Stefan Shaffer shares the latest US Private Capital Report for July 2023. From a purely capital markets perspective, investors remain solidly in “risk off” mode. The non-bank direct lending market, however, is more difficult to gauge; abundant capital for deployment is available, but lenders continue to maintain a “wait and see” attitude, remaining selective, but willing to drop pricing and increase leverage metrics to garner the most competitive assets. Read the full report below.

The Prospect of Recession Continues To Fade

A quote often attributed to Mark Twain reads, “The reports of my death are greatly exaggerated.” The same could be said of the U.S. economy in 2023. In January, the NY Fed projected a 70% probability of recession for the coming year. While the potential for a recession still looms ahead (the Statista Research Department predicts that by June 2024, “there is probability of 67.31 percent that the United States will fall into another economic recession”); the prediction is predicated on the difference between 10-year and 3-month treasury rates (currently at -1.65%, i.e., an “inverted” yield curve), which historically at least has been an exceedingly accurate gauge of recession (an inverted yield curve has preceded every recession for the past half-century). Increasingly, however, the prospect of a recession this year or in 2024 continues to fade. As Goldman Sachs published earlier this month, “Our economists say there’s a 25% chance of a recession in the next 12 months, down from their earlier projection of 35% shortly following the failure of Silicon Valley Bank in March.”

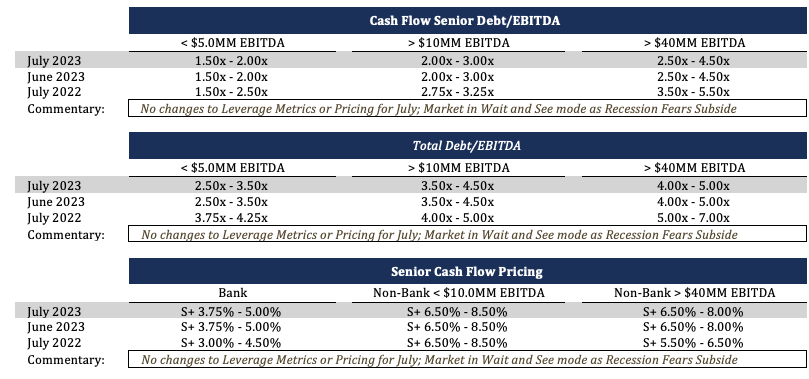

While the publicly traded and 144A markets have already responded to this perceived uptick in economic optimism (both investment grade and high yield corporate credit spreads have tightened more than 100 – 150 basis points since February), the private capital markets move in a much more sluggish fashion; most lenders remain in “wait and see” mode, with credit spreads and leverage multiples largely unchanged over the course of the last six months.

Commercial Bank Financing Remains A Primary Source of Liquidity

Commercial Banks continue to be the most conservative lending constituency this summer. SPP’s anecdotal experience suggests bank hold levels are roughly 60% of where they were this time last year, with lenders particularly sensitive to large committed but undrawn credit facilities. As noted in the Fed’s April Senior Loan Officer Survey on Bank Lending Practices, “Over the first quarter, significant net shares of banks reported having tightened standards on C&I loans to firms of all sizes. Banks also reported having tightened all queried terms on C&I loans to firms of all sizes over the first quarter. The tightening was most widely reported for premiums charged on riskier loans, spreads of loan rates over the cost of funds, and costs of credit lines. In addition, significant net shares of banks reported having tightened the maximum size of credit lines, loan covenants, and collateralization requirements to firms of all sizes.” This trend will likely only continue through the summer, as commercial banks continue to face many of the same challenges they did in March after the SVB and Signature Bank failures. Specifically, as noted in the Fed Survey, “a less favorable or more uncertain economic outlook, reduced tolerance for risk, worsening of industry-specific problems, and deterioration in their current or expected liquidity position.”

It is important to note that commercial bank financing still remains a primary source of liquidity for many middle market issuers; while banks may not be stretching for cash flow term facilities to the same extent they did in 2021 and 2022, their markedly lower cost of capital (SOFR+3.5% – 4.0%) vs. their non-bank direct-lending competitors (SOFR+6.5% – 7.5%), still makes bank financing a preferred source of capital, even when paired with a tranche of mezzanine financing. To drill down on this analysis, assuming a non-bank direct lender can provide 4.0x Debt/LTM EBITDA at SOFR+7% (~12% floating), a comparable bifurcated senor/sub structure with aggregate leverage of 4x comprised of senior debt at 2.50x LTM EBITDA at SOFR + 3.5% (~8.5%) combined with a 1.5x Sub Debt/LTM EBITDA at 14% (fixed) still equates to a blended cost of capital of 10.59%, or a discount of ~1.50% to the non-bank direct lending alternative.

For many middle-market issuers, however, commercial bank financing may not even be a viable alternative this year; this is especially the case for cash flow deals (vs. ABL financing), and potential borrowers will have no alternative except to seek non-bank direct lenders. The good news is that there is no dearth of non-bank direct lenders capable of providing liquidity. The non-bank private credit market today stands at ~$1.5 trillion and has grown by ~10% CAGR over the last 10 years. Of that $1.5 trillion, ~$500 billion constitutes “dry powder” yet to be deployed. Preqin projects private credit will hit $2.2 trillion by 2027.In short, non-bank direct lending liquidity is abundant. As noted above, though pricing is still at a significant premium to commercial bank financing, non-bank lenders can provide markedly lower required amortization for term debt facilities (1% – 5% per annum) than their commercial banking counterparts (7.5% – 15% per annum), keeping actual aggregate debt service (principal amortization and cash interest) dollars consistent with commercial bank lenders. Additionally, because non-bank lenders often provide unitranche facilities that bridge the gap between senior and subordinated tranches, covenant structures for non-bank deals are often significantly less restrictive than comparable commercial bank term debt facilities.

Tone of the Market

Private market liquidity conditions for July remain virtually identical to the prior month. From a purely capital markets perspective, investors remain solidly in “risk off” mode; leverage multiples are at least one full turn of EBITDA less than this time last year, and though credit spreads are consistent with where they were a year ago, base rates are up by approximately 4.3% (SOFR at 7/18/23 is 5.06%, while SOFR at 7/18/22 was 0.75%). The higher cost of capital has strained fixed charge coverage ratios, resulting in elevated credit downgrades and increased defaults. Commercial banking activity is particularly sluggish. Commercial Banks, still plagued by deposit migration, capital adequacy concerns, and increased regulatory oversight, continue their retreat from their historically dominant role in financing middle-market issuers. The non-bank direct lending market, however, is more difficult to gauge; abundant capital for deployment is available, but lenders continue to maintain a “wait and see” attitude, remaining selective (i.e., actively bidding deals across the middle market but holding out for premium pricing), but willing to drop pricing and increase leverage metrics to garner the most competitive assets. The elephant in the room is the economy; investors have almost universally based their current underwriting strategy on a presumed 2023 recession, a recession that increasingly seems less likely with each economic report.

Minimum Equity Contribution

Cash equity contributions have become the primary focus point for all leveraged buyouts in the private market. Almost regardless of the enterprise multiple, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. For the foreseeable future, the days of 20% – 25% equity contributions are over. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum is the primary metric.

Equity Investment and Co Investment

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502