Stefan Shaffer shares the latest US Private Capital Report for Sept 2023. As the calendar inches closer to the fourth quarter, the private market experiences a familiar surge in deal activity. This year in particular, they anticipate a literal deluge of new deal flow—all with identical timing—closing by year-end. In this article, we’ll delve into the dynamics at play in this year’s year-end rush. The private market is poised for a busy and transformative period. Those who act early may find stability and favorable conditions. Read the full report below.

Surge in Deal Activity Expected in Q4

Every year, deal activity in the private market gets gradually more hectic in the fourth quarter as issuers vie to lock in financing prior to year-end. Unfortunately, as the deal calendar gets increasingly congested, capacity for credit review becomes more strained, and transaction timetables inevitably become attenuated. That is even more so in 2023, a year characterized by exaggerated macroeconomic volatility, a commercial banking crisis, and a 12-month spike in interest rates of 232 basis points (from 2.99% on 9/27/22 to 5.31% on 9/27/23). Private market participants not only expect the typical flurry of new deal activity in the final quarter of 2023, but this year in particular, they anticipate a literal deluge of new deal flow—all with identical timing—closing by year-end. As history has proven in prior years, those issuers that can get deals into the market early in Q4 will have the best odds of closing prior to the end of the year. In short, the trick is to get into the market “Before the Deluge.”

Stable Liquidity Conditions in Q4

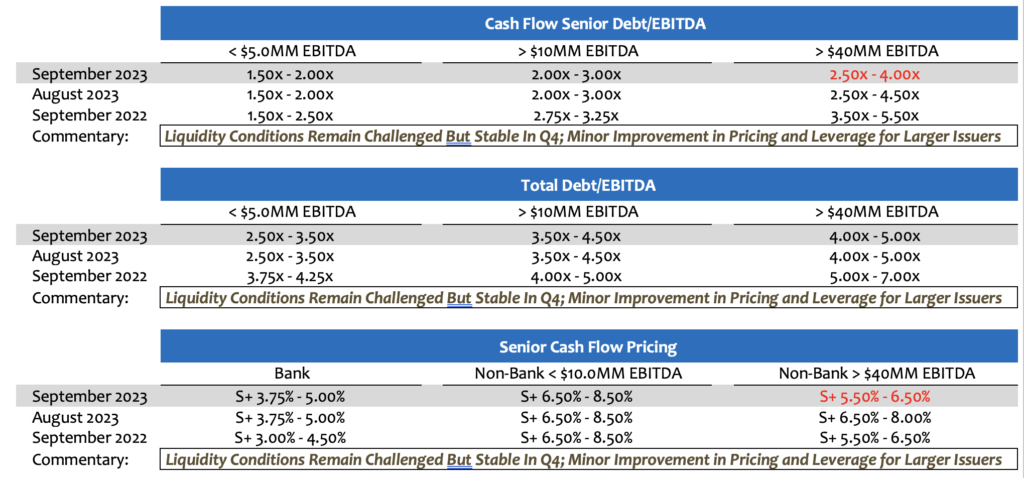

The good news is that issuers that get into the market early in ‘Q4 23, will find liquidity conditions that, while not optimal, are at least stable. SPP has not made any material modifications to its leverage multiples and credit spread guidance this month, reflecting the fact that pricing and leverage metrics have, in large part, stratified at current levels. With respect to larger middle market issuers (~$15-$40+ million in LTM EBITDA), we have even lowered our credit spread guidance between 50 and 100 basis points. The compression in pricing is not particularly noteworthy; it just reflects the increasing competition for higher-quality assets (i.e., higher EBITDA generation, lower leverage, better capitalization, and/or well-regarded sponsor support). It should be noted that better pricing is not the only benefit accruing to these larger, better capitalized issuers; importantly, these companies will also be strong candidates for leveraged recapitalizations, enhanced delay draw facilities, and more competitive covenant structures.

Shifts in the Private Market Landscape

While our tweaks to the metrics are minor quantitative adjustments to terms for ‘Q4, there are significantly more profound qualitative shifts underway in the private market, specifically (i) the continued retreat of commercial banking lenders across the private market credit spectrum and (ii) the increased role of private direct lending credit funds as the dominant source of capital for middle market lending.

