In this episode of Eaton Square Perspectives, Stefan Shaffer, Managing Partner and Principal from New York, discusses how the current crisis has affected US Private Debt. Watch the full video below:

Impact of COVID-19 on US Private Debt Availability

Not surprisingly, COVID-19 dominates the narrative going into April. The speed and severity of the crisis has completely upended the private capital markets, reversing the excess liquidity conditions that have characterized the market for the last nine years.

While most market participants say they are “open for business,” existing portfolio management has overwhelmed most of the middle market lending community as investors assess the depth and breadth of the damage wreaked by COVID-19 on their portfolio assets.

Following the lead of the public markets, spreads have widened, leverage tolerances have contracted, and a good swathe of the leveraged lending community has been relegated to the sidelines until the current economic dislocation subsides.

Having said that, the market as a whole is not shut down by any means; there remain significant pockets of liquidity, and while leverage metrics may not be as competitive as they were a month ago, new deals are still being launched, reviewed, and brought before credit committees.

Typical transaction timetables have become attenuated as investors are still somewhat reluctant to commit to final pricing and closing terms, but deals are still being processed, and our expectation is that a return to a more traditional closing calendar will occur over the course of the next month.

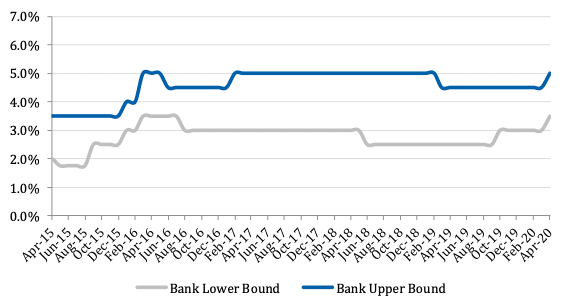

Historical Senior Cash Flow Pricing (Bank)

Source: SPP’s “MIDDLE MARKET LEVERAGE CASH FLOW MARKET AT A GLANCE”

Minimum Equity Contribution

In the current environment, most lenders are seeking a minimum aggregate of 50% base level equity (inclusive of any rollover) is likely required for most deals, with at least 30% minimum new cash equity.

Equity Investment and Co-Investment

There is still liquidity for both equity investment and co-investment, though given the current level of uncertainty combined with the widespread expectation of a post COVID-19 recession, valuation multiples are subject to broad speculation and significant deltas.

Most equity participants are apprehensive to commit to terms in the immediate environment unless the valuation expectation is clearly on the conservative side and eminently defensible. There is still interest and support for independent sponsors, especially in the case where an independent has secured an LOI at “value” pricing.

Though there is no cohort to compare given the rapid onset of the Coronavirus, both history and conventional wisdom suggest that carry provisions, management fees, etc., will be subject to greater scrutiny.

The most dramatic change in the equity equation is the number of traditional control equity sponsors now actively seeking out minority investment positions. M&A activity in February and early March was already thin, and the onset of COVID-19 erased what little activity there was. Given the diminished access to debt capital for most middle market issuers, especially for those sectors most severely impacted, minority equity investment opportunities are taking an enhanced profile within the traditional control equity community, providing much needed liquidity and strategic expertise for those issuers most adversely impacted.

Recapitalization Liquidity

Dividend and share recapitalizations for the immediate future are on hold, particularly for non-sponsored issuers. Given the overall credit dysfunction and widespread anticipation of a recession in 2020 (potentially continuing into 2021), lenders across the credit spectrum will be loathed to deploy capital for non-accretive purposes. There will be exceptions for sponsors with longstanding relationships in place, where the resulting aggregate leverage is still quite modest, the return of capital is combined with an acquisition, or there is a deferred payout to former owners (or other non-recap use of proceeds). Additionally, there will always be liquidity for leveraged recapitalizations that provide some equity upside to the lender.

Story Receptivity

Almost every deal brought to market for the next few months will be “storied” in some way or another, and investors have already begun to discuss the concept of “Normalized EBITDA” (i.e. – pre-COVID-19 annualized EBITDA, or other creative approaches). Accordingly, if the “story” is simply the impact of COVID-19, there will be more than sufficient liquidity for most issuers except those in the truly most hard hit of sectors (hospitality, restaurants, brick and mortar retail, event planners, etc.).

Liquidity for issuers that were already credit challenged going into the COVID-19 onset will experience a different course, and raising capital for these entities will be particularly burdensome. This does not mean that the markets will be closed or that liquidity will be unavailable; however, it is likely that the cost of capital will be high and, in many cases, will require some equity upside as well. There has been an abundance of capital raised for private market distressed financing over the course of the last three years in anticipation of a more traditional recession, and these funds combined with the influx of capital from traditional control equity sponsors now seeking minority positions will provide a much needed escape valve for issuers in need of liquidity.

LIBOR Floors

LIBOR floors are back for almost all lenders. Over the course of the last two years, LIBOR floors were routinely found in non-bank and institutional senior loans, second lien, subordinated, and unitranche financing (a recent survey by the Lead Left reported approximately 56% of respondents claimed that 80% to 100% of their loans have LIBOR floors), but floors had in large part disappeared from the middle market commercial bank lending constituency. Given the recent drop in Treasury yields, commercial banks are routinely requiring LIBOR floor language. Importantly, most banks will seek LIBOR floor protection, not only in the context of new deals, but as a concession for covenant modifications, interest or amortization remedies, and other credit relief.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC.