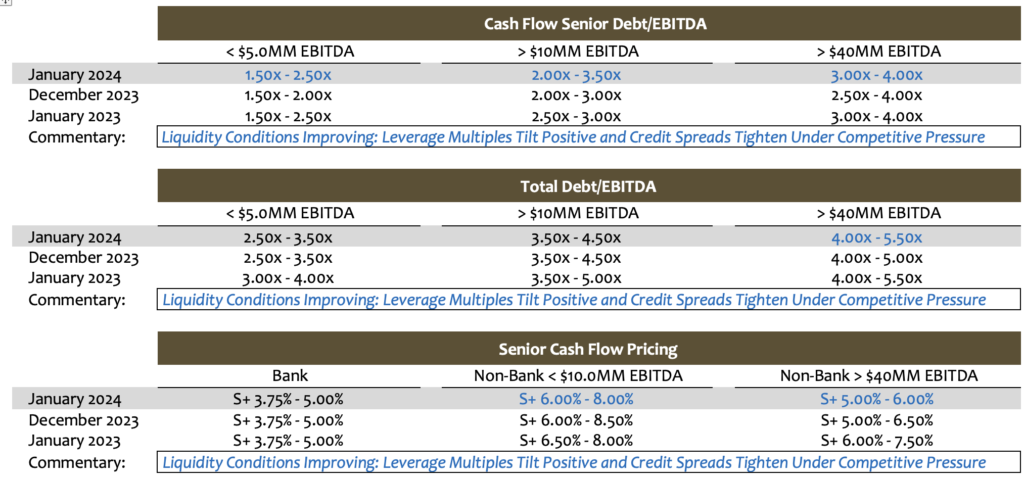

Stefan Shaffer shares the latest US Private Capital Report for January 2024. In a positive turn of events for January, we are reducing the credit spread indications across the middle market credit spectrum by approximately 50 basis points. In addition, we are making a slight adjustment to our leverage multiple indications, expanding them by a half-turn more of EBITDA for issuers with at least $10 million in LTM EBITDA. It’s hard to pinpoint what is driving the new sense of optimism and enthusiasm, but it is readily apparent that, after twelve months of repeated interest rate increases, the threat of recession, marked declines in M&A and refinancing activity, and an ever increasingly volatile and unstable geopolitical landscape, almost all investing constituencies in the private capital markets are ready get to back to deal-making. If there is a battle cry in the private debt markets these days, it is undoubtedly “Let’s Get it Started.”

Impact of Increasing Interest Rates

There is little doubt that repeated rate increases have had a distinct chilling effect on new transaction activity over the course of the last year. SOFR now sits at ~5.31%, about 1% above where it started the year and about 5% higher than it was in January of 2022. Increased interest costs have prevented issuers from seeking refinancing, and impaired private equity’s capacity to meaningfully employ leverage. The lack of leverage in turn adversely impacts enterprise multiples, which disincentivized the sale of portfolio assets. The prevailing strategy among many middle market issuers was to simply “hang tight” until such time as the Fed reduced the cost of capital. At the same time, starting in March 2023 with the SVB-induced “banking crisis of 2023,” commercial banks took a pronounced step back from cash flow lending, especially for lower middle market issuers, and in many cases, forced these issuers from cheaper bank financing (SOFR + 3.5% – 4.0%) to higher-cost non-bank direct lending (SOFR + 6.50% – 7.50%).

Factors Shaping Landscape For Issuers and Lenders in 2024

There are a variety of factors at play in 2024, which we anticipate may change the calculus for both issuers and lenders. From an issuer’s perspective, first and foremost, conventional wisdom is that interest rates are going to be “higher for longer.” The recent Federal Open Market Committee (“FOMC”) meeting minutes attest to the fact that while inflation has abated from its highs in 2023, it is still stubbornly higher than the Fed’s 2% mandate. While the Fed has paused its Fed Funds rate increases, near-term reductions in the Fed Funds rate are still likely more than a quarter away. Most bank and non-bank credit facilities range in maturity between 3 and 5 years; accordingly, transactions executed between 2020 to 2022 will begin to come due in 2024 and 2025. Additionally, most bank senior term facilities have backloaded amortization structures (i.e., where they only amortize 5% – 7.5% in the initial years of the debt facility; amortization increases to 15% – 20% in the latter years); this stepped-up amortization drives down fixed charge coverages, but more importantly, it compels issuers to seek refinancing. In short, many middle-market issuers are facing a “perfect storm”—interest rates are higher, but amortization demands, and upcoming maturity dates are forcing them into the market—and increasingly, a market dominated by more expensive private credit lenders, not low-cost bank facilities. There is some upside; however, non-bank credit facilities, while more expensive, require significantly lower fixed amortization, ranging from 1.0% per annum to 5.0% per annum.

