Stefan Shaffer shares the latest US Private Capital Report for March 2025. While liquidity remains favorable today, issuers have a valuable opportunity to secure capital under current market conditions. Staying proactive and prepared will be key as the market evolves. Read the full report to prepare for what’s next.

M&A Activity Falls Short of Expectations

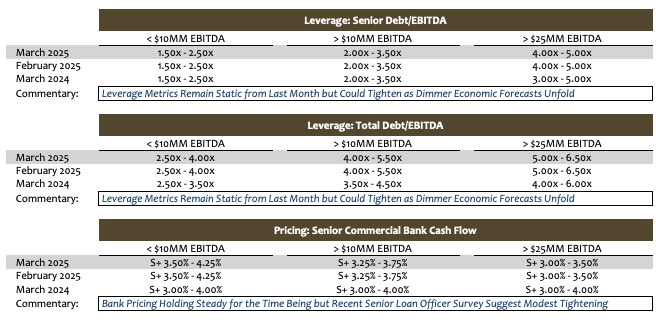

SPP is not making any changes to its pricing and leverage metrics for the month of March, but potential issuers should not necessarily assume that the current borrower-friendly, “risk-on” liquidity conditions in the private market will remain static into the spring, for as Bob Dylan aptly predicted in the fall of 1963, “The Times They Are A-Changin’,” and unfortunately, not necessarily for the better.

When Donald Trump was elected, investors thought his deregulation agenda would help bring back M&A dealmaking, exits, and distributions. Contrary to expectation, however, deal flow into the third month of the year remains lackluster; the “tidal wave” or “deluge” (or whatever is your preferred terminology) of new M&A activity has simply not materialized. In fact, private market M&A activity has only diminished in 2025—by a factor of 30% compared to the same time last year. As noted in LSEG, “Amid the whiplash of ‘will they or won’t they’ come into effect, talk of tariffs have contributed to the slowest start to the U.S. M&A calendar in ten years. Despite market hopes that the new administration would ease regulatory pressures to support a meaningful increase in acquisition deals during 2025, the return of market volatility and recession fears has contributed to a slowdown in announced M&A deals—at least for now. So far this year, 1,873 M&A deals have been announced in the U.S., a drop of over 30% compared to the same time last year.”

The Supply and Demand Imbalance in Private Markets

That lack of new money deals (i.e., proceeds for that add net-new issuance to the market, such as acquisition financing, capital expansion, and dividend recaps) serves only to perpetuate a supply/demand imbalance overwhelmingly in favor of issuers. Institutional lenders need to deploy capital, but the pace of new money deal flow remains languid, and the majority of financing activity that is reported is for refinancing and repricing. As reported by @markets, “Repricings have surged to dominate leveraged loan issuance, vastly outpacing new money deals and refinancings. This trend accelerated sharply in early 2024 and continues into 2025, driven by borrowers adjusting loan terms amid strong demand and tightening spreads.” In short, there is no underlying macroeconomic influence driving more competitive conditions in the private market, but rather a deficit in deal flow, especially new money deal flow.

Importantly, current “excess-liquidity” conditions could turn quickly; there is increasing evidence of a potential credit “down-cycle” in the works, which could have a materially adverse impact on pricing, leverage capacity, and, for some, even access to capital itself. As per data from S&P Global Market Intelligence, U.S. corporate bankruptcy filings reached a 14-year high in 2024 (694 filings in 2024 marked the highest number of such filings since 2010). Recent data from Fitch suggests private market default exposure is increasing as well. “The default rate in Fitch Ratings’ portfolio of U.S. privately monitored ratings (PMR) rose sharply to 8.1% in 2024. This is the highest level since Fitch recorded the first default in the portfolio in 2019.”

The inflationary impact of tariffs, a prolonged trade war, and even talk of recession is already having a profound impact on other, more traded markets. Corporate credit default swap spreads (i.e., the annual premium, expressed as a percentage of the notional amount, that the protection buyer pays the protection seller for insuring against the risk of default of a specific debt obligation) have spiked recently, reflecting an increasing level of investor angst. Not surprisingly, underlying corporate credit spreads in the traded bond markets have widened sharply in recent weeks as well.

Impact on Middle and Lower Middle Market Issuers

Short-term volatility in the public, 144A, and syndicated loan markets is not determinative of liquidity conditions in the private capital markets, especially with respect to the mid-middle market ($20+ million of LTM EBITDA) and lower middle market (sub-$10 million of LTM EBITDA) issuers. However, should the recent increasingly negative macroeconomic indicators (the Atlanta Fed’s GDPNow predicting GDP contraction of -1.8% and the University of Michigan’s Consumer Confidence in March declining to 57.9, the lowest level since 2022) be a sign of what is to come, the private market will be ultimately be affected with access to capital impaired (i.e., higher credit spreads, lower leverage multiples, and tighter covenant restrictions (including adjustments to EBITDA), less market receptivity to non-accretive uses of capital (i.e., recaps and share repurchases), and greater barriers to entry for issuers in highly cyclical sectors, the lower middle market, and “storied” credits.

Looking Ahead: Opportunities Amid Change

While liquidity remains favorable today, issuers have a valuable opportunity to secure capital under current market conditions. Staying proactive and prepared will be key as the market evolves — after all, “The Times They Are A-Changin’.”

Again, as of this writing, private market liquidity conditions remain optimal; but, for the first time in two years, the foundation upon which this liquidity sits is more fragile, and to many a signal that “The Times They Are A-Changin’.”

Tone of the Market

The long-awaited “tidal wave” of M&A deal activity still has not materialized, keeping the supply/demand advantage firmly in favor of issuers. Pricing and leverage metrics remain static for the time being, still hovering among their most competitive levels historically. However, increasing macroeconomic uncertainty surrounding tariffs (i.e., trade wars, inflation, and even recession) has lenders rethinking their underwriting parameters and increasingly contemplating a more defensive credit positioning for a potential “down-cycle.” Should these fears play out, the potential adverse effects on new issuance will be dramatic and have an even more chilling impact on M&A activity. As we have seen play out in the private market during the Great Recession and Covid era, as banks and institutional lenders circle the wagons, lower middle market, storied, and more challenged credits will be disproportionately adversely impacted, recapitalization and other “non-accretive” uses of capital will be discouraged, and leverage multiples will contract while credit spreads widen. Less leverage capacity and higher costs of capital will diminish enterprise values, further deteriorating whatever nascent M&A activity currently exists. That, of course, is a worst-case scenario, and the current market consensus is that less draconian credit conditions will emerge as the underlying strength of the economy (moderate inflation, low unemployment, and continued growth in GDP) combined with a more tempered trade policy diminishes current market volatility.

Minimum Equity Contribution

The level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders remain fixated on a minimum 50% LTV (i.e., equity capitalization of 50% of enterprise value), and actual new cash in a deal should also constitute at least 75% of the aggregate equity account. While lenders will certainly give credit to seller notes and rollover equity, the cash equity quantum continues to be an essential and primary underwriting consideration. The good news is that non-bank lenders, private credit funds, insurance companies, BDCs, and SBICs are all potential sources of equity capital as well as debt capital, and in many cases, are more than happy to shore up and backfill the equity account directly.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments is robust in the new year, and in most cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Importantly, equity investment can take a variety of forms (preferred, common, warrants, even HoldCo notes) depending on the unique requirements of a given deal. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real “skin in the game” (i.e., a meaningful investment of their own above and beyond a roll-over of deal fees). While family offices remain the best source of straight common equity, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing combined debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

斯蒂芬·谢弗(Stefan Shaffer)

执行合伙人兼负责人

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502