Stefan Shaffer shares the latest US Private Capital Report for May 2025. While public markets have seen dramatic swings, private credit has remained remarkably stable in 2025. This update explores why deal terms haven’t budged and how current conditions continue to favour issuers. Read the full report to prepare for what’s next

A Steady Private Market in an Unsteady World

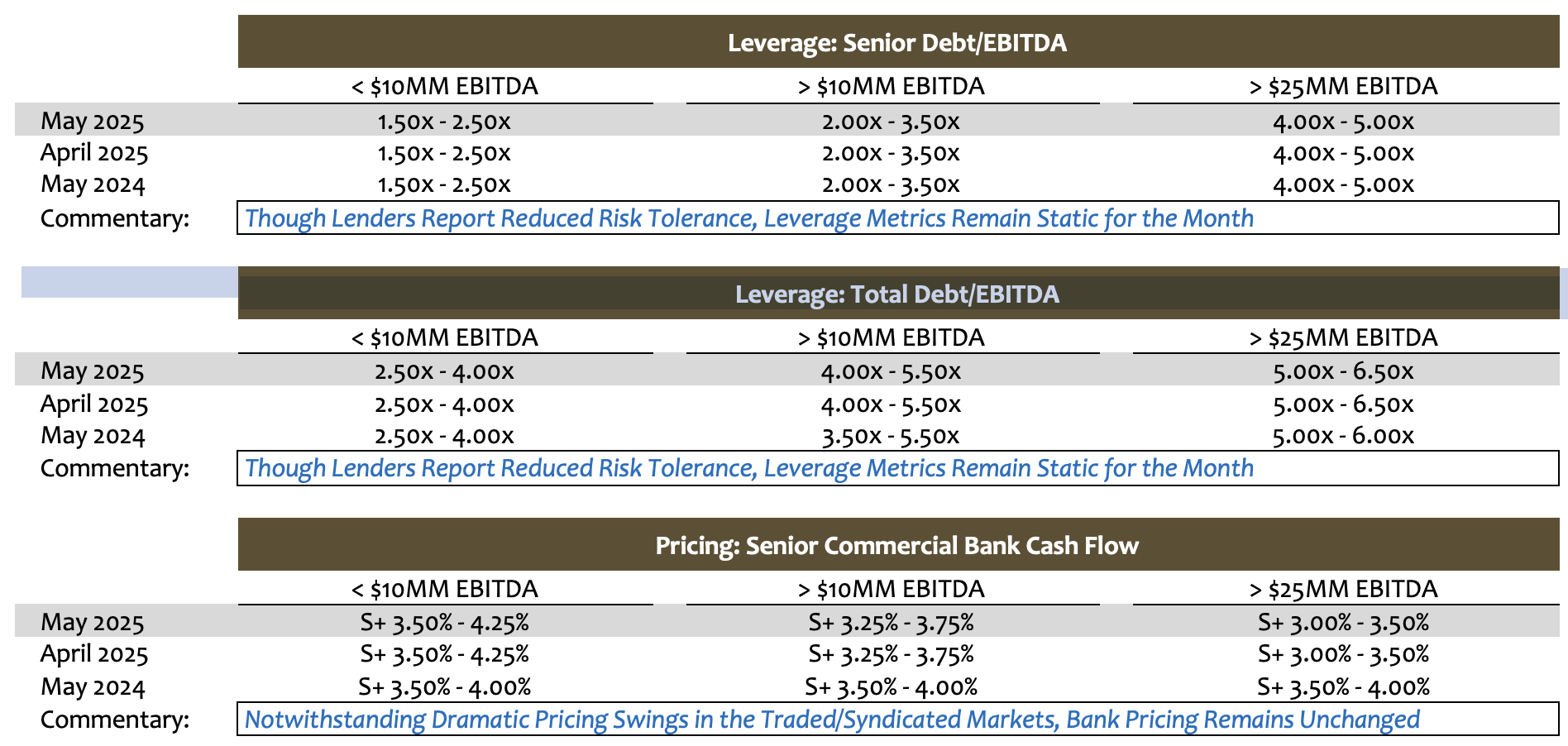

For the fourth consecutive month this year, we are not making any changes to its Market-At-a-Glance metrics. While the mere maintenance of the status quo would hardly be noteworthy in most economic environments, given the magnitude of the shifts in pricing and yields in the traded debt markets (public, 144A, and syndicated loans) for the same period, it is actually quite remarkable. The lack of private market volatility in 2025 in the face of heightened geopolitical tensions, unprecedented economic uncertainty, and an on-again/off-again trade war between the two largest economies in the world has many private market participants wondering why “Nothing Changes Around Here.”

Public Credit Spreads Swing—Private Terms Hold Firm

To be more specific, the CE BofA U.S. High Yield Index Option-Adjusted Spread on March 24th was ~305 basis points; by April 7th (five days after “Liberation Day”), that spread increased to 461 basis points; by May 6th, that spread declined to 315 basis points (an ~51% swing both up and down within ~43 days). For investment-grade bonds (ICE BofA U.S. Corporate Index) for the same period, spreads went from ~90 basis points up to 120 basis points and back down to 93 basis points (still a 33% spike up and drop back in about a month and a half). Not surprisingly, these dramatic swings in pricing correlate precisely to the odds of a recession of the U.S. economy as well; by April 7th, consensus odds for a recession (U.S. Polymarket 2025 Recession Odds) surpassed 65% before declining to approximately 37% by mid-May.

