Stefan Shaffer shares the latest US Private Capital Report for November 2022. Yet again, the private capital middle market remains stubbornly robust, where there was only a marginal deterioration of LBO purchase price multiples. Lenders remain firmly in “risk-off” as we enter into the final months of the year. Read the full report below.

A Tougher Private Market

Issuers in Q4 2022 are finding a radically different private market than they did in Q1. Between January 1st and March 15th of this year, SOFR remained static at 0.05%; today, SOFR sits at ~3.80%. At the same time, credit spreads have widened ~1.0% for most commercial bank loans, while senior non-bank facilities, unitranche, second lien and mezzanine debt structures have increased between 1.5% – 3.0%, pushing “all-in” coupon rates to a range of 8.0% for high-quality issuers, to more than 12.0% for most middle market issuers. Lest we not forget, these are floating rates, and do not include closing fees or OIDs. To paraphrase the Boss, this market is clearly “Tougher Than the Rest”.

While base rates are high, it should be noted that they are not at unprecedented levels. In August of 2007, three-month LIBOR was 5.62%, well above the consensus estimate of 5.00% for SOFR by mid-2023. From an underwriting perspective, banks and institutional lenders are already routinely modeling SOFR rates of 5.00+% to gauge the impact of anticipated higher capital costs on a potential issuer’s fixed charge coverage on a go-forward basis.

Direct Lending Thriving in 2022

Interestingly, at least for the time being, the higher cost of capital does not seem to be having a materially adverse impact on issuance. On the contrary, as reported by KBRA DLD, Refinitive: “U.S, direct lending is thriving in 2022, with a year-to-date volume up 77%… Volume recorded through October totalled $122 billion, up from $69 billion through the same period last year.”

The higher cost of capital, and correspondingly, the reduced leverage capacity that has come to characterize this current market would also suggest that enterprise valuations would decline. That has certainly been the case with respect to large corporate LBOs. As reported by Refinitive, “last quarter, LBO purchase price multiples in the large corporate syndicated market declined to 10.8x, the lowest since 4Q18.” Yet again, the private capital middle market remains stubbornly robust, where there was only a marginal deterioration of LBO purchase price multiples. Specifically, the syndicated and direct lending middle market averaged “a 12.4x LBO purchase price multiple in 3Q22, a decrease from 12.6x in 2Q22, but level with 1Q22’s level. That market has now averaged a 12x or higher LBO purchase price multiple for 6 out of the last 7 quarters, after never averaging 12x or higher before 1Q21.”

Rate Increases Will Impact the Level of New Issuance

While the impact on issuance and enterprise valuations may appear minimal at this moment in time, it has only been a matter of weeks since the last uptick in rates by the Fed, and given the strength of the most recent economic reports (i.e. October non-farm payrolls at 261,000, CPI at 7.7 percent y/y through October), consensus is that the Fed will still likely opt for another 0.75% rate hike at the December FOMC (bringing the feds fund rate range to 4.50%-4.75%, and by extension, SOFR to ~4.55%). SOFR moves in tandem with the Fed Funds rate; SOFR is an effectively risk-free overnight rate, the dynamics of which are closely linked to those of the Fed Funds overnight rate, which, in turn is the interest rate most directly impacted by US monetary policy.

Continued rate increases will inevitably impact the level of new issuance and enterprise valuations. Already in October, we have witnessed what might be the beginning of this phenomenon. With reference again to the KBRA DLD data, on a monthly basis, US direct lending slowed 15.3% over the $6.5 billion recorded in October 2021. While certainly not enough input to suggest a trend, it does merit notice.

The larger consideration for most portfolio managers, however, is not merely future issuance levels and enterprise valuations, but rather the underlying health of those assets already in the portfolio. In a recent study by KBRA titled, Insight on Private Credit: 12% Is Not Affordable for Many Borrowers, the authors quantified the interest stresses of more than 2,400 middle market companies, financed by traditional middle market lenders, and the conclusions are sobering: “the markets are indicating future rate hikes could add up to 225 basis points to borrower costs by the end of Q1 2023. In a resulting 12.00% interest rate environment, up to an additional 16.00% of companies in the study portfolio may not generate enough cash flow from their operations to cover their interest expenses.”

What makes this study all the more alarming is that it only takes into account the increased cost of capital, excluding “the impact of downward recessionary pressure on revenues and upward inflationary pressures on costs—all of which will, along with higher interest costs, begin to fully manifest in corporate cash flows in Q4 2022 and Q1 2023” (i.e.- not factoring in continued inflation, the war in Ukraine, continued global economic weakness, and a very real potential for recession in the US). Considering this more expansive and comprehensive perspective, the private capital markets are decidedly – Tougher Than the Rest.

The Tone of the Market

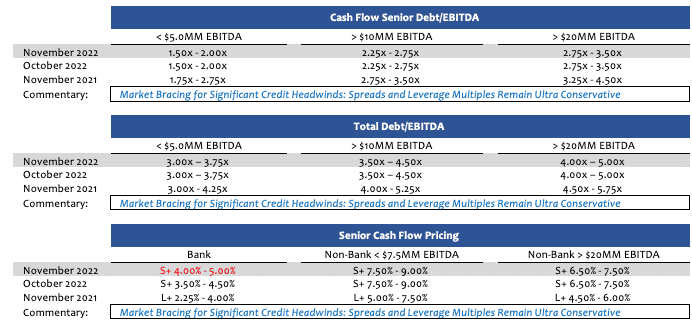

After a major overhaul of both pricing and leverage guidance for the month of October, SPP is not making any significant modifications to our indicative metrics for November. Lenders remain firmly in “risk-off” as we enter into the final months of the year, anticipating a sustained deterioration of credit quality into Q1 of 2023. While most lending constituencies still cite inflation, the war in Ukraine, and global economic weakness for the devolving credit environment, lenders have increasingly begun to recognize that interest rate increases alone may pose the greatest threat to credit quality going forward. After the most recent Fed hike, SOFR sits at approximately 3.80%, and there is a consensus that SOFR may spike to 5% or more in 2023. These base rates, when combined with average spreads ranging between ~4.0% – 5.0% from commercial banks, and ~7.0% – 8.5% from non-bank lenders, result in all-in senior debt coupon rates ranging from ~8.0% for higher quality issuers to more than 12.0% for most middle market issuers. Most market participants (on both sides of a deal) have never operated in such a prohibitive cost-of-capital environment, where fixed charge coverages will almost certainly atrophy, and the risk of widespread covenant breaches intensifies.

Minimum Equity Contribution

Minimum equity contribution levels required in leveraged buyouts have remained relatively consistent since 2017, ranging from a low of 44.5% in 2018 to a high of 44.8% in 2021. As a general proposition, lenders remain wary of thinly capitalized deals and that is especially true for 2021 vintage financings where enterprise multiples were elevated. Minimum aggregate base level equity of 50% (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack, including cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Equity Investment and Co-investment

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

斯蒂芬·谢弗(Stefan Shaffer)

执行合伙人兼负责人

Stefan在私人市场拥有30多年的经验,包括在北美,亚洲和欧洲的数百笔交易。在成为SPP Capital的负责人之前,Stefan曾是Bankers Trust Company私人配售小组的副总裁,负责国内和国际资本市场集团私人配售的发起,结构设计和定价。

[email protected]

Ph: +1 212 455 4502