From a private lender perspective, this may be the best of all possible worlds—rates for high-quality middle market issuers (i.e., >$20 million in LTM EBITDA; Total Debt/EBITDA less than 4.0x) are still priced at ~SOFR + 6.00% – 6.50% (i.e., 11.30% – 11.80%), a return historically more associated with mezzanine security than high-quality senior debt risk. At the same time, both inflation and recession risks have abated, ostensibly lowering their credit risk. As noted by Troy Gayeski of FS Investments in GF Data’s annual review, “We’re in kind of a dream scenario for private lenders… We have to pinch ourselves a little bit because not only is the Fed going with ‘higher for longer’ but the probability of a recession has dropped significantly. We also have a positive feedback loop from stable government spending, more business and more construction driven by the Inflation Reduction Act. This creates an ideal environment for direct lenders, which stand to earn more income for longer at wider spreads and lower leverage levels.”

Liquidity in Private Credit An All-Time High

It is no surprise that private credit has grown so precipitously in recent years, which also coincides with a precipitous decline in commercial banking. The shift from commercial banking to non-bank private credit has been nothing short of seismic. As reported by PE Daily: “Since the financial crisis, lending activity has been leaving banks as regulations have tightened, forcing banks out of some businesses, while accruing to the shadow banking industry, which accounted for nearly 47% of assets in the financial system in 2022, up from 43% in 2008, according to recent data from the U.S. Financial Stability Board. That trend doesn’t look set to change soon. Upheaval in the sector this spring has ramped up regulatory pressure for banks to adhere to Basel III Endgame, a set of rules requiring banks to hold more capital against their risk-weighted assets. Implementation of the rules, which are set to begin next year, will constrain banks’ ability to lend — basically meaning that banks will favor only the more pristine credits, putting small businesses and borrowers with unconventional credit histories at risk of losing funding. Private creditors, while charging steeper interest rates, can guarantee funding — as long as they feel it’s worth the risk.”

How big has private credit become? Today, is estimated that private credit is ~$1.6 trillion and is on a path to grow to $2.3 trillion by 2027 (estimates are that the private credit AUM swelled to almost $900 billion in the last year alone).

It is precisely these dynamics that are the driving force behind our reduction in credit spread metrics for the month of January. That capital simply must be deployed. Importantly, the growth of private credit AUM comes at the same time as a dramatic decline in middle market deal flow. According to PitchBook’s Q3 US PE Middle Market Report, middle market buyouts are down to a six-year low. The third quarter dipped to an estimated $87.7 billion, a 13% decline from Q2 2023 and a 48% decline from the peak in Q4 2021. Simply stated, liquidity in private credit is at an all-time high, while new transaction issuance has been in steep decline since 2021—as the song goes, Let’s Get it Started!

Tone of the Private Market

Hope springs anew in 2024! Though leverage tolerances have loosened to a small extent, they remain relatively unchanged from Q4 ’23; however, pricing is tightening. SPP is lowering credit spreads by approximately 50 basis points across the credit spectrum. The downward pressure on credit spreads is largely driven by the non-bank direct lending community, whose dry powder continues to build in the face of diminished deal flow. High interest rates (SOFR currently sits at 5.31%) have had a profound and chilling effect on both M&A and refinancing, driving a steep decline in deal flow since peak activity in 2021. Competition for new assets is fierce and given that both bank and private credit lenders can still earn returns of 10.00% – 11.50% in cash interest for high-quality senior debt risk, there is certainly some additional room for spread compression for the best assets. Recent Fed pronouncements suggest that interest rates will remain “higher for longer,” so issuers contemplating a potential debt issuance in 2024 would be well served to get in early in the year, when deal flow is light and competition for new assets is so aggressive.

Minimum Equity Contribution

Cash equity contributions have become the primary focus point for all leveraged buyouts in the private market. Regardless of the enterprise multiple, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. For the foreseeable future, the days of 20% – 25% equity contributions are over. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum is the primary metric.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502