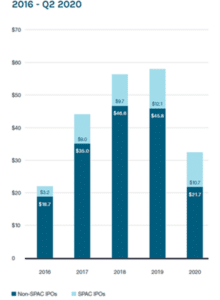

Special Purpose Acquisition Company (SPACs), also known as blank check companies, are nothing new, but the novelty has found interest in today’s market and they have become very popular. According to Forbes, SPACs have raised over $20 billion this year and have created a flurry of public activity in the US capital markets.

*Image from Pitchbook

“The new big-money status symbol of 2020 is running your own blank check company. Hedge fund billionaire Bill Ackman has a new one. Oakland A’s executive Billy Beane, who was played by Brad Pitt in the film Moneyball, got into the game with an initial public offering in August. Even former U.S. Speaker of the House Paul Ryan is getting one going.” – Crystal Tse, Bloomberg Businessweek (Aug. 27, 2020)

“Unlike conventional private equity investors, SPACs are not reliant on high yield debt to do their deals (although they may make use of leverage or offer shares as well as cash by way of consideration for an acquisition). In the absence of significant inflationary pressure, they are relatively immune from falls in share prices generally, as the value of their cash trust fund does not diminish in a falling market (which may enable them to get more for their money).” – Westlaw

SPACs as a Third Way to Go Public

Often, SPACs and Special Purpose Vehicle (SPVs) hold funds for investment or distribution. To start, here are a few mechanics behind SPACs and SPVs. When an SPV is treated like a SPAC, and is not utilized for the purpose of holding sequestered or reserved funds, SPACs pay up to 5% on the money it raises to the book running the bank.

At this moment in economic history – long-term interest rates and the COVID pandemic – SPACs are being seen as a third way to go public. As of late, Silicon Valley luminaries Peter Thiel and Reid Hoffman have joined in the SPAC boom.

“When a SPAC completes its IPO, usually 100%, but in no event less than 90%, of the funds raised are held in escrow to be released either upon completion of a business combination transaction, or back to shareholders in the event a transaction is not completed within a set period of time. A SPAC business combination must have a market value of at least 80% of the value of the amount held in escrow at the time of the agreement to enter into the transaction. Shareholders that object to the business combination have the right to convert their shares into a pro rata share of the funds held in escrow. A SPAC generally has 24 months to complete a business combination; however, it can get up to one extra year with shareholder approval. If a business combination is not completed within the set period of time, all money held in escrow goes back to the shareholders and the sponsors will lose their investment.” – Laura Anthony, Esq.

What does this mean for the market?

Apart from SPACs and SPVs reverse merging with private companies, we are likely to see a plethora of cross-border M&A activity for a variety of reasons.

SPACs are almost always utilized to pool money together for an acquisition company or blank check company. In most aspects, particular 2020 funds are utilized to acquire a concern and then list the company through the SPAC as an asset and or entirely change the name and structure of the SPAC into the target company. Recent examples include DraftKings, Nikola and Virgin Galactic.

Going public is an exciting time for many business owners and investors, but the IPO market is cyclical, and at times can ground to a halt. On the other side, a SPAC is relatively quick, requires much less interaction with the banks and investors, and has a certain element of price certainty.

Asesoramiento y ejecución de operaciones corporativas

En nuestros muchos años de trabajo en acuerdos, descubrimos que hay algunos clientes que están ansiosos por participar en una venta comercial o aumento de capital, pero simplemente no están listos o los clientes están ansiosos por comprender lo que deberían hacer para estar listos para una transacción. en un año o dos.

This work commonly involves reviewing the history, business model, management and financial accounts, board practices and records, staffing, corporate structure, any existing transaction marketing materials, forecast financial models and other items and areas that may come up in discussions:

- Evaluating potential buyer positions and developing tax and financial scenarios to help maximize after-tax proceeds;

- Preparing a strategic and competitive industry-based market assessment Identifying, assessing, and supporting potential revenue and cost synergies Preparing, populating, and managing data rooms and buyer information requests;

- El grado de preparación para las transacciones que encontramos en el negocio, incluidas las discusiones y recomendaciones sobre brechas y problemas que puedan descubrirse;

- Summary of the Owners’ available options (fundraising, listing, sale) and our view on the appropriateness of each;

- A discussion of the existing transaction marketing materials and any recommendations for improvement.