The failure of Silicon Valley Bank in March instigated something of a “banking crisis” that continues to reverberate in the current private capital market. Private market participants uniformly report that commercial banking credit facilities continue to become increasingly difficult to execute, with most commercial banks, and especially with respect to regional commercial banks, failing to renew expiring credit facilities and not aggressively bidding new potential banking customers. Typical “hold” sizes for credit facilities have also declined.

As reported in the July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices published by the Board of Governors of the Federal Reserve, “Over the second quarter, major and significant net shares of banks reported having tightened standards on C&I loans to large and middle-market firms and small firms, respectively. Additionally, banks reported having tightened all queried loan terms on C&I loans to firms of all sizes over the second quarter.” Commercial bank loan growth has fallen to its lowest level since the height of the pandemic, and expectations for future loan growth are decidedly pessimistic.

Shift from traditional banks to private lenders

In the same way nature abhors a vacuum (i.e., “nature requires every space to be filled—and that there are no naturally occurring empty spaces because denser surrounding material immediately and always fills a void”), the private market has compensated for the void in commercial bank lending by supplanting it with non-bank direct lenders. As Ares Management’s private credit head, Sara McGinty, noted in a recent WSH Pro series,” the shift from traditional banks to private lenders is a transitional moment as big as what we saw post-financial crisis… As [banks] are pulling back we’re moving into the space, because there’s a really attractive risk-return there.” According to Pitchbook, total private-debt assets under management exceeded $1.2 trillion as of the end of 2022, and firms raised more than $200 billion for new funds over the course of 2023. Recent data released by Preqin also points to the increased liquidity available for deployment in the private market: “Direct lending dry powder in North America hit a record breaking $123.9bn as of July 2023. While displaying gradual growth from 2021 to 2022, the last six months saw a 16% increase, the largest jump in nearly five years”.

SPP’s anecdotal experience in recent months confirms the empirical data: commercial bank lending has diminished to its lowest level in years, and that is especially the case in cash flow facilities for middle market issuers. To the extent we do see a commercial bank component in financing, it is usually in the context of an asset-based revolving credit facility transaction combined with a cash flow term loan provided by a non-bank direct lender or mezzanine facility provided by an SBIC. While non-bank lending facilities carry a significant premium to traditional bank term financing (SOFR + 6.50% – 8.00% non-bank vs. SOFR +3.50% – 4.50% commercial bank), fixed amortization requirements for non-bank facilities are significantly less stringent (1.0% – 2.5% on average for non-bank vs. ~10% per annum for commercial banks), resulting ultimately in similar aggregate debt service cash requirements.

Conclusion

As we approach the final quarter of 2023, the private market is poised for a busy and transformative period. Those who act early may find stability and favorable conditions. While challenges persist, the shift towards non-bank lending and the increased availability of private capital are reshaping the landscape.

In the ever-evolving world of private market dynamics, staying informed and proactive is essential for success.

Tone of the Market

There is little headline news in the private market going into Q4; credit spreads and leverage multiples remain roughly in the same range as they did in the early summer months. However, given the greater macroeconomic uncertainty, lenders are happy to expand leverage tolerances and tighten spreads for larger, better capitalized issuers. Accordingly, SPP is making only minor modifications to its metrics to better reflect the increasingly competitive environment for higher-quality assets. Below the headline numbers, however, there is a more profound metamorphosis underway: commercial banks, especially smaller, more regionally based institutions, continue their retrenchment from cash flow-based lending, focusing increasingly on ABL formula-based facilities. This departure is leaving many middle market issuers (and especially lower middle market issuers) in the lurch with few competitive sources of capital. Not surprisingly, non-bank direct lenders are filling the void, in large part becoming the de facto provider of cashflow-based facilities for the middle market. Unfortunately, non-bank direct lenders’ cost of capital comes at a hefty 250 – 400 basis point premium to the commercial banking lending constituency. With SOFR rates hovering around 5.50%, this only serves to further stress fixed charge and debt service coverage ratios. In many cases, the only viable alternative sources of capital for lower middle market issuers (sub-$10 million in LTM EBITDA) is a formula based ABL revolving credit facility paired with either (i) a non-bank direct lender term loan or (ii) mezzanine financing provided by an SBIC.

Minimum Equity Contribution

Cash equity contributions have become the primary focus point for all leveraged buyouts in the private market. Almost regardless of the enterprise multiple, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. For the foreseeable future, the days of 20% – 25% equity contributions are over. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum is the primary metric.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502