Stefan Shaffer shares the latest US Private Capital Report for July 2024. As we enter the summer of 2023, market conditions are remarkably stable, we are maintaining our pricing and leverage metrics for the second month in a row. This follows a period of tightening credit spreads and rising leverage multiples, but it does not indicate a slowdown. Instead, the aggressive issuance environment driven by non-bank direct lenders offers an unparalleled opportunity for issuers. In this blog, we explore the emerging “barbell effect,” examine the competitive landscape, and discuss why now may be the perfect time to secure favorable financing terms. Read the full report below.

Stability in Market Metrics

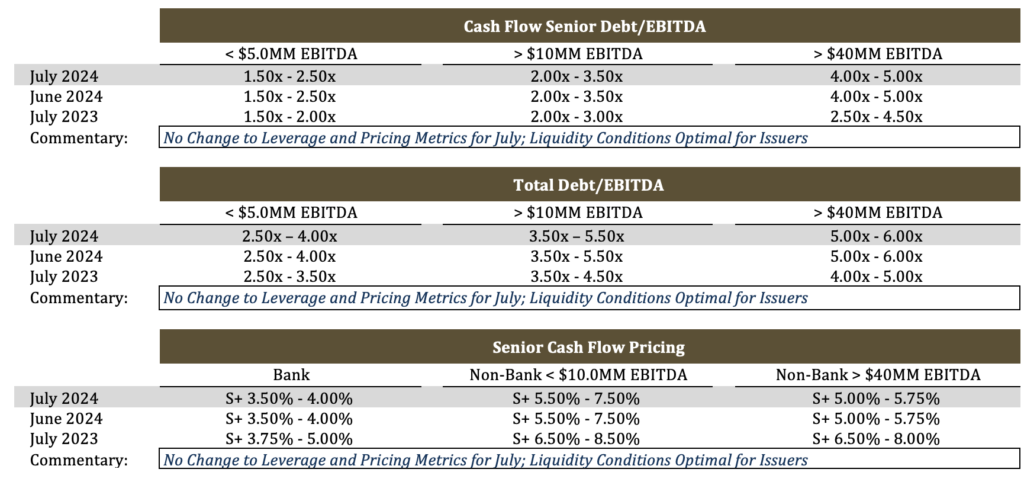

For the second consecutive month, we are not making any modifications to its Market-At-A-Glance pricing and leverage metrics; this comes after five consecutive months of tightening credit spreads (by a dramatic 100 to 150 basis points) and increasing leverage multiples (by a lesser but still notable 0.5x to 1.5x LTM EBITDA). Is this evidence of a “cooling off” in private market liquidity conditions? The answer is decidedly, unequivocally, no. Driven by the unprecedented growth of non-bank direct lenders (an ~$1.5 trillion lending constituency), issuance conditions in July are as aggressive and competitive as we have seen them in the last five years, and arguably, when it comes to optimal issuance conditions, some of the most astute private equity asset managers have concluded, “This is It.”

The Barbell Effect: Diverging Market Dynamics

While aggregate market dynamics are substantially similar today to where they were in May, there are more subtle influences taking place behind the headline pricing and leverage multiple metrics. More specifically, the market is undergoing something of a “barbell effect,” a transition where the market is dividing between a significant grouping of institutional lenders on the aggressive side of the market where pricing is substantially more competitive (ranging from SOFR+5.25% to SOFR+6.25%) for higher quality assets (i.e., LTM EBITDA >$20 million, a history of consistent growth and performance, etc.) and a significant cluster of investors seeking a higher yield (SOFR+7.5% to SOFR+8.5%) for lower middle market issuers or more “storied” paper (sub $15 million LTM EBITDA issuers, greater cyclicality, and EBITDA volatility). The good news for issuers, however, is that there is more than abundant liquidity on each side of the barbell.

Seize the Summer: Optimal Issuance Conditions

A very strong case can be made that the July to September summer months may present the best opportunity for issuers to take advantage of an exceedingly competitive market. As noted above, issuance conditions in the non-bank direct lending and private credit markets are among their most issuer-friendly in recent history; that translates to more aggressive credit spreads, higher leverage multiples, heightened covenant flexibility, more forgiving “adjustments” to EBITDA, and more expansive acceptance of non-accretive uses of capital (refinancing, leveraged dividends, and share purchase recapitalizations). The only thing not necessarily in the issuer’s favor are base rates; SOFR sits at ~5.32%. After the release of the June non-farm payroll data, the Fed finally seems poised to lower rates (consensus of 2-3 rate reductions by year end). Since the clear majority of non-bank debt financing is at a floating rate, it makes eminent sense to lock in the most aggressive non-rate terms possible today and float down with the market as the Fed loosens credit and cuts the Fed funds rate.

Hedge Your Bets: Defensive Financing Strategies

There is one overriding and even more compelling argument for issuers, heretofore sitting on the sidelines, to enter this private market and lock into aggressive floating rate financing today, and that is for defensive hedging purposes; more specifically, a hedge against (i) adverse macroeconomic conditions and global instability, (ii) operating performance unique to each issuer, and (iii) against a change in market liquidity conditions (lenders incapacity or unwillingness to provide capital as aggressively as they do today).

