Stefan Shaffer shares the latest US Private Capital Report for October 2024. As we enter the last quarter of 2024, private market dynamics have taken an unexpected turn. Lower Fed rates, which would usually kick-start refinancing and M&A activity, were expected to fuel intense deal flow. Yet, the anticipated demand has not materialized, leading to a surprising tightening of credit spreads rather than an uptick in activity. With private lenders now underinvested, Q4 may present an ideal window for capital raises in an unexpectedly liquid market. Could this be the optimal time for your business to consider issuance? Read the full report below.

The Calm Before the Storm

Last month’s “State of the Private Market” was entitled “About to Get Crazy,” reflecting our belief that the Fed’s decision to lower interest rates (the Fed Funds Rate range was lowered from 5.25%-5.50% to 4.75%-5.00%) was going to drive a deluge of new deal flow into the traditional private placement market. The long-awaited reduction in rates would spur companies to refinance at lower rates, undertake deferred capital projects, and most significantly, unlock a wave of M&A activity (i.e., lower rates translate to greater debt capacity, which translates to higher enterprise multiples, which drives exit activity). On top of all this, it was taking place in the last quarter of the calendar year, traditionally the most active season in the private market for deal-making. If anything, I expected that for our October Update I would be increasing credit spreads reflecting the increased demand for capital against a finite amount of capital and resources. Instead, SPP is lowering credit spread metrics across the credit spectrum by a factor of 25 to 50 basis points. That is just “Strange.”

Interest Rate Shift Sparks Optimism for Private Placement Markets

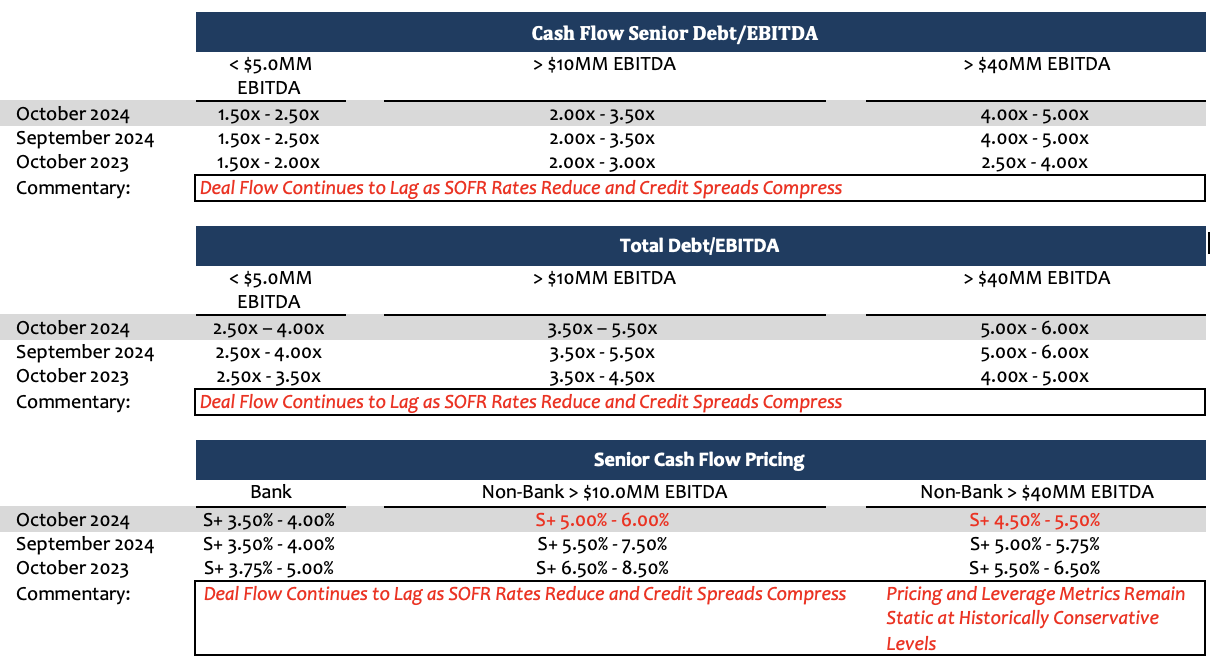

More specifically, SPP is lowering its credit spread metrics by approximately 50 basis points for senior non-bank direct lending and by 25 to 50 basis points for unitranche and second lien financing. The move comes in response to the private market’s need to attract deal flow; institutional private credit providers remain starved for quality deal flow and come into Q4 of 2024 palpably underinvested for the year. SPP’s anecdotal data, based on our continued canvassing of more than 120 middle market commercial banks, non-bank direct lenders, and private credit funds, shows that deal flow is approximately 75% of what it was a year ago. Our data is consistent with recently published data by LSEG; according to LSEG LPC’s 4Q24 Middle Market Outlook Survey, most middle market lenders found “insufficient” deal flow for Q324. “A majority of respondents (63%) said they were not able to lend as much as they wanted in 3Q24. This was particularly the case for banks, with 83% of them not lending as much as they wanted. In comparison, the responses from direct lenders were more mixed, with just over half (52%) not able to lend as much as they desired”.

Unexpected Tightening in Credit Spreads

A tightening in credit spreads is not unique to private middle market lenders. Almost every major credit constituency (public, private, 144A, and syndicated loans) has experienced enhanced liquidity, evidenced by tighter credit spreads in recent weeks; investment grade spreads have tightened 50 to 100 basis points, and high yields by 100 to 150 basis points. However, the similarities between the more parochial, illiquid private middle market and the more efficient, larger “traded” markets end there. While private market deal activity remains suppressed, deal flow in the traded markets has literally exploded in the last month.

