Stefan Shaffer shares the latest US Private Capital Report for February 2025. Pricing and leverage metrics remain unchanged for February, with liquidity conditions still highly aggressive. Middle-market M&A activity is subdued, driving fierce competition, while issuers benefit from favorable terms, flexible covenants, and surplus liquidity expected to persist through Q2. Read the full report to prepare for what’s next.

Middle Market M&A: Slow Now, but Poised to Rebound

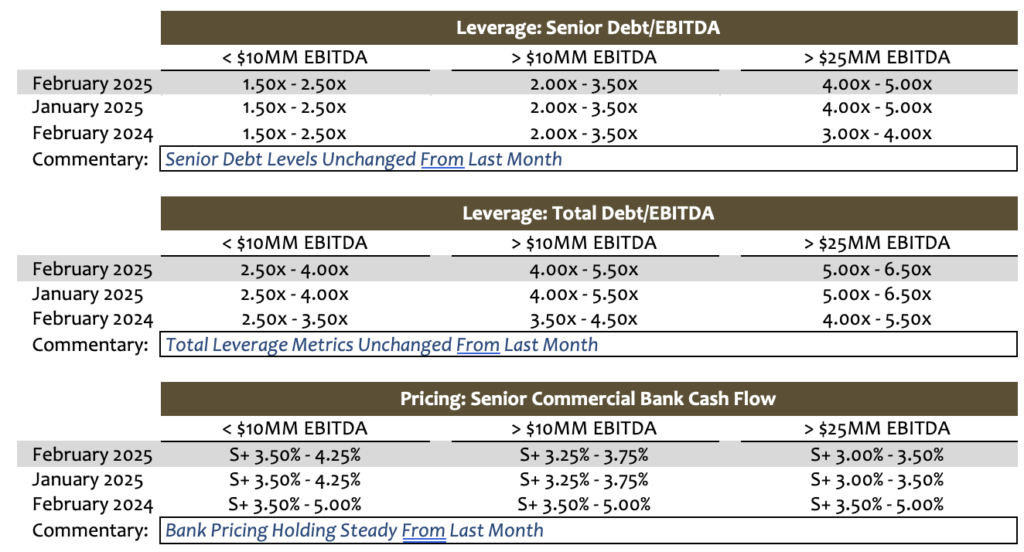

As noted earlier, SPP is not making any modifications to its pricing and leverage metrics for February; credit spreads and leverage multiples remain at levels among the most competitive since SPP started tracking such metrics in 2011. As confirmed by SPP’s weekly outreach to institutional private market participants, the most significant driver for the fierce competition for assets remains “the lack of quality actionabl opportunities,” and the “unprecedented level of capital available” for deployment in 2025. As discussed in greater detail below, though M&A-based financing activity is beginning to pick up for upper middle market transactions (issuers with >$50 million of LTM EBITDA), the number of new money LBO opportunities for mid-lower middle market issuers remains depressed, and lenders are becoming increasingly creative to attract what limited deal flow does exist. It is widely anticipated, however, that middle market M&A activity will gain steam through a variety of factors, including lower base rates (SOFR at ~4.3%), tighter credit spreads, resulting higher enterprise valuations, sponsors’ need to return LP capital, increasingly optimistic expectations for macroeconomic growth, and more permissive regulatory environments all which conspire to break the “logjam” of middle market M&A deal activity. Better stated, the middle market is anxiously “Waiting On the World to Change.”

