Stefan Shaffer shares the latest US Private Capital Report for Oct 2023. Private market deal flow is surprisingly light this October. As a general rule, new deal activity begins to build dramatically in the first few weeks after Labor Day, but that is definitely not the case in 2023. Read the full report below.

Private Market Deal Flow Lighter Than Expected

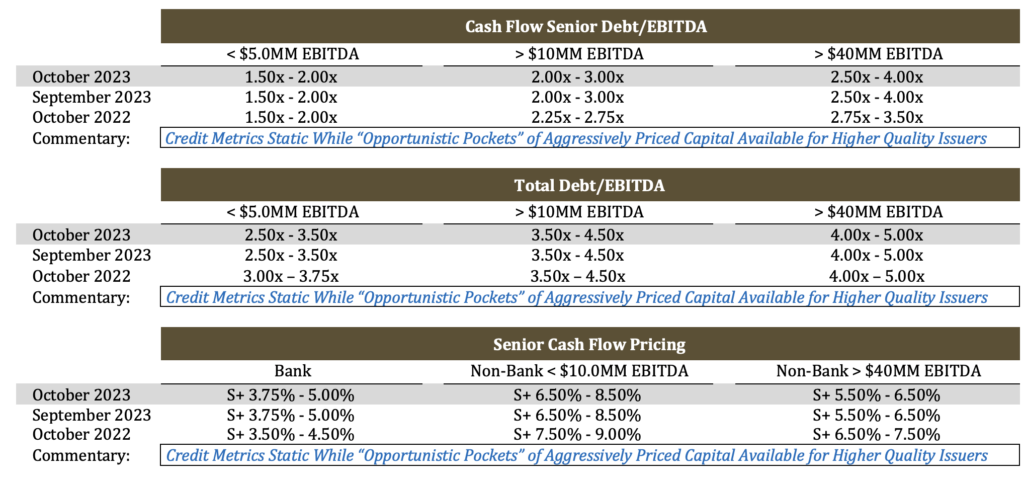

We are not making any changes to its pricing and leverage indications this month as metrics seem to have stabilized at current levels. The headline news in the market, surprisingly, is not about deals, but rather the lack of them. Lenders across the credit spectrum report a profound diminution of transaction activity, which, given the time of year, is especially alarming. Financing activity in the final quarter of the year is almost always characterized by a robust round of new deal flow, usually strategically timed to close by year-end. Though it’s too early in the quarter to have any empirical data to support the trend, anecdotal accounts suggest that new transaction activity has literally fallen off a cliff. It’s not rocket science to figure out the culprit; the Fed has hiked rates 11 times in an effort to cool inflation, putting the funds target rate range between 5.25% and 5.50%, almost 5.50% since January 2022, and representing the fastest growth in interest costs in recent history. Simply stated, this is a high-interest rate environment, and it is likely to remain as such for an extended period. Welcome to “The Real World.”

The title song for last month’s update was “Before the Deluge” by Jackson Browne, reflecting the private market’s traditional spike in ‘Q4 deal flow. As noted above, it seems apparent heading into the final two months of 2023, that is not going to be the case this year. Lenders canvassed by SPP over the course of the last few weeks almost universally report they are long cash and short deals in ‘Q4. As is typically the case in the private market, when deal flow declines, most lending institutions will compete aggressively in an effort to secure new assets. Already, we have witnessed an increased willingness for lenders to consider leveraged recapitalizations, opening a window that had been largely shut for most of the year. Additionally, closing fees are falling back in line with historical levels (~.50%-1.00% for commercial banks and ~2.00% for non-bank direct and mezzanine lenders), about ~.50% and 1.00% cheaper for banks and non-bank lenders, respectively. With respect to pricing, lenders generally will lower credit spreads by 25-50 basis points to secure a transaction; however, with base rates having spiked so precipitously over the course of the last year (SOFR is hovering around 5.31%), 25 basis points don’t materially change the all-in blended cost of capital.

Issuers Holding Off on Financing Activity

While many potential issuers have the luxury of holding off any financing activity for the short term, ultimately, most companies will have to transact in what will likely be a high interest environment at some point in the next 12 – 24 months, and given the stickiness of the current inflation cycle, rates will likely remain at elevated rates for the near future. As noted by Goldman Sachs Chief economist Lofti Karoui in a recent interview with Pitchbook, “Everything that’s happened the last five or six weeks seems to suggest that 2024 is shaping up as another year of elevated cost of capital. You’re not getting any funding relief for the next four quarters at least, maybe longer. This means that the ability of companies across the board to offset those elevated funding costs via strong earnings growth is going to remain greatly constrained. Basically, you have a 5 ½-point increase in interest expenses over a very short period of time, and that—combined with what we know is a very sluggish earnings growth environment—means there’s no question that the higher-for-longer cost of capital environment is going to test the asset class in a way that the COVID-19 crisis did not”.

