Michael Mufson, our Principal from Philadelphia, reports the deal activity in the US Middle Market for the first half of 2021. Read the highlights below.

Increase in Middle-market US Activity

For the first 6 months of 2021, US M&A as a whole reported over a 2.5x increase in total deal value

YoY:

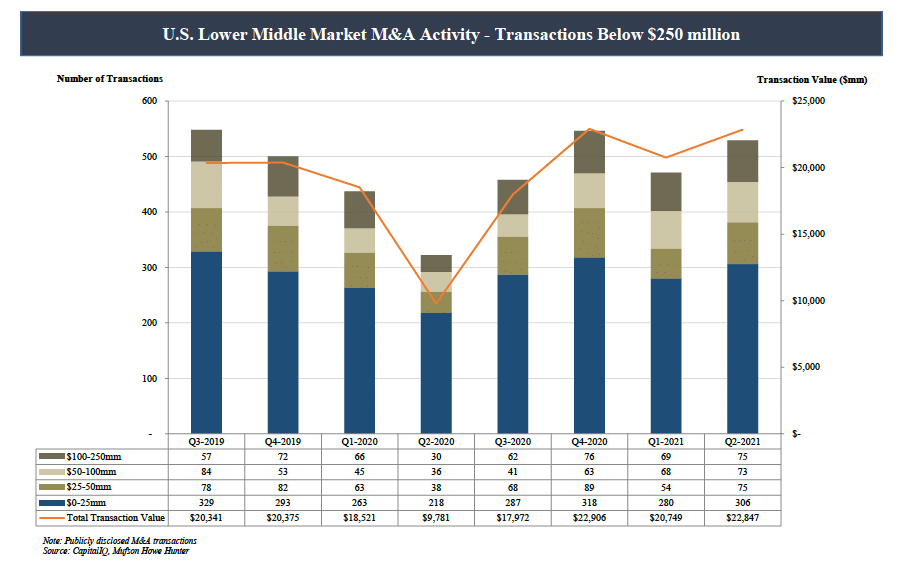

- Middle market US M&A activity (transactions below $ 250mm in EV) saw an increase in number

of deals of 32% YoY with transactions over $ 1 billion increasing 2.35x - Quarter over Quarter, in 2021 Middle Market M&A was up 12% in deal count and at $1 billion and

above, deal counts increased 19% - Q1 over Q2 2021 total transaction volume in dollars was up 23%

• For the 1st 6 months of 2021, YoY Middle Markets transaction dollar value increased 54% with

transactions between $100mm to $250mm up 50% and deals below $50 mm in EV up 22%

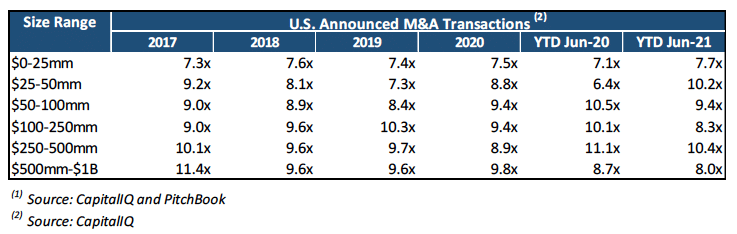

• All US M&A valuations for the first six months of 2021 averaged 8.8x EBITDA vs. 8.5x for the

same period in 2020

Liquidity in Private Market Remains at Historical Levels

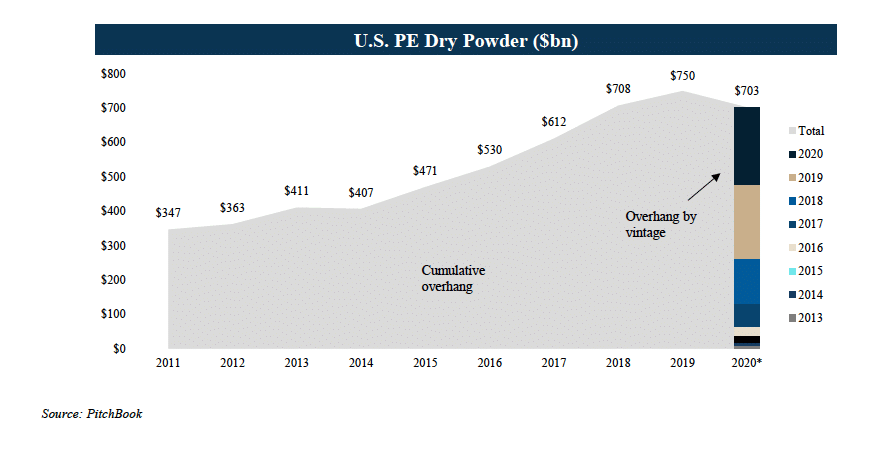

- Private Equity Sponsor transactions for deals below $1 billion was 13x in Q2 2021; employing

roughly 51% of leverage per transaction vs. a 12.5x in Q1 2021 with leverage at ~50% on average - Liquidity remains at historical levels with over $750 billion in dry powder for US Private Equity

Sponsors to take-down. - With Private Debt becoming a more active source of funding with an

additional $270 billion, when combined with dry powder equity, results in over a trillion in funding

without traditional commercial banking.

For M&A private debt, the credit markets for middle-market deals as of Q2 remain historically robust. You can view the full Private Market report here.

We expect the remainder of the year to be particularly active with many closely held private companies seeking to beat a possible tax code change in cap gain rates and private equity sponsors bringing portfolio companies to market to take advantage of the valuations. You can download the full US Middle Market report here.

If you have questions or would like to speak to our M&A advisors, feel free to book a call here.

Michael Mufson

Managing Partner and Principal

Michael Mufson has almost 30 years experience as an investment banker to middle market companies. Prior to the founding of Mufson Howe Hunter in 2004, he served as the founder and head of equity capital markets for Commerce Bancorp (now TD Bank).

[email protected]

Ph: +1 215-399-5410