Stefan Shaffer shares the latest US Private Capital Report for April 2025. While public markets have faced historic volatility in recent weeks, the private capital market has remained surprisingly resilient. From tariff-induced uncertainty to tightening credit conditions, this report offers a timely, in-depth look at key dynamics shaping deal flow, leverage, and liquidity in 2025. Read the full report to prepare for what’s next.

Private Market Paradox

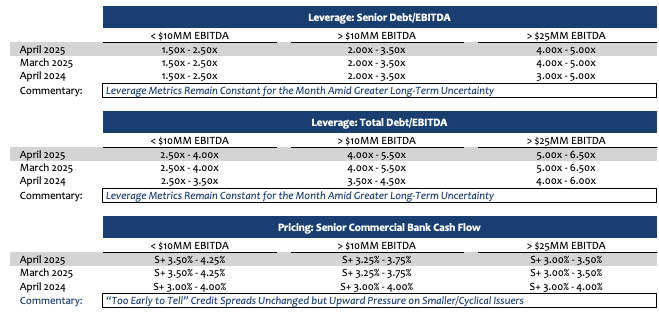

Notwithstanding two of the most tumultuous weeks in capital markets history, SPP is not making any modifications to its leverage and pricing metrics guidance for the month of April. While these first couple of weeks of the month have seen literally trillions of dollars in value erased in the equity markets and an increase in bond yield levels not seen since the early stages of the Covid pandemic, private market liquidity conditions remain, at least for the time being, among their most competitive levels historically. Regardless of the larger issues of a global trade war, middle-market issuers retain most of the same market advantages and benefits they did in January, and for higher-quality credits (>$25 million in LTM EBITDA), potentially even better terms. What we term as the “private market paradox,” others simply see a literal “Ball of Confusion.”

Private Market Liquidity Holds—For Now

The traded capital markets (i.e., syndicated loans, public and 144A bonds) literally melted down in the last week before recovering on April 9th upon the announcement by the White House of a temporary reversal of “reciprocal tariffs.” Prior to the announcement, corporate bond spreads widened for eight consecutive trading sessions in a row. Yield premiums on a Bloomberg index of investment-grade corporate bonds rose to 90 basis points on April 4th, wiping out all the tightening that took place previously for the year. That move cemented the index’s longest streak of widening spreads since October 2023, according to data compiled by Bloomberg. The fallout for below-investment-grade bonds was more marked, where U.S. high-yield spreads broke a two-year trend downward and jumped from a spread of ~300 basis points over UST to over 450 basis points over UST. U.S. Treasuries were not immune either; as Kenny Polcari summarized the volatility, “The benchmark 10 yr U.S. Treasury collapsed causing yields to spike, reaching a high of 4.51% before retreating to end the day at 4.32%. This followed a volatile week where yields had already climbed from a low of 3.85%. The 2-yr yield hit 4.01% after yielding 3.47% last week. …all while the 30-yr hit 5.02%, a level not seen since November 2023, before easing slightly to end the day at 4.73%.” Unlike the hourly fluctuations in the traded capital markets however, private market liquidity conditions move glacially and remain for the most part static; the overwhelming majority of debt and equity security purchasers in the private market are “buy and hold” investors the concept of trading out of an asset or seeking secondary liquidity for the most part, simply doesn’t exist. It’s the primary reason lenders spend the time and effort of crafting bespoke covenant structures for every unique opportunity.

The Key Driver: Lack of “New Money” Deal Flow

The single greatest driver for the current “excess liquidity” conditions in the private market has been lack of deal flow, and more specifically, the lack of “new money” deal flow (i.e., capital raised for acquisitions, LBOs, recaps, and other growth initiatives—excluding refinancing and repricings). As reported by Bloomberg, “At just $35.9b or 11% of volume in Q1 2025, new money financing remains sluggish amid record levels of issuance. At $339.2b, first quarter issuance was among the busiest since Bloomberg began tracking the data in 2013, however that did not translate into the M&A spree many were hoping for. Instead, since the start of 2024 repricings have commanded a whopping 70% of deal flow at the expense of new money issuance, which over the same time has made up just 10% of US institutional leveraged loan volume and falls well below the five-year average of 31%.”

Given the heightened level of uncertainty around tariffs and the adverse implications of a prolonged trade war, it is unlikely that the long-awaited revival of M&A activity will happen anytime soon. To the contrary, as the first two weeks of April suggest, it is becoming increasingly possible that the proposed U.S. tariff scheme and pending trade war will push inflation up and drive economic activity down, and ultimately, the private market will not be immune. In short, liquidity conditions will suffer. This played out during the Great Recession and again during the pandemic. Even before the so-called “tariff tantrums” began, there already were warning lights burning red for the economy; bankruptcy filings have been on a steady upward rise beginning in January of 2025, and distressed debt levels are at their highest levels since October of 2024. Though predictions of a 2025 recession have moderated since the announcement of the 90-day tariff pause, they are still elevated. After the President’s announcement, Goldman economists still maintain a 45% probability of a recession in 2025. “We are reverting to our previous non-recession baseline forecast with GDP growth of 0.5% and a 45% probability of recession,” a group of researchers led by Jan Hatzius wrote in a report. Roughly an hour earlier, the same researchers had said that they forecast a GDP loss of 1% this year and a 65% probability of the economy entering a recession in the next twelve months.

