Stefan Shaffer shares the latest US Private Capital Report for February 2024. With credit spreads lowered for private market issuers across various segments, optimism is on the rise fueled by robust economic data and a decline in new transaction activity. As economic conditions continue to improve, lenders are transitioning to a more bullish stance, creating a favorable environment for issuers of all kinds. Read the full report below.

A Notable Shift in the Private Capital Landscape

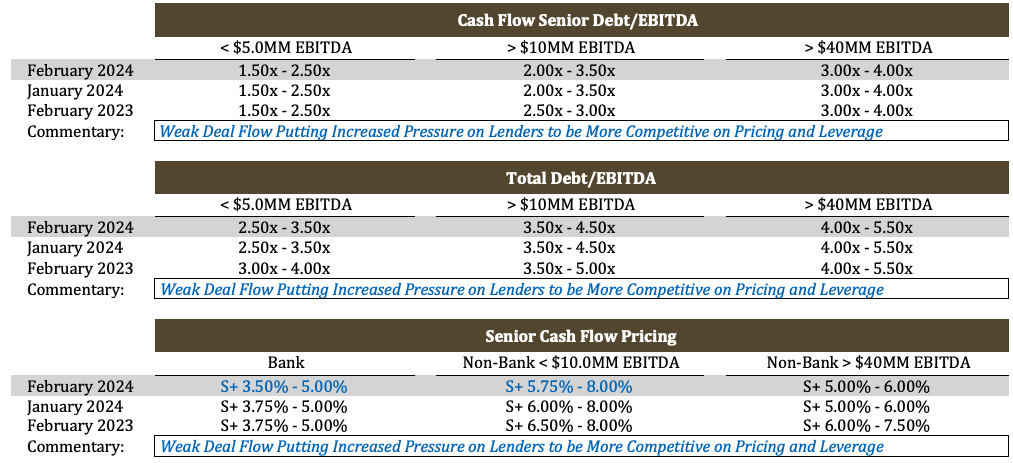

For the second consecutive month in a row, we are lowering its credit spread indications for private market issuers. More specifically, we are lowering credit spreads by 25 basis points on the low end of the band for both senior cash flow loans by commercial banks (from SOFR + 3.75% to SOFR + 3.50%) and by non-bank direct lenders (from SOFR + 6.00% to SOFR + 5.75%). Additionally, we have reduced credit spreads for both unitranche and second lien pricing by 25 basis points for issuers with greater than $10 million in LTM EBITDA (from SOFR+6.00% to SOFR+5.75%) and by 50 basis points for issuers with greater than $40 million in LTM EBITDA (from SOFR+5.75% to SOFR+5.25%). Importantly, these modifications come on the heels of both tighter pricing indications and increased leverage tolerance indications for the month of January. There seem to be two primary drivers for the increased optimism sweeping the private capital markets:

- (i) increasingly robust economic data, and

- (ii) markedly reduced new transaction activity, and especially, a dramatic reduction in higher-quality transactions.

However, regardless of the specific cause, issuers and lenders agree that everything is “Better Now.”

There is little doubt that macroeconomic conditions have improved appreciably over the course of the last quarter. GDP grew by 3.1% in 2023 (3.3% for Q4 alone), shaking off much of the recessionary sentiment that permeated market sentiment most of the year. As Mark Zandi, chief economist at Moody’s Analytics, noted, “It’s just a perfect report: strong growth and low inflation… Everything contributed to growth: consumers, businesses, government, housing, trade, inventories. All of the economic wheels were moving in the same direction.”

On top of that, inflation fears have continued to abate; the CPI for January registered 3.0% year on year, down from 3.3% a month earlier. Core CPI followed suit, dropping year-over-year from 3.9% to 3.7%. While inflation is still running slightly hotter than many anticipated, it continues to grow at a slower pace. Finally, non-farm payrolls stunned at 353,000, dwarfing consensus expectations of 187,000. Unlike this time last year, when credit committees nationwide were underwriting an “imminent” recession, the Fed seems to have pulled off the elusive “soft landing,” and expectations for continued economic growth in 2024 abound (which, from a lender perspective, translates to enhanced EBITDA generation).