As reported by Kelly Thompson of KBRA Direct Lending Deals (“KBRA DLD”), private “jumbo loan” (loans whose aggregate principal amount exceeds $1 billion) volume has increased dramatically in recent months. “Private jumbo loan volume stands at a record totaling $69.7 billion through Sept. 18. The total tops full-year volume of $50.3 billion in 2023, and the previous high of $59.2 billion recorded in 2022. Final 3Q24 numbers are pending but indicate YTD volume will be closer to $80 billion. At the current pace, full-year volume is on track to finish at roughly $100 billion, assuming 4Q24 volume can match 4Q23.” We have also seen a massive leap in deal flow in the U.S. broadly syndicated loan market. As reported by LSEG LPC, “The U.S. broadly syndicated loan market supported over US$110.5bn of acquisition financing in 3Q24, the strongest quarterly results in over two years, pushing 1-3Q24 totals to nearly US$266bn. Issuance for the first nine months was up 35% year over year.”

Current Challenges in Private Market Deal Flow

The big question remains as to why deal flow in the private middle market still lags compared to its larger traded peers. Historically, at least, private market activity tends to move slower than the more efficient traded markets. For one thing, private lenders are traditionally “buy & hold” investors, creating the need to have more detailed, unique, and restrictive covenant schemes (as a general proposition, lenders cannot simply “trade out” of a loan gone south); thus, deal processes themselves tend to be more protracted and lengthier. However, SPP’s anecdotal investor surveys suggest the real reason behind the slower deal calendar in the private market is that the much-anticipated increase in M&A has simply not materialized… yet.

This trend is supported by recent data published by PitchBook, which suggests GPs are not rushing to the market yet to sell off assets, even in light of the current lower interest rate/higher enterprise value model. M&A deal activity has declined globally each year since 2021, when the value of M&A transactions reached an eight-year peak of $4.7 trillion, according to PitchBook. The total fell to $3 trillion last year and at $1.46 trillion this year through June is on track for a further decline. According to PitchBook, “GPs that have held out for better exit conditions stretched out the median holding period of PE investments, which reached a record of 6.4 years for U.S. PE middle-market assets in 2023. GPs have alleviated some of the pressure mounting from a backlog of exits, rolling back the median holding period to 5.4 years for assets that have exited this year so far. The same trend can be seen in the broader PE market as well. Still, the exit/investment ratio fell to 0.36x in Q2, a new low that reflects the beleaguered state of exits. Thus, we can assume that GPs are bringing their highest-quality assets to market to secure favorable exits while holding off on the rest of their portfolios. We expect holding periods of PE backed exits to remain drawn out until the exit environment improves meaningfully.”

Lingering Uncertainty and Projections for M&A Recovery

While deal activity in the traditional private middle market remains lethargic, there is still a widespread consensus that deal activity will pick up, and the uptick should be substantial. “As [the] cost of capital comes down, you’ll see an increase in transaction volume, and the most direct beneficiary of that increase in transaction volume will be direct lending because a lot of the activity in that market is M&A driven,” said Michael Zawadzki, the global chief investment officer for Blackstone’s credit and insurance team.

Q4 2024: The Most Favorable Liquidity Conditions for Middle Market Issuers in Years?

So, taking stock of current conditions, middle market issuers currently have about the best possible liquidity conditions for issuance they have had in years. Base SOFR rates are lower and expected to drop further, credit spreads have tightened (and absent a flood of new deal activity in the coming weeks, may even continue to compress), and private market lenders are markedly underinvested for 2024. Rather than Q4 being the least hospitable environment for new financing, in 2024, Q4 may in fact be optimal for issuance. “Strange.”

Tone of the Market

All indications are the liquidity conditions are optimal for issuance in Q4 of 2024; (i) SOFR rates have declined to ~4.90%, down about 40 basis points since the Fed lowered the Fed Funds rate at its September FOMC meeting; (ii) credit spreads for mid-upper middle market issuers have compressed by approximately 25-50 basis points; and (iii) the majority of private credit portfolios remain underinvested for the year. Strangely, however, new deal activity in the private market is stunningly anemic. The predictions for a dam-busting deluge of new M&A activity this fall have simply not materialized, and even the traditional Q4 surge of deals set to close by year-end lags behind prior periods.

Historically, the fourth quarter is a less hospitable issuance environment for middle market issuers, as larger, better capitalized issuers dominate the new deal calendar, but 2024 may prove to be the exception. Even lower and mid-middle market issuers will benefit from tighter spreads, enhanced leverage capacity, and increased receptivity to non-accretive uses of capital such as leveraged recapitalization financings. However, the lack of uptick in activity may prove to be more of a timing issue than anything else. Larger corporations, “jumbo” issuers, widely syndicated deals, and the publicly traded markets have all experienced record amounts of new deal flow; the traditional private capital middle markets, we believe, are simply lagging behind the more efficient traded markets.

Minimum Equity Contribution

Notwithstanding otherwise aggressive metrics across the market, the level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. Most lenders remain reticent to provide aggregate leverage in excess of 4.0x LTM EBITDA with only 20% to 25% new cash equity. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum continues to be an essential and primary underwriting consideration.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502