share repurchases will drive higher spreads than acquisition financings, growth capital, or other accretive uses of proceeds. We are not making any changes to its leverage multiple guidance for the month. However, any material downturn in economic activity will also clearly have a chilling effect on leverage tolerances. Not surprisingly, the same factors that impacted pricing this month will also influence aggregate leverage, including sponsored vs. non-sponsored financing, sector, size, and credit strength of the issuer.

Inflation Threatens Access to Private Market Liquidity

The drivers impacting private market pricing and leverage multiples are by no means a mystery at this point. Inflation and the war in Ukraine have combined to not only drive up the cost of capital but also potentially threaten even access to liquidity in the private market. The March consumer price index (“CPI”) surged to a four-decade high of 8.5%, driven by skyrocketing energy and food costs. This is the highest annual pace since 1981, and a 6.5% premium to the Fed’s 2.0% target. On a brighter note, Core CPI (which excludes the more volatile food and energy costs) increased 6.5% year on year but was only up 0.3% from the prior month (expectation was for a 0.5% tick up), which could suggest that core inflation may have peaked and will decline in the coming months. However, it appears that the Fed has decided it does not have time to wait for inflation to naturally transition and has taken a more hawkish posture. At the March Open Market Committee, Fed officials agreed to begin trimming the central bank’s balance sheet by $95 billion a month and indicated that after its initial 25 basis point increase, 50 basis point rate increases are likely ahead.

Additionally, the war in Ukraine continues to frustrate supply chain channels and will likely slow GDP growth in the U.S. Goldman Sachs cut its forecast for GDP growth to 1.75% from 2.00% in March. According to Jan Hatzius, Goldman Sach’s chief economist, “We now see the risk that the U.S. enters a recession during the next year as broadly in line with the 20-35% odds currently implied by models based on the slope of the yield curve”.

The potential for a recession is not as outlandish as it sounds. According to a Bloomberg Markets Live Survey conducted between March 29 and April 1, “48% of investors expect the U.S. to fall into recession next year. Another 21% expect the downturn to happen in 2024, while 15% of the 525 respondents expect the recession to come as early as this year.” Deutsche Bank became the first major bank to forecast a U.S. recession for next year. The report co-authored by the bank’s chief economist, David Folkerts-Landau, and former Fed official Peter Hooper finds that “the U.S. economy is expected to take a major hit from the extra Fed tightening by late next year and early 2024.”

Private Market Conditions Remain Exceedingly Aggressive

It must be noted that private market conditions, on balance, still remain exceedingly aggressive. Even with SPP’s revised guidance on pricing, credit spreads and leverage multiples remain at historically competitive levels, and there is little empirical data to suggest that liquidity conditions will reverse themselves in the near future. However, the cumulative effect of the macroeconomic and geopolitical influences discussed above may already be taking a toll on leveraged activity in general. According to Refinitiv LPC, “The combination of SOFR rollout, inflationary pressures, labor and supply chain issues and the war in Ukraine (as well as its impact on commodities) all tinged the US leveraged loan market in 1Q22, contributing to lower volumes and increasing spreads. At $186.3bn, 1Q22 leveraged loan volume was down 48% compared to year ago levels. At $98.92bn, leveraged institutional issuance was down a more substantial 62% year over year, while the HY bond market plummeted almost 70% year over year.”

In sum, underlying private market liquidity conditions remain robust, but the same influences that have plagued the larger capital markets ecosystem may have finally caught up.

Tone of the Private Market

It looks as though the war in Ukraine, the global economic uncertainty the conflict has precipitated, and continued inflationary pressures may have finally caught up with the U.S. private capital markets. Pricing for many middle market issuers is already beginning to tick upwards by approximately 50 basis points. While leverage tolerances remain, for the most part, at the same aggressive levels set earlier in the year for acquisitions and other “accretive” uses of capital, leveraged recapitalizations and other “non-accretive” uses of proceeds will be subject to stricter leverage guidance. Companies with exposure to highly cyclical sectors, and especially those with heavy capex needs, are beginning to face a less accommodating private market characterized by tighter leverage multiples, higher pricing, and more restrictive covenant schemes. It should be noted that to date, these changes have been modest in scope. However, should underlying inflationary influences persevere through Q3 2022, combined with the Fed’s continued interest rate hikes to cool the economy, and the contagion from the hostilities in Ukraine augment the potential for recession in the U.S., the private capital markets could quickly morph into a state remarkably like Q3 2020 during the initial stages of the pandemic.

Minimum Equity Contribution

Minimum equity contribution levels required in leveraged buyouts have remained relatively consistent since 2017, ranging from a low of 44.5% in 2018 to a high of 44.8% in 2021. As a general proposition, lenders remain wary of thinly capitalized deals and that is especially true for 2021 vintage financings where enterprise multiples were elevated. Minimum aggregate base level equity of 50% (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack, including cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Recapitalization Liquidity

M&A activity remains somewhat muted compared to 2021, while recapitalization activity continues at a robust pace. Recapitalizations for both sponsored and non-sponsored transactions remain elevated, with sponsored recapitalizations receiving more aggressive leverage tolerances and tighter pricing. The aggregate proceeds generated by a recapitalization will be in large part a function of perceived enterprise value, with leverage multiples reaching up to 50% of enterprise value for issuers with more than $20 million in LTM EBITDA.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502