New Paradigm Financing Market Expected in 2024

To put this into practical terms, most traditional commercial bank and non-bank direct lending facilities range from 3-5 years on average, which means a sizable portion of the financing activity transacted in 2020 and 2021 will be due for refinancing in 2024 and 2025 (i.e., the “maturity wall”). Not only will putative issuers be subject to a materially increased cost of capital from their initial financing, but also a vastly different constituency of lenders. The March 2023 banking crisis instigated by the collapse of Silicon Valley Bank continues to reverberate through the private capital markets. Commercial banks have taken a distinct step back from cash-flow lending, especially from cash flow lending for middle-market issuers. As stated specifically in the Fed’s July Senior Loan Officer Opinion Survey on Bank Lending Practices, commercial banks “reported a reduced tolerance for risk, deterioration in their liquidity positions, worsening industry-specific problems, increased concerns about the effects of legislative changes, supervisory actions, or changes in accounting standards, and decreased liquidity in the secondary market for loans as important reasons for tightening standards or terms for C&I loans.” Again, like interest rates, the withdrawal of commercial banks from middle market cash flow lending is a phenomenon that will not likely correct itself in the next 12-24 months. The “new paradigm” financing market that will greet middle market issuers in 2024 and 2025 will likely be comprised primarily of non-bank direct lenders. According to Pitchbook data, the private debt market has grown exponentially over the past few years, exceeding $1.5 trillion in 2022 with $434.4 billion in dry powder.

While non-bank direct lenders have a significantly higher cost of capital than commercial banks for middle market issuers (i.e., SOFR +7.00% – 7.50% vs. SOFR + 3.50% – 4.00% respectively), they do offer other benefits, specifically lower annual required term loan amortization (1.0% – 2.5% per annum vs. 7.5% – 10.0% respectively). Assuming a continuation of current trends, a typical 4.0x leveraged middle market issuer will, in most cases, have to choose between two alternative financing strategies, specifically: (i) an ABL term loan provided by a commercial bank combined with a non-amortizing tranche of subordinated debt provided by a mezzanine fund, or (ii) an all-senior unitranche non-bank term facility.

In sum, when it comes to middle market financing, change is coming; it will impact pricing considerations, transaction structures, and lending constituencies. That is the “Real World.”

Tone of the Market

Private market deal flow is surprisingly light this October. As a general rule, new deal activity begins to build dramatically in the first few weeks after Labor Day, but that is definitely not the case in 2023. Market participants report anecdotally that deal flow has dropped to some of its lowest levels of the year, and the anticipated traditional “deluge” of Q4 deal flow is becoming increasingly unlikely. The dearth of new transaction activity can obviously be attributed to the progressive increase in interest rates; SOFR is currently at ~5.30%, resulting in traditional cash flow bank deals being priced at ~8.80% – 9.30%, while non-bank direct lending costs are closer to 11.80% – 12.30% for the majority of middle market issuers ($7.50 – $20.0 million in LTM EBITDA). These capital costs have had a chilling effect on discretionary new issuance and refinancing, while at the same time depressing enterprise multiples and, consequently, overall M&A activity. Adding insult to injury, regional commercial banks, historically the lender of choice for middle market issuers, continue their retreat from middle market cash flow lending, leaving more expensive non-bank senior, unitranche, and mezzanine capital providers as the only viable alternative sources of capital. The good news is that there are alternative approaches to credit that are available for issuers vulnerable to increased borrowing costs, whether it be a low-cost formula ABL structure (SOFR + 2.50%) combined with a non-amortizing tranche of sub debt or a tier of structured equity with a PIK preferred dividend. These structures, while not cheap (and can even prove to be dilutive), do alleviate constraints on cash flow and ease fixed charge coverage burdens.

Minimum Equity Contribution

Cash equity contributions have become the primary focus point for all leveraged buyouts in the private market. Almost regardless of the enterprise multiple, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. For the foreseeable future, the days of 20% – 25% equity contributions are over. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum is the primary metric.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502