The June unemployment numbers, while not particularly noteworthy in themselves (June nonfarm payrolls rose by 206,000, beating expectations for 189,500, while the unemployment rate inched up to 4.1% from May’s 4.0%), did contain one component that carries particular significance; specifically, the unemployment rate increased from 4% to 4.1% marking its highest level since November 2021. This rise triggered the Sahm Rule. The Sahm Rule is an indicator that looks at signals related to the onset of a recession. According to the rule, the initial stages of recession are signaled when the three-month average unemployment rate moves above the lowest three-month moving average unemployment rate over the last 12 months by half a percentage point or more. Developed by former Fed economist Claudia Sahm, the rule is based on the idea that, when people start losing jobs, they cut back on spending, and this causes more job losses. A small rise in unemployment can seem trivial in a labor force of 168 million people, but layoffs can escalate quickly, which is why this indicator has been so accurate over time. After Friday’s jobs report, the Sahm Rule rose to 0.43, uncomfortably close to the recession trigger of 0.50.

From a potential issuer’s perspective, the same data set that has economists predicting a reduction in the Fed Funds rate can also spur particularly adverse issuance conditions in the private market in Q4 of 2024. A general slowdown in macroeconomic activity can also signal weaker trading conditions, slower growth, and reductions in EBITDA, which would impair an issuer’s capacity to attract competitive capital. From a lender’s perspective, once a possible credit “down-cycle” is forming, investors tend to stand down, or at the very least, slow down their underwriting efforts to better gauge a possible recession. We know from very recent history that even the perception of a recession has a chilling effect on issuance conditions—lower middle market and cyclical issuers can be locked out of the market, and even higher quality credits can find tough sledding when it comes to attracting recap dollars or tapping higher leverage multiples.

This is not lost on some of the most astute professional equity asset managers. As reported by LSEG, a leading global financial infrastructure and data provider, private equity sponsors tapped the loan market for a record U.S. $227 billion in 2Q24, pushing sponsored issuance for the first six months of the year to over US$400 billion. The half-year total not only represented a record high as well but also exceeded the full-year total in 2023. These sponsors recognize that they can reap the benefits and optimize their borrowing capacity by tapping into today’s exceedingly competitive market and still ride the benefit of a lower cost of capital when the Fed ultimately loosens credit policy and brings rates down. In other words, when it comes to tapping the private credit markets at the best possible time, “This is It.”

Conclusion

In conclusion, the private market is currently offering some of the most favorable conditions for issuers we’ve seen in recent years. The stability in pricing and leverage metrics, combined with the competitive issuance environment, presents a unique opportunity for issuers to secure advantageous terms. By understanding the “barbell effect” and leveraging current market dynamics, issuers can navigate these conditions to their benefit. Now is the time to act and capitalize on the favorable financing terms available in this robust market.

Tone of the Market

Market conditions heading into the dog days of summer are about as robust as they have been since 2021. The sheer magnitude of private capital available for deployment is unprecedented; the size of the private credit market at the start of 2024 was approximately $1.5 trillion, compared to approximately $1 trillion in 2020, and is estimated to grow to $2.8 trillion by 2028. This “excess liquidity” has spurred a wave of competition that has driven non-bank credit spreads to their tightest levels in the last five years. As described in greater detail herein (see “State of the Private Market” below), though base rates remain at comparatively elevated levels (SOFR at 5.32%), at least two and potentially three Fed rate reductions this year are anticipated (i.e., rates will float down later in the year). The same macroeconomic forces, however, that are pushing rates lower may also suggest a less hospitable lending market in the latter part of the year. If economic activity does decelerate, EBITDA generation for many issuers could also slide, and lenders may be increasingly reluctant to extend credit so aggressively. This devolution in trading conditions, or credit “down-cycle,” is a phenomenon witnessed many times in the private market; i.e., a market characterized by higher spreads, tighter leverage multiples, greater credit discrimination, and increased apprehension to fund non-accretive uses of leverage such as recapitalizations. In short, if the only thing keeping an issuer currently out of the market is high base rates, the best strategy may be to issue now when liquidity conditions are robust, lock in aggressive terms, and ride rates down into 2025.

Minimum Equity Contribution

Notwithstanding otherwise aggressive metrics across the market, the level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. Most lenders remain reticent to provide aggregate leverage in excess of 4.0x LTM EBITDA with only 20% to 25% new cash equity. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum continues to be an essential and primary underwriting consideration.

Recapitalization Liquidity

The market remains exceedingly recap-friendly, especially where the recap is combined with a more accretive use of capital, such as an acquisition or specified growth capital initiative. Commercial banks remain highly reticent to fund recapitalization financings, absent exceedingly low leverage (<2.0x LTM EBITDA) and LTV metrics (<30% TD/Enterprise Value) combined with a historical credit relationship. Non-bank lenders, however, have little or no reluctance to fund leveraged recaps, with leverage tolerances exceeding 4.5x LTM EBITDA for larger middle market issuers (>$20 million of LTM EBITDA). Leveraged recap activity reached its highest level in the first quarter of 2024 since Q1 of 2021.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502