Private Market In A Definitive Transition

As economic conditions continue to move in a positive direction, private market deal flow seems to be moving in the opposite direction. Though actual numbers have not been released to date, year-end 2023 data is conclusive: M&A deal activity dropped precipitously in 2023, totaling only $1,389 billion (down from $2,325 billion in 2022), while leveraged loan refinancing continued to decline year-over-year since its peak in 2021. According to SPP’s internal polling of institutional investors, deal flow for Q1 2024 is at its slowest pace in two years. This anecdotal evidence is confirmed by the January 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices (the “SLOOS”). As stated explicitly in the SLOOS, “Regarding demand for C&I loans over the fourth quarter, significant net shares of banks reported weaker demand for loans from firms of all sizes. Furthermore, a significant net share of banks reported a decrease in the number of inquiries from potential borrowers regarding the availability and terms of new credit lines or increases in existing lines.”

Though the SLOOS also noted that, in the aggregate, “Over the fourth quarter, moderate net shares of banks reported having tightened standards on C&I loans to firms of all sizes. Banks also reported having tightened most queried terms on C&I loans to firms of all sizes over the fourth quarter of 2023.” There were two important qualifications to be noted: first, “the tightening of C&I lending standards and terms was less widely reported by large banks than by other banks for loans to firms of all sizes,” and second, “major net shares of banks that reported having tightened standards or terms on C&I loans cited a less favorable or more uncertain economic outlook, a reduced tolerance for risk, less aggressive competition from banks or nonbank lenders, and deterioration in their current or expected liquidity position as important reasons for doing so.” In short, though the net share of banks continued to tighten credit, (i) they did so disproportionately for smaller or more challenging credits, and (ii) the rationale for tightening went back to a “deteriorating” economic outlook, conditions that seem to have in large part already remedied themselves entering 2024.

It is readily apparent that the private market is in the midst of a definitive transition, from a “risk-off” lending environment to a decidedly more aggressive and bullish lending ecosystem, epitomized by classic supply and demand market influences. To wit, a dearth of deal flow and an overabundance of institutional liquidity. A market where not only premium assets (i.e., well capitalized, sponsor-supported, and reasonable leverage) can achieve superior pricing and terms but where all issuers will find a more hospitable lending community. In short, the market is simply “Better Now.”

Market conditions are improving for February, driven primarily by a lack of deals and pent-up demand. SPP is lowering senior cash flow indicative pricing by 25 to 50 basis points for both bank and non-bank direct lenders this month. SPP’s latest investor survey indicated that lenders report a marked lack of deal flow, but especially for higher-quality or better capitalized issuers. Importantly, after months of sitting on the sidelines, commercial banks seem to be firmly back in the mix for middle-market cash flow deals and aggressively pricing new issuances. Notwithstanding recent pricing compression, however, bank leverage metrics, covenant structures, and EBITDA adjustments remain squarely in “risk off” mode and consistently more conservative than what is available in the non-bank direct lending community. This has created an interesting, but not surprising, choice for potential issuers: lower-cost financing with commercial banks (SOFR + 3.50% vs. SOFR + 6.50% for middle-market issuers with at least $10 million in LTM EBITDA) vs. more aggressive and permissive amortization (1.0% vs. 7.5% required fixed amortization per annum) and covenant structures with non-bank direct lenders. In any event, the market today is unquestionably more aggressive (both qualitatively and quantitatively) than this time last year.

Minimum Equity Contribution

Cash equity contributions have become the primary focus point for all leveraged buyouts in the private market. Regardless of the enterprise multiple, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. For the foreseeable future, the days of 20% – 25% equity contributions are over. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum is the primary metric.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502