Stefan Shaffer shares the latest US Private Capital Report for March 2024. After a slow start, deal activity is surging back. Reduced credit spreads and increased flexibility in deal structures are reshaping opportunities for family-owned businesses and investors alike. As the market landscape evolves, understanding these driving forces becomes crucial for informed decision-making. Read the full report below.

M&A Deal Activity is Growing

After one of the most lethargic starts to the new year, deal activity is back, and back with a vengeance. Investors surveyed by SPP this month report a precipitous jump in new deal activity. What is driving this new surge? We know it is not interest rates; after a small jump up to 5.40% on January 2nd of this year, SOFR hasn’t really moved north of 5.31% since July of 2023. M&A activity is growing, but still at a fraction of the level of activity two years ago. The apparent surge in deal activity seems to be more a function of three converging forces:

- A realignment of interest rate expectations: Issuers recognize that we are going to be in a high interest rate environment for an extended period, and while the Fed may reduce rates piecemeal over the course of the next year, a return to the post-Covid zero percent interest rates is no more than a distant memory. Acquisitions, capex, and other growth initiatives that were postponed during the Fed hiking cycle in 2023 are back in focus;

- Enhanced confidence in macroeconomic conditions: Unlike the first quarter of 2023, recessionary fears have subsided. Notwithstanding armed conflicts in both Europe and the Middle East, U.S. Real GDP is at a current level of 22.67T, up from 22.49T last quarter and 21.99T one year ago. This is a change of 0.79% from last quarter and 3.09% from one year ago. As noted recently in Seeking Apha, “Credit spreads suggest no cause for concern about an impending domestic recession or rise in corporate solvency risks.”; and

- Private Market Liquidity: Private Market lenders are flush with cash and eager to deploy capital. Commercial banks (and more saliently with respect to the middle market, regional commercial banks) have returned to a more competitive lending posture. The March 2023 SVB failure prompted a true banking “crisis,” which evidenced a wholesale retreat by commercial banks from cash flow lending, especially among smaller regional institutions. The situation seemed to have reversed itself, and smaller banks are back in the lending business. On top of increased commercial bank participation, the non-bank direct lending community continues to grow at a staggering pace. According to data compiled by Preqin, closed-end private debt funds have approximately $1.7 trillion of assets under management globally as of June 2023, up from around $500 billion at the end of 2015. BlackRock, Inc. predicts that “tectonic shifts” in financial markets will spur the value of the global private debt market to $3.5 trillion by 2028.

Understanding the Economic Landscape: Insights and Trends

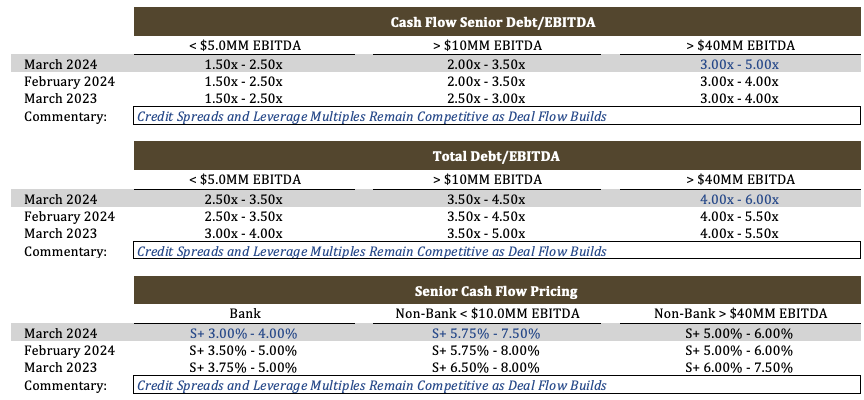

Not surprisingly, SPP continues to lower its credit spread indications for a third consecutive month in March. A quick perusal of our March “Market-At-A-Glance” shows a reduction in commercial bank cash flow credit spreads of 50 to 100 basis points from February, ~50 basis points by non-bank lenders for senior debt, and 25 basis points for both second lien and unitranche lenders. While leverage multiples have not loosened to the same extent evidenced in pricing, we have increased our leverage tolerances by a full turn of leverage for larger issuers (>$40 million of LTM EBITDA). While it would be premature to characterize this as an “issuer’s market,” there is little doubt that risk tolerance is increasing.

It should be noted that private market dynamics are entirely consistent with what is happening in the public and traded capital markets. Investment grade issuer activity hit a new record in ‘Q1 of 2024, coming in just short of $500 billion in new bond issuance. Additionally, as reported by Goldman Sachs, credit spreads in the public and traded markets for both investment-grade and high-yield bonds are among their tightest levels historically.

Flexibility Reigns: Key Factor in Choosing Middle Market Lenders

SPP’s ongoing survey with private market participants this month yielded some interesting feedback. A majority of middle market sponsors canvassed by SPP responded that “flexibility” is the single most important factor in determining which lender is most appropriate for their portfolio assets. While “pricing” and “maximum leverage” were also key considerations in choosing the best debt provider, flexibility is the single most important consideration. Among the responses:

- “Flexibility in structure (taking a piece of equity) is helpful. Covenant flexibility in order to realize post-close strategies is a priority.”

- “Flexibility (which would include terms as well as a general understanding of the nuances of the target business) is most important, closely followed by rate and speed/ability to close.”

- “We tend to value more flexibility, which can be best achieved with non-bank groups, but it comes with a trade-off in pricing.”

Non-bank credit lenders clearly have a leg up when it comes to providing flexibility, but as noted above, it comes at a cost; whereas a commercial bank cash flow facility for a typical $15 million LTM EBITDA issuer with median leverage (~2.5x to 3.5x total debt) will price out at SOFR + ~3.50%, a comparable non-bank credit provider will cost SOFR + ~6.50%. However, the non-bank provider can, in most cases, provide significantly lower mandatory amortization (1.0% vs. 7.5%), less restrictive covenants, more expansive add-backs to the dbacks to the definition of “Adjusted EBITDA” and, increasingly, the capacity to co-invest in the equity.

Non-bank lenders have a distinct advantage over commercial banks when it comes to flexibility due to the lack of regulation and oversight, but that might be changing as well. Michael Hsu, the acting Comptroller of the Currency, has raised concern over private credit providers “acting like banks.” According to Hsu, “PE firms and other so-called nonbanks don’t face the same level of federal oversight as traditional lenders. This disparity is an issue as firms act more and more like banks.” Hsu went on to note that “regulators need to prevent next great blurring. Without clear guardrails, the line between commerce and banking tends to blur. The more incremental and rational the blurring, the harder it is to detect and to address.”

Conclusión

While regulation may be coming, it is clear sailing right now: deal flow is robust, base SOFR rates seem to have maxed out, credit spreads continue to favor issuers, and flexibility in deal structure is more readily available than it has been in a year. As the Fab Four stated most elegantly, it is “getting… so much better… all the time.”

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Socio director y director

Stefan tiene más de 30 años de experiencia en el mercado privado que incluye cientos de transacciones en América del Norte, Asia y Europa. Antes de convertirse en director de SPP Capital, Stefan fue vicepresidente del Grupo de Colocación Privada en Bankers Trust Company, donde fue responsable de la originación, estructuración y fijación de precios de colocaciones privadas para el Grupo de Mercados de Capitales, tanto a nivel nacional como internacional.

[email protected]

Ph: +1 212 455 4502