Private Markets Show Unusual Stability

With all this noise in the general economy and heightened volatility in the traded exchanges, you would think there would be a corresponding unsettling in the private market, but that really never materialized. To the contrary, as a general proposition, pricing, leverage multiples, and general terms in May are nearly identical to where they were in January—and lest we not forget, pricing and terms in January were among the most aggressive and competitive they have been since 2007. As noted in our January Update, “It is hard to imagine a more favorable environment for financing middle-market issuers than the private market in Q1 2025. Credit spreads have compressed to their lowest levels in years, and leverage multiples for larger issuers have expanded to levels not seen since just before the Great Recession.”

Excess Liquidity, Limited Deal Flow

Importantly, the drivers for these “excess liquidity” conditions in May are literally identical to those in January, but simply more pronounced. The two most significant drivers are the magnitude of private credit “dry powder” (i.e., untapped capital available for deployment into new deals) and a dearth of “new money” deal flow (i.e., M&A transactions, LBOs, growth capital, and leveraged recapitalizations). As per Pitchbook, “Halfway through 2024, private debt dry powder sat at $566.8 billion—a new high—and is on track for its second consecutive year of growth. The dry powder is through June 30 due to late reporting from GPs and LPs. The asset class’s robust fundraising supported the growth over the past couple years. Despite the slight fundraising slowdown in 2024, dry powder’s ascent has not been affected as it has in other asset classes, such as PE. Moreover, dry powder’s share of AUM now sits at 31.1%, which aligns with each of the last two years.” In short, the “supply” side of the equation is robust; however, the “demand” side of the equation remains woefully below expectation.

A Perfect Storm for Private Equity

The Wall Street Journal recently published “Private Equity World Engulfed by Perfect Storm,” noting that “even before President Trump’s tariff chaos, buyout firms had been struggling to sell their portfolio companies and return money to anxious investors. Now recession fears and market turmoil have brought dealmaking to a near standstill.” As per data cited by Pitchbook, “Wild stock-market swings related to tariffs threaten to upend private equity’s plans to exit from investments as the industry sits on a backlog of more than 12,000 U.S. companies, including about 3,800 that have been held for five to 12 years… The year started relatively strong with an estimated 402 exits during the first quarter worth some $186.6 billion, up from 332 exits totaling $88.2 billion the same period a year earlier, but the preliminary data also show that while exit value has been increasing quarter on quarter, the number of exits in the first quarter declined from the fourth.” Until we see a meaningful uptick in PE exits and M&A activity in general, market conditions will continue to favor issuers as commercial banks, non-bank senior direct lenders, credit funds, SBICs, BDCs, and insurance companies all compete for a diminished supply of new money deal flow. Continued economic uncertainty only exacerbates the situation.

An Opportune Moment for Recapitalisations

There is one particular beneficiary of the current incongruity between capital and deal flow; specifically, equity sponsors that are seeking liquidity for their LPs yet are reluctant to exit and transact at current enterprise multiples. Timing is exceedingly opportune for leveraged recapitalizations. SPP’s ongoing outreach to lenders confirms a heightened interest in recaps, with pricing and terms historically reserved for accretive uses of capital (acquisitions and growth capital). That translates to pricing without the “premium” associated with a non-accretive use of capital, expanded leverage capacity, and increased “adjustments” to EBITDA for covenant compliance businesses. Investors will still scrutinize leverage as a percentage of enterprise value (i.e., the residual “LTV” or loan to value) as well as traditional underwriting considerations (size, sector, supplier/customer concentration, and cyclical vulnerabilities).

Conclusion: Issuers Still Have the Upper Hand

The takeaway this month is pretty straightforward; given the lack of overall transaction activity and an abundance of capital earmarked for deployment, with base rates and credit spreads remaining among their most competitive levels in the last five years, this is still very much an issuer’s market, and luckily, issuance conditions are not likely to deteriorate anytime soon. After all, “Nothing Changes Around Here.”

Minimum Equity Contribution

The level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders remain fixated on a minimum 50% LTV (i.e., equity capitalization of 50% of enterprise value), and actual new cash in a deal should also constitute at least 75% of the aggregate equity account. While lenders will certainly give credit to seller notes and rollover equity, the cash equity quantum continues to be an essential and primary underwriting consideration. The good news is that non-bank lenders, private credit funds, insurance companies, BDCs, and SBICs are all potential sources of equity capital as well as debt capital, and in many cases, are more than happy to shore up and backfill the equity account directly.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments is robust in the new year, and in most cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Importantly, equity investment can take a variety of forms (preferred, common, warrants, even HoldCo notes) depending on the unique requirements of a given deal. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real “skin in the game” (i.e., a meaningful investment of their own above and beyond a roll-over of deal fees). While family offices remain the best source of straight common equity, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing combined debt and equity tranches.

Dividend Recapitalization Liquidity

Though continued volatility and a perceived credit down-cycle could inhibit and even terminate dividend recap activity, for the time being, the market remains dividend recap-friendly, especially where the recap is combined with a more accretive use of capital, such as an acquisition or specified growth capital initiative. As a general proposition, non-bank lenders are readily available to fund leveraged recaps, with leverage tolerances exceeding 4.5x LTM EBITDA for larger middle-market issuers (>$25 million of LTM EBITDA), while commercial banks remain reticent to fund recapitalization financings absent exceedingly low leverage (<2.0x LTM EBITDA) and LTV metrics (<30% TD/Enterprise Value) combined with a historical credit relationship.

Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502