Stefan Shaffer, our New York Partner, shares the latest Private Capital Report for March 2022. While economic resurgence drove the M&A activity in 2021, what we foresee this year is an upward trend in debt recapitalizations. Read the full report below.

Increase in Debt Recapitalization Transactions Projected

While 2021 was the year of M&A, 2022 may be shaping up as the year of recapitalizations. Both sponsored and unsponsored issuers are finding abundant liquidity for recapitalization strategies, providing a clear message for the leveraged lending community – “Get It Fore It’s Gone.”

Economic resurgence paved the way for record M&A activity in the U.S. during 2021. North American aggregate deal value hit approximately $2.8 trillion, a 55% increase from the $1.9 trillion logged in 2020. In fact, U.S. deal flow accounted for approximately 60% of all global deals. Deal volume also surged last year, recording a new all-time high of 7,896 transactions. While most expected that 2022 would follow the trends established in 2021, SPP anecdotal feedback suggests a precipitous reduction in M&A activity and a corresponding increase in debt recapitalization transactions.

Market Volatility at Its Highest Level

Conventional wisdom argues that recapitalization activity peaks at the height of a business cycle, especially when volatility is elevated. A recapitalization is often a perfect hedge that allows financial sponsors to take money off the table and distribute capital to their investors on an expedited basis, rather than undertaking a lengthy, and at times, uncertain, sales process. While inflationary concerns certainly influenced the capital markets in January and February, the invasion of Ukraine has only exacerbated current market conditions, driving volatility to its highest level in years.

The Chicago Board Options Exchange’s CBOE Volatility Index (“VIX”) is a popular measure of the stock market’s expectation for volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE and is often referred to as the “fear index” or “fear gauge.” Relative to history, the VIX is now around the 88th percentile. In other words, it’s only been historically higher 12% of the time. Many capital markets experts are dialing back U.S. GDP growth resulting from the combination of higher interest rates, soaring energy prices, and geopolitical instability. Goldman Sachs has cut its forecasted gross domestic product growth for the United States to 1.75% this year after previously forecasting a 2.00% increase in GDP. According to Goldman Sachs chief economist, Jan Hatzius, “We now see the risk that the U.S. enters a recession during the next year as broadly in line with the 20-35% odds currently implied by models based on the slope of the yield curve.”

Pricing and Leverage Multiples at Their Most Aggressive Levels

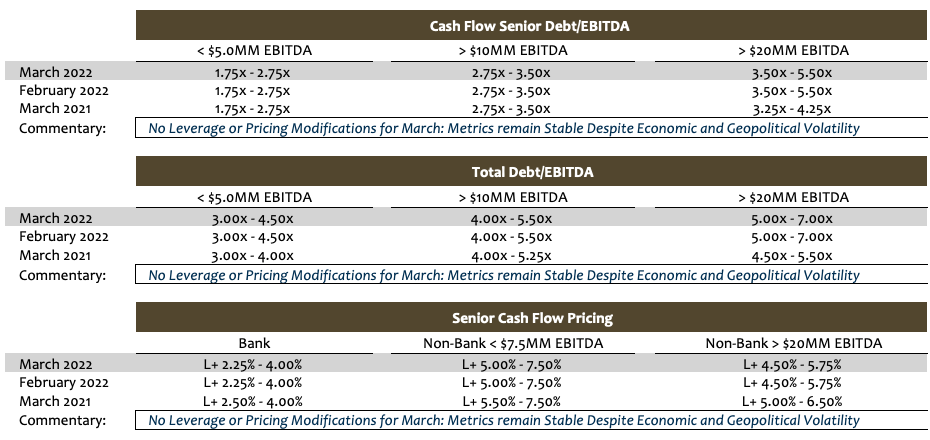

Not surprising against this backdrop, SPP’s anecdotal experience is that debt recapitalization transactions have surged in the last month, for both sponsored and unsponsored issuers. Fortuitously, the spike in recapitalizations also comes at a time when pricing and leverage multiples are at their most aggressive levels. We are not making any changes to last month’s metrics in March.

Respecting debt recapitalizations specifically, our March canvassing of private market leverage providers revealed:

- Non-sponsored recapitalizations will generally result in less leverage than a corresponding sponsored recapitalization;

- For non-sponsored issuers with ~$10-$20 million in LTM EBITDA, leverage multiples peak at 3.0x for a recap vs 4.0x for accretive (i.e.-acquisitions, growth, non-recap) uses of proceeds;

- For sponsored issuers with ~$10-$20 million in LTM EBITDA, leverage multiples peak at 4.0x for a recap vs 5.0x for accretive uses of proceeds;

- For sponsored transactions, most lenders have a negative bias to deals where the sponsor is seeking more than 100% of its aggregate cash equity commitment; and

- The key consideration in assessing the magnitude of the recapitalization will be the enterprise valuation “cushion” below the debt stack. In most cases, lenders will seek a loan to value not exceeding ~50%.

While it will be a few months before the empirical data tracking recapitalization activity will be generated, in light of the increasing current economic volatility, geopolitical instability, and anticipated Fed interest rate hikes, there is little argument that for any issuer contemplating a liquidity event, a thoughtful debt recapitalization strategy warrants serious consideration. Stated more succinctly, Get It ‘Fore It’s Gone.

Tone of the Market

SPP is not making any changes to its leverage multiple or credit spread indications for the month of March. However, the fact that these metrics are static for the time being is, quite noteworthy. First, our leverage and pricing metrics are already at historically aggressive levels and remain at their lowest since the inception of the SPP Private Market Update in 2008. Second, and perhaps more extraordinarily, these metrics remain unchanged amongst significant economic and geopolitical volatility: (i) inflation remains elevated and sits at its highest point in 40 years with the consumer price index (“CPI”) at 7.9%, (+0.8% in February) and Core PCE, the Fed’s preferred measure of inflation, at its highest since January 1982 (6.4% annualized); (ii) U.S. Crude oil is at its highest level in more than a decade with the global benchmark topping $113 per barrel; (iii) the Fed continues to par down asset purchases and is expected to raise the Federal Funds Rate 0.25% in March; and (iv) Russia’s invasion into the Ukraine has destabilized world markets, bringing nuclear tensions to their highest levels since the Cold War. These events have wreaked havoc on the equity and debt markets and pushed credit spreads between investment grade and high yield bonds up to their highest levels since July. While it is almost inconceivable that the recent political and economic events will not have an adverse impact on the private market at some point, issuance conditions remain solidly issuer friendly for the time being.

Contribución mínima de capital

Minimum equity contribution levels required in leveraged buyouts have remained relatively consistent since 2017, ranging from a low of 44.5% in 2018 to a high of 44.8% in 2021. As a general proposition, lenders remain wary of thinly capitalized deals and that is especially true for 2021 vintage financings where enterprise multiples were elevated. Minimum aggregate base level equity of 50% (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack, including cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Inversión de capital y coinversión

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Socio director y director

Stefan tiene más de 30 años de experiencia en el mercado privado que incluye cientos de transacciones en América del Norte, Asia y Europa. Antes de convertirse en director de SPP Capital, Stefan fue vicepresidente del Grupo de Colocación Privada en Bankers Trust Company, donde fue responsable de la originación, estructuración y fijación de precios de colocaciones privadas para el Grupo de Mercados de Capitales, tanto a nivel nacional como internacional.

[email protected]

Ph: +61 412 778 807