Why Issuer Strategy Matters More Than Ever

If credit conditions do in fact continue to deteriorate, lenders in the private market will revert to a more defensive “down-cycle” underwriting strategy (i.e., the underwriting equivalent of “circling the wagons”). To no one’s surprise, that translates, quantitatively, to higher spreads and lower leverage multiples (pretty much erasing the spread compression and leverage multiple expansion of the last year), and the re-emergence of SOFR floors (in response to the expectation that the Fed will likely have to cut rates to boost liquidity). Qualitatively, that translates to expanded diligence and attenuated timetables (“waiting for the shoe to drop”) and increased barriers to entry for lower middle market, cyclical, and “storied” issuers, and in particular, issuers with material exposure in their supply chain to international procurement.

However, there are critical steps potential issuers can take to insulate themselves from the impact of a down credit market and a less hospitable issuance ecosystem.

- First and foremost, in the same way lenders have increased scrutiny for issuers during economic volatility, issuers should have heightened awareness to have the right credit partner. Lenders that have trouble in their portfolio, or that are publicly traded and experiencing liquidity constraints due to share price reductions, simply may not have the capacity to be flexible and constructive in a down cycle.

- Enhanced issuance strategies should be employed; issuers should have a broad and comprehensive offering to capture every potential lender that can offer the most aggressive terms available in the market. Offering materials must also be comprehensive and detailed to specifically address heightened underwriting scrutiny, with a sophisticated (again, comprehensive and detailed) financing model, with thoughtful operating forecasts for setting adequate covenant compliance levels.

While most sponsors have their list of “go to” lenders for a given opportunity, and legacy credit relationships are a staple of the private market, the overwhelming majority of sponsors and issuers simply don’t have the frequency and magnitude of deal flow to really exploit the myriads of competing pools of capital available in 2025, and especially so in a tighter credit environment. To put it in perspective, since 2011 (when SPP started tracking this data and publishing the Market Update), SPP has averaged a 5.0x oversubscription per financing. We do this by assuring our issuers enhanced access to the $1.5 trillion pool of private capital competing for assets and using the most effective, empirically-based offering strategies available. As so brilliantly exposed over the course of the last few weeks, this market is the epitome of a “Ball of Confusion”; having the right partner (whether a bank, non-bank direct lender, credit fund, or placement agent that provides access to all of them) is crucial to successfully navigating it.

Tone of the Market

Private market liquidity conditions can best be described as a period of stasis in April (i.e., “a state of static balance, equilibrium, or inactivity, where something remains unchanged or stagnant”). Market dynamics started the year on a very optimistic note; base rates were about 100 basis points below where they were a year earlier, credit spreads had compressed by approximately 50 to 150 basis points, key macroeconomic metrics were positive, and all indications were that M&A activity, long dormant, was poised for a robust and precipitous revival. Importantly, private market lenders were sitting on unprecedented levels of dry powder eager to deploy with pricing and terms as aggressive as they have been since 2007. Since then, threats of a trade war have escalated, more than ~$5 trillion in value has been erased in the stock market and credit spreads in the traded syndicated loan, 144A and public bond markets have reverted to levels last seen in mid-2023. One of the great attributes of the private market, however, is its resilience. Notwithstanding the magnitude of volatility felt in the traded markets, private market liquidity conditions remain stubbornly issuer-friendly, and while the “risk-on” and “go-go” euphoria that characterized Q1 is gone, lenders are not revising their underwriting criteria, hiking spreads, or cutting leverage tolerances…yet. Nevertheless, uncertainty is rampant, keeping prospective acquisitions, capital expenditure, and growth initiatives on a back burner. Interestingly, something of a private market paradox is forming; while more efficiently traded markets are experiencing heightened volatility and deteriorating issuance metrics, the lack of deal flow in the private market is keeping already financing-deprived banks and direct lenders with continued competitive terms and, in some cases, improving market metrics. This paradox will be short-lived however; if the current trade standoff leads to higher inflation and a recession, the private market will most certainly correct as well.

Minimum Equity Contribution

The level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders remain fixated on a minimum 50% LTV (i.e., equity capitalization of 50% of enterprise value), and actual new cash in a deal should also constitute at least 75% of the aggregate equity account. While lenders will certainly give credit to seller notes and rollover equity, the cash equity quantum continues to be an essential and primary underwriting consideration. The good news is that non-bank lenders, private credit funds, insurance companies, BDCs, and SBICs are all potential sources of equity capital as well as debt capital, and in many cases, are more than happy to shore up and backfill the equity account directly.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments is robust in the new year, and in most cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Importantly, equity investment can take a variety of forms (preferred, common, warrants, even HoldCo notes) depending on the unique requirements of a given deal. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real “skin in the game” (i.e., a meaningful investment of their own above and beyond a roll-over of deal fees). While family offices remain the best source of straight common equity, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing combined debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502