Stefan Shaffer, our New York Partner shares the June 2021 Private Capital Report. The market conditions continue to exhibit the same level of liquidity established in Q1 2021. The capital available for deployment continues to outstrip the supply of new transaction flow. While the summer months historically represent a quieter, less active period, this year may be an exception to the rule. Read the full report below.

Tone of the Private Market

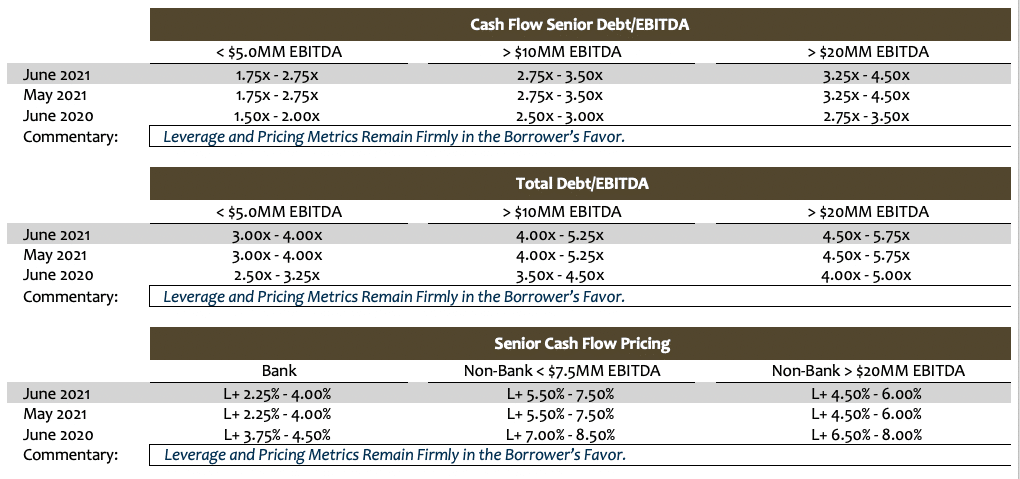

The credit spread and leverage multiple indications remain static and consistent with the aggressive levels established in May. Competition for assets is at an all-time high in the private market. Notwithstanding a rather precipitous increase in deal flow activity, liquidity conditions remain robust with capital available for deployment continuing to outstrip the supply of new transaction flow.

All leading lending constituencies (commercial banks, non-bank direct lenders, credit opportunity funds, BDCs, and insurance companies) are seemingly flush with capital, providing a unique competitive advantage to transactions broadly distributed. With current pricing and leverage among their most aggressive historic levels, there is increasing pressure for investors to compete on non-purely economic terms such as accelerated timing to close, looser covenant restrictions, and expansive definitions of “Adjusted EBITDA.”

Credit Spreads More Aggressive Than Pre-Pandemic Conditions

SPP is not making any changes in June respecting credit spreads or leverage tolerances, reflecting the fact that market conditions continue to exhibit the same level of liquidity established in Q1 2021.

The market has clearly settled into “post-pandemic” mode; both credit spreads and leverage multiples are now at more aggressive levels than pre-pandemic conditions, and in many cases at levels that are as aggressive as they have ever been. It seems that almost every major lending constituency from commercial banks and non-bank direct lenders to BDCs are better positioned than they have been in years. Reflecting the improved credit profiles of their customers, commercial banks are reversing loan loss provisions on their balance sheets established during the pandemic.

In addition, to compete with non-bank direct lenders, many banks are routinely exceeding Fed, OCC, and FDIC “3X Sr. Debt/4X Total Debt leverage” guidance (the “3/4 Box”), though in most instances, lending outside the 3/4 Box is limited to Sponsor Coverage lending groups. BDCs continue to strengthen their competitive position as well. As of today, 21 of the 44 publicly traded BDCs are trading at or above their net asset value (“NAV”), 39 of them are trading at a level that is at least 80% of their NAV, and only 3 are trading at less than 75% of their NAV.

These “excess liquidity” conditions are not going unnoticed, with market participants reporting a precipitous uptick in deal flow. While the summer months historically represent a quieter, less active period, this year may be an exception to the rule. Refinitiv LPC reports that Q2 2021 syndicated middle market volume exceeded $26 billion through May 2021, only $3 billion short of the volume for all of Q1 2021. Below the headline volumes, sponsored deals accounted for $10.6 billion of that total (exceeding the $9.8 billion of sponsored deals for all of Q1 2021). According to Refinitiv, middle market issuance is at its highest level since Q3 2019.

Conventional wisdom suggests that when deal flow increases at this rapid a pace, demand slows, and market participants become more selective by extracting higher spreads and focusing on less levered opportunities. However, that is simply not the case this year. Notwithstanding the dramatic increase in deal flow, credit spreads and leverage multiples remain at their most aggressive levels and show no signs of deteriorating in coming months.

Steady As She Goes.

Minimum Equity Contribution

Most lenders remain wary of thinly capitalized deals, and as a general proposition, a minimum aggregate of 50% base level equity (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack however, even supporting cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Equity Investment and Co-Investment

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

斯蒂芬·谢弗(Stefan Shaffer)

执行合伙人兼负责人

Stefan在私人市场拥有30多年的经验,包括在北美,亚洲和欧洲的数百笔交易。在成为SPP Capital的负责人之前,Stefan曾是Bankers Trust Company私人配售小组的副总裁,负责国内和国际资本市场集团私人配售的发起,结构设计和定价。

[email protected]

[email protected]

电话: +61 412 778 807