Debt Market Conditions Remain Extremely Favorable

There is no dearth of data supporting the proposition that issuance conditions for the debt markets are optimal. Pricing on leveraged loans, investment grade, high yield, and 144A bonds (i.e., credit spread over base rate SOFR or UST) are among their most competitive levels historically. As noted by Wall St. Jesus, “Credit Spreads are close to modern day tights and at levels last seen in 1997-1998.” Price compression has also impacted unitranche pricing, a relatively new addition to tracked leverage data. LSGEG LPC, recently reported that “unitranche pricing tightened significantly over the course of 2024, moving steadily lower in the first nine months of the year before edging higher in 4Q24. The unitranche blended spread averaged 539bp in 4Q24, up marginally from 533bp in 3Q24 but well below the 604bp recorded in 4Q23. Looking at the different market segments, the average unitranche spread for large corporate issuers tightened to 519bp in 4Q24, down from 599bp a year earlier. In comparison, middle market issuers saw unitranche spreads drop by 62bp year-over-year to 544bp in 4Q24.”

Though pricing is usually the first metric that is top of mind in assessing how competitive the market is, leverage multiples (i.e., aggregate debt capacity) are usually second, and again, current market leverage metrics for middle market issuers don’t disappoint; as reported by LSEG LPC, “…average total leverage of 4.70x in 4Q24 was above the 4.52x recorded at the same time last year. Leverage increased and spreads declined across company size in 2024. … leverage widened by 0.14x to 4.77x. In the lower middle market (EBITDA

Merely being aggressive in pricing and leverage capacity doesn’t necessarily translate into increased deal flow however, and increasingly lenders are resorting to expedited underwriting and diligence to attract assets. Whitehorse Capital recently published their “2025 Lending Outlook,” featuring an interview with Stuart Aronson, executive managing director and CEO of Whitehorse U.S., and Pankaj Gupta, president of Whitehorse U.S., where they discussed the new trend in such “diligent-lite” strategies. Gupta noted that, “Unfortunately, I think as lenders, we saw a gradual relaxation of those underwriting standards. And really, it depends on what part of the market we’re talking about. If you’re thinking about sponsored transactions, private equity-led LBOs for middle, upper middle market companies, given the relatively benign economic environment that we experienced in ’24 and what we’re experiencing right now with the outlook as it is right now, people have gotten pretty aggressive. People are competing to win business and the way they’re competing to win business is by relaxing their underwriting standards, doing something that we call “diligence-light”, which is effectively desktop-level diligence done in a few days to a week. And that has become more and more accepted in the upper middle market sponsor space”.

In addition to “diligent-lite” underwriting, issuers are increasingly also able to secure “covenant-lite” structures. Gupta noted, “Covenant light, I’m sure everyone knows, has crept into the middle market where companies now with typically $50 million or more of EBITDA are candidates for covenant light deals. And sometimes in certain situations we’ve even seen that go below $50 million. So that weakens the protections for lenders.” It doesn’t end with specific covenant levels either; as Gupta continued, “the other thing in that part of the market is, again, regardless of where the covenant is set, the underlying definitions that people are using for EBITDA in that market allow for pretty aggressive adjustments. And so with the stroke of a pen of a CFO, they could furnish a compliance certificate, which allows for unlimited add-backs to the EBITDA or prospective add-backs for revenue synergies and/or cost savings that are on the covenant that haven’t been actioned, or customers haven’t been won or whatever it is.”

As noted in this publication and others on countless occasions, the lack of new M&A deal activity is one of the primary causes of the “excess liquidity” conditions in the private capital middle markets described above. The good news is that it may be beginning to change; there is an increasing quantum of data suggesting M&A activity may be picking up. According to Pitchbook, in January, M&A-related leveraged loan volume jumped to its highest level in three years; having said that, it also should be noted that the new money for LBO purposes only accounted for $8 billion of a total of $186 billion of total institutional leveraged loan issuance for January, or ~4.3% of total issuance. Still, at $8 billion, the January M&A leverage loan activity was almost double the $4.1 billion recorded in January of 2024. At $146.9 billion (79% of monthly volume), repricings continued to account for the clear majority of leveraged loan issuance.

