Private capital availability is at a record high. Around the world, private equity funds, venture capital managers and debt equity providers are seeking out deals that can deliver to them the large accelerated returns that their investors seek.

For some business owners, these investors can be the right fit, delivering an opportunity to accelerate their growth and the possibility of a higher future return. Sometimes, however, what a business owner desires is a financial backer whose interests are better aligned to a strategy for long term growth.

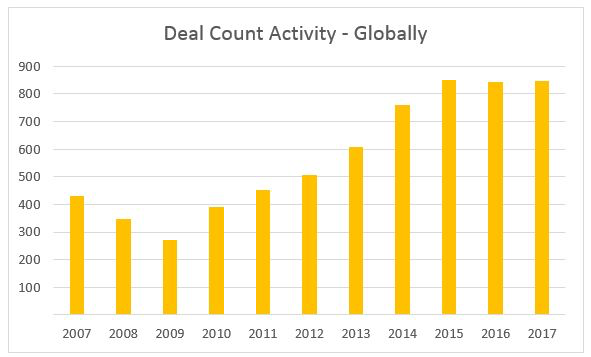

The Growth of the Family Office

Source: Pitchbook, 2018

The increasing importance of Family Offices is a consequence of long term growth in their originating enterprises and generational change. Accumulation of wealth from established family-controlled businesses and the introduction of professional managers to those operational businesses free up family members to develop a family investment house.

The Family Office brings some significant points of difference as an investor. Unlike private equity and venture capital managers, they are not constrained by the need for a liquidity event to distribute returns to investors. This patient capital is well suited to businesses that cannot attract the attention of investors seeking “moon-shot” opportunities. Additionally, whilst they will have areas of focus they generally have greater freedom to invest in compelling opportunities across different sectors and asset classes. Additionally, as we have found in a recent engagement in the waste management area, businesses in sectors outside of the usual areas of interest for venture capitalists can be attractive to family offices looking for more private investments.

Where a Family Office investor can be attractive

While some company founders may be looking for an immediate exit there are many for whom the goal is to release some cash for their own personal needs while remaining engaged in growing the business. For them, a patient capital partner with the resources to continue to back their growth may be the best option. This is not uncommon in the technology space where young founders have experienced success and want to remain driving the business but are looking to realise some of that value creation.

Another consideration that commonly plays a part in selecting an investor is the desire of the company owner to preserve the employees, management and culture of their enterprise. Again the less interventionist involvement of a Family Office can facilitate this.

Structuring a deal that works for both parties often poses challenges. Family Offices have the flexibility to think more creatively about how to construct such an arrangement, outside the constraints of doing a 3-5 year flip.

As in most things, there is a cost for securing these advantages. Generally, Family Offices adopt a more conservative approach to valuation. They are rarely interested in a competitive process, partly through a desire to protect their privacy and partly due to their fiscal prudence – they rarely utilise debt to leverage their return.

Challenges for Family Offices

Family Offices in their early stages tend to invest in areas close to their domain – they buy what they already understand. As the Office matures, or the family’s operational connection with their business diminishes, the networks they have within their own industry may weaken. In that case or upon the introduction of professional investment managers into the Family Office the scope of opportunities considered will tend to broaden.

For many Family Offices, the desire for privacy can constrain the flow of quality deals. This is where professional advisors, having relationships with Family Offices and free to search out deal opportunities can assist in bringing a potential transaction to a successful conclusion.

Another challenge, cited by around 70% of Family Offices, is the issue of conducting an appropriate level of due diligence. Individually, Offices may undertake relatively few investments, a fact which can constrain their internal capabilities and domain expertise. A sell-side advisor, understanding the perspective and issues concerning an investor or buyer, can reduce the friction in the process and expedite an outcome.

Ensuring a business is ready for a transaction is key to getting it done … and that is a full-sized topic for another day.

If you’re interested to learn more about investment opportunities, please send me an email at [email protected].