Stefan Shaffer, our New York Partner shares the May 2021 Private Capital Report. Generally, market conditions are identical to where they were in April. The Private Market is hot but is it a little too hot? There is also some new “heat” in the market, but decidedly, not the kind that improves liquidity conditions. Read the full report below.

Tone of the Market

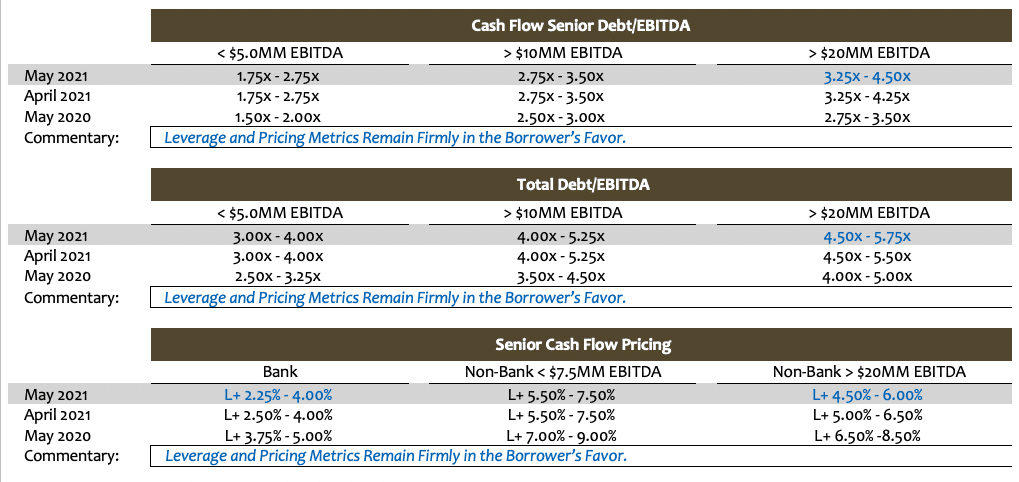

May 2021 market conditions continue to push the limits on maximum liquidity. The now “post-pandemic” struggle for assets has tightened credit spreads to their most aggressive levels in recent memory, while the same competitive dynamics continue to expand leverage multiples, especially for larger middle market issuers. The metrics delineated in this month’s Market-At-A-Glance are at their most aggressive levels since we started tracking data in 2011.

As the non-bank direct lending market builds to the trillion-dollar AUM level, traditional middle-market players such as commercial banks, BDCs, and insurance companies are being forced to keep spreads tight and leverage multiples loose for issuers up and down the credit spectrum. The looming question on many market participants minds is what impact inflation may have on a market that has had the gorged itself on low-cost capital for the last 10 years.

The Private Market Is Hot

There is little doubt in anyone’s mind that the private market is hot, but is it too hot?

Though we made some minor tweaks to pricing and leverage for the month of May (specifically, increasing leverage multiples for $20 million+ EBITDA issuers by a quarter to a half turn, and reducing pricing for the same cohort by 50 basis points), generally market conditions are identical to where they were in April.

In just about every metric possible, this is an extremely overheated market:

- Credit spreads (in both the public and private market) are at their tightest levels since 2018, and in some cases at all-time historic lows;

- Leverage multiples continue to expand, both (i) directly, with investors willing to go an extra turn on EBITDA with the expectation that EBITDA generation will improve in the “up-cycle” and Debt/EBITDA multiples will fall into more traditional metrics post-closing, and (ii) indirectly, with lenders taking a more liberal perspective on the definition of Adjusted EBITDA (i.e., normalizing EBITDA for the full year based on 2-4 months of “post-pandemic” performance);

- Almost all lender constituencies are experiencing greater liquidity, affording them the luxury of taking a more aggressive stance to pricing and covenant flexibility:

- Non-Bank Direct Lenders – now approaching the Trillion Dollar AUM level.

- Commercial Banks – reporting in the April 2021 Senior Loan Officer Opinion Survey on Bank Lending Practices, “Regarding loans to businesses, respondents to the April survey indicated that, on balance, they eased their standards on commercial and industrial (C&I) loans to firms of all sizes over the first quarter.”

- Business Development Companies – Share prices, as a percent of Net Asset Value (“NAV”), staged their largest recovery in the last 10 months—a recovery stronger than in the period five years after the Great Recession.

There is also some new “heat” in the market, but decidedly, not the kind that improves liquidity conditions. The inflation data in April took many by surprise; consumer prices (as evidenced in the April Consumer Price Index, or “CPI”) rose by its fastest pace in 10 years, jumping up 0.8% following a similarly robust 0.6% in March. On an annual basis, that is 4.2% boost to CPI (over the last three months, prices actually rose at a 7.2% annual rate).

A jump in CPI alone, however, is not earth shattering, in large part because it is usually the product of activity in the more volatile sectors of the economy, specifically food and energy costs. The bump in CPI in April, though, was primarily attributed to “Core CPI”—which specifically excludes food and energy costs. Core CPI rose 0.9% in April, its largest monthly gain since 1982, and annually, Core CPI is up 3% year over year. Higher prices for used autos surged 10% in April, their largest monthly increase on record.

While the most recent pronouncements of the Fed suggest this most recent inflation surge was “transitory,” resulting from the “re-opening of the economy” and that it will “likely moderate in coming months,” almost nobody predicted the magnitude of the April CPI gains (expectation was less than 0.4% vs. the actual 0.8% recorded for the month). However, recent data suggests that even a “transitory” increase in prices could have a deleterious impact on market conditions. Already, the April retail sales surprised to the downside, suggesting that U.S. consumers are beginning to balk at higher prices (the Commerce reported on May 14 that Retail Sales were unchanged following a 10.7% surge in March; expectation was for a 1.0% April increase). Additionally, the University of Michigan consumer sentiment index slumped in May, coming in well below market consensus. The Index registered 82.8, down from 88.3 in April, a rather sobering decline of -6.2%. According to the official University of Michigan report, “Consumer confidence in early May tumbled due to higher inflation—the highest expected year-ahead inflation rate as well as the highest long term inflation rate in the past decade.”

If the most recent surge in inflation is not transitory, the Fed will have no choice but to increase rates, which will result in a chilling effect on private market activity from higher borrowing costs and the potential for higher default rates for highly indebted companies. Higher capital costs translate to less leverage, and less leverage translates to lower valuations. The consequence of lower valuations historically results in depressed M&A activity, and the cycle continues.

Yes, we have a very hot market, but if the underlying economy may be even hotter, and that might prove to be … Too Hot.

Minimum Equity Contribution

Most lenders remain wary of thinly capitalized deals, and as a general proposition, a minimum aggregate of 50% base level equity (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack however, even supporting cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Equity Investment and Co-Investment

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Managing Partner and Principal

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

[email protected]

Ph: +61 412 778 807