Signs of M&A Rebound Are Emerging

According to its latest M&A report, Bain & Company is “optimistic” for the year ahead in M&A. One reason for the optimism is how “companies have pursued M&A despite three years of headwinds, including high interest rates and regulatory scrutiny.” As noted by Maria Dikeos of LSEG, “New year, new administration, and improving U.S. economic outlook have combined to bring a much-needed boost to market psyche when it comes to hopes for new money deal flow in 2025.” Respondents to LSEG LPC’s Q1 2025 outlook survey are especially optimistic about M&A prospects. Among leveraged lenders, a whopping 63% of survey respondents note that momentum for more M&A/LBO deal flow is expected to build in 2025, up from 22% who felt this way heading into Q4 2024. An additional 13% believe that there will be significant upticks, up from 11%.

Private Equity’s Pressure to Return Capital May Drive More Deal Flow

One major driver often cited for expectations of increased M&A activity is the need for middle-market equity sponsors to return capital to LPs—either by harvesting portfolio companies or undertaking leveraged recapitalization financings. According to Pitchbook’s latest U.S. Market Insights report, the holding period of U.S. buyout-backed company inventory has risen to a median of 3.4 years in 2024, the longest period on record since 2015, and a ~10.2% increase over 2023. Drilling down further, in 2024, ~18.4% have been held 5 to 7 years, and ~13.2% have been held for more than 7 years (up from 17.5% and 9.1%, respectively, in 2023).

In short, 2025 is “expectation rich”—fueled by macroeconomic, political, and regulatory optimism, unprecedented private market liquidity, and a release of pent-up demand by sponsors to both deploy new capital and return LP investment via M&A/Recap financing; i.e., “Waiting On the World to Change.”

Tone of the Market

SPP has not made any changes to pricing or leverage metrics for February; liquidity conditions, for all practical purposes, are virtually identical to January. Having said that, it must be noted that January metrics were among the most aggressive we have published in the last five years. Deal flow, especially middle market M&A-based transaction activity, remains subdued, and resultingly, competition for new assets is fierce. Lenders across the credit spectrum complain about the lack of “quality” actionable opportunities. January saw an uptick in the larger leveraged loan M&A market, which historically correlates to a subsequent increase in middle market M&A-driven activity. For the time being, however, this is clearly an issuer’s market characterized by unprecedented competitive pricing, expanded leverage capacity, streamlined underwriting (from diligence through documentation), flexible covenant structures, and expansive “adjustments” to EBITDA. While concerns remain respecting the inflationary impact of tariffs and the removal of foreign laborers, underlying macroeconomic strength continues seemingly unabated. As a general proposition, market participants expect current “surplus liquidity” conditions to persevere through the second quarter.

Minimum Equity Contribution

The level of new cash equity in a deal remains a primary focus point for all leveraged buyouts. Regardless of enterprise multiples, lenders remain fixated on a minimum 50% LTV (i.e., equity capitalization of 50% of enterprise value), and actual new cash in a deal should also constitute at least 75% of the aggregate equity account. While lenders will certainly give credit to seller notes and rollover equity, the cash equity quantum continues to be an essential and primary underwriting consideration. The good news is that non-bank lenders, private credit funds, insurance companies, BDCs, and SBICs are all potential sources of equity capital as well as debt capital, and in many cases, are more than happy to shore up and backfill the equity account directly.

Equity Investment and Co-Investment

Liquidity for both direct equity investments and co-investments is robust in the new year, and in most cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Importantly, equity investment can take a variety of forms (preferred, common, warrants, even HoldCo notes) depending on the unique requirements of a given deal. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real “skin in the game” (i.e., a meaningful investment of their own above and beyond a roll-over of deal fees). While family offices remain the best source of straight common equity, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing combined debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

斯蒂芬·谢弗(Stefan Shaffer)

执行合伙人兼负责人

Stefan has over 30 years of experience in the private market includes hundreds of transactions in North America, Asia and Europe. Prior to becoming a principal at SPP Capital, Stefan was a Vice President in the Private Placement Group at Bankers Trust Company where he was responsible for origination, structuring and pricing of private placements for the Capital Markets Group, both nationally and internationally.

[email protected]

Ph: +1 212 455 4502