Stefan Shaffer, our New York Partner, shares the latest Private Capital Report for September 2022. Overall, liquidity conditions remain comparatively robust, and most issuers this month will find ample funding sources available, albeit at a decidedly higher cost of capital. Read the full report below.

The Real World

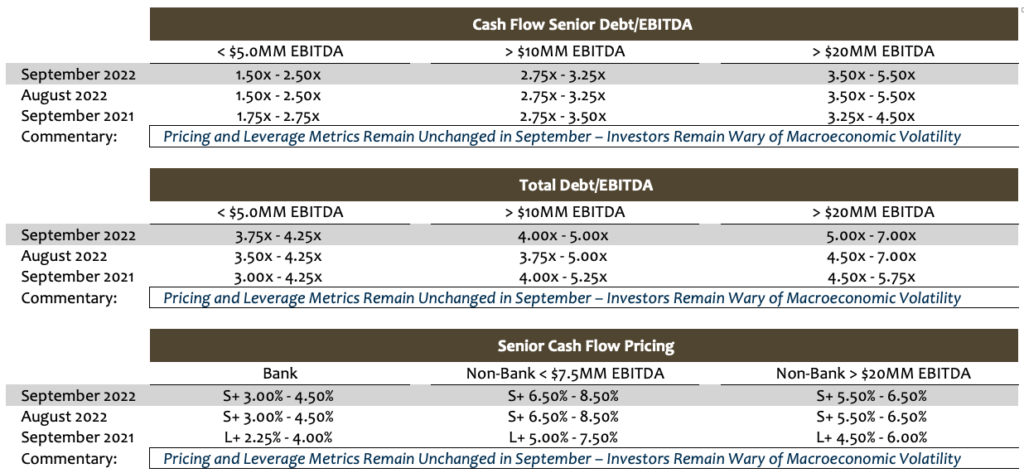

We are not making any modifications to its credit spread or leverage multiple metrics for September, reflecting the market’s acceptance of a more conservative credit environment. Nevertheless, liquidity conditions remain comparatively robust, and most issuers in September will find ample funding sources available, albeit at a decidedly higher cost of capital. With the exception of the highest quality issuers, all-in pricing for the clear majority of issuers sits at approximately 2.0% – 4.0% higher than this time last year. Welcome to the Real World.

To be clear, credit spreads for most issuers have not widened from 2.0% – 4.0%, as there are a variety of factors at play. First, base rates have expanded to levels not seen since before the Great Recession. For the last decade, LIBOR rates ranged between 0.0% – 1.0%. Today, SOFR (LIBOR’s replacement) currently sits at ~2.3%, with term SOFR rates ranging from 2.77% – 3.72% for 1-month SOFR to 12-month SOFR, respectively.

As detailed monthly in the SPP “Private Market At a Glance,” credit spreads above the base SOFR rate have widened as well, ranging from ~50 – 100 basis points for commercial bank cash flow loans, ~100 – 200 basis points for senior non-bank direct lenders, and ~150 – 250 basis points for unitranche, second lien, and subordinated notes. Of course, the individual credit profile of a given issuer will also have a profound impact on the magnitude of the increase in credit spreads. For instance, while credit spreads for high-quality issuers (>$25 million in LTM EBITDA with moderate leverage) may have risen only 25 – 50 basis points, the increase can be as much as 200 basis points for lower middle market issuers (<$10 million in LTM EBITDA). This “credit quality spread discrimination” is readily apparent in the high-yield market. The difference in spreads between CCC-rated bonds and single B-rated bonds has expanded from ~1.75% in mid-2021 to over 5% in 2022. On top of that, the use of proceeds (i.e., acquisition vs. recapitalization), sector (i.e., cyclical vs. defensive), and credit history, all also have a significant impact on pricing.

For purposes of illustration, in September of 2021, SPP brought a middle market manufacturer with ~$10 million in LTM EBITDA to the non-bank direct lending market and secured pricing of LIBOR + 6.0% (1.0% LIBOR floor) for all in pricing of 7.0%. Today, that same issuer would likely garner SOFR + 7.5%, with a 2.5% SOFR floor, for an all-in cost of capital of 10.0%.

In short, what was standard senior debt pricing in 2021 feels like mezzanine pricing in 2022.

Importantly, most institutional investors canvassed by SPP over the course of the last month still anticipate a sustained credit down-cycle for the remainder of 2022 and into Q1 2023. Inflation, the war in Ukraine, and increasingly weaker global macroeconomic conditions, including potential recessions among developed European nations, have all conspired to keep investors firmly in risk-off mode. The expectation of a third consecutive 0.75% increase in the Fed Funds rate later this month only further exacerbates the situation as SOFR rate spikes will likely follow. A growing number of investors report creating “no-fly zones” for vulnerable and cyclical sectors such as apparel, discretionary retail, and building products.

Again, capital is still readily available for most issuers, but as a general proposition, anticipate elevated spreads and curtailed leverage multiples. This is the Real World.

Tone of the market

Heading into the final month of Q3, the private market, for lack of a better term, is “quirky.” While market dynamics have largely remained unchanged since June, including elevated interest rates and credit spreads, enhanced credit scrutiny (i.e., tighter leverage multiples, less flexible covenant structures etc.), and an agreement among most investors that there will be a sustained credit down-cycle though year-end, the amount of credit fund “dry powder” remains at an all-time high, and the number of “outliers” (i.e. lenders willing to buck the tide and bid aggressively on selected credits) continues to increase as many lenders find themselves under deployed for 2022. While the market is still, as a general proposition, in “risk-off” mode, there remains an exceedingly liquid constituency of lenders available. Importantly, base rates are at some of the highest levels we have seen since the Great Recession (SOFR sits at approximately 2.30%), which will likely have a chilling effect on aggregate leverage levels, and correspondingly, enterprise valuation multiples.

Minimum Equity Contribution

Minimum equity contribution levels required in leveraged buyouts have remained relatively consistent since 2017, ranging from a low of 44.5% in 2018 to a high of 44.8% in 2021. As a general proposition, lenders remain wary of thinly capitalized deals and that is especially true for 2021 vintage financings where enterprise multiples were elevated. Minimum aggregate base level equity of 50% (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack, including cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Equity Investment and Co-Investment

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502