Stefan Shaffer, our New York Partner, shares the latest November 2021 Private Capital Report. The private capital market has recorded one of its most prolific years in history, with leveraged lending surpassing over $1 trillion since January. The dramatic uptick in deal flow has impacted the middle market in a dramatic fashion. It seems the private market’s capacity to digest new deal volume this year is insatiable. Read the full report below.

State of the Private Market

The private capital markets are on fire… but in a good way. New deal activity continues at the same frenzied pace that has come to characterize 2021. Thus far, there has been more than $1.3 trillion in leveraged loans and bonds executed through Q3 2021.

While most commentary respecting the heightened level of deal activity usually focuses on the mega-deals (i.e., deals for larger corporate issuers or in the public and high yield markets), the dramatic uptick in deal flow has also impacted the middle market in dramatic fashion. Recent data compiled by Refinitiv LPC shows that middle market LBO direct lending reached record levels Q3 2021, with volume rising to $16.3 billion. This is almost double the volume of Q2 2021, and 50% above the prior record set in Q4 2020.

Moreover, Refinitiv’s data details almost $33.9 billion in middle-market direct lending LBO volume for the first three quarters of the year, which is just south of the full year volume of $35.7 billion recorded in 2018. Outside of these record-setting totals for LBOs, add-on acquisitions and dividend recapitalizations totaled $9.2 billion and $2.1 billion in Q3 2021, respectively.

Increase Capacity To Process Additional Transactional Flow

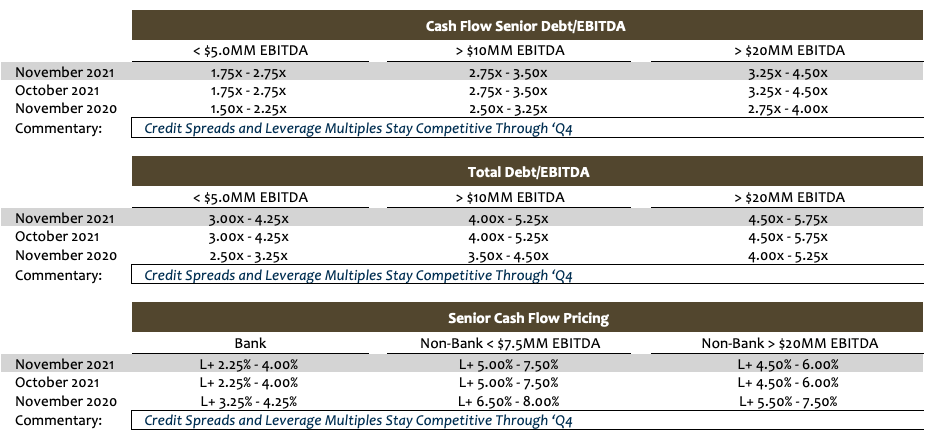

Notwithstanding the surge in new transaction volume for middle-market lending, liquidity conditions stubbornly remain as robust as they have been all year. For the third consecutive month, we are not making any changes to its “Market-At-A-Glance” pricing and leverage metrics. It seems the private market’s capacity to digest new deal volume this year is insatiable. Rather than tightening credit under the deluge on new deal activity, almost every major lending constituency reports having increased capacity to process additional transactional flow. The Fed’s most recent Senior Loan Officer survey noted a large majority of commercial banks employing looser loan standards to attract new deals – a leading economic indicator signalling future credit growth.

Another major middle-market lending constituency, business development companies (“BDCs”), are also experiencing robust improvement in liquidity conditions. Public BDCs share prices have bounced back considerably since the onset of the pandemic. As of November 3rd, 22 publicly traded BDCs have released their Q3 reports. Within this cohort, the net asset value (“NAV”) on a per-share basis has increased by an average of 5.6%.

Adding to these already “excess liquidity” conditions, new private capital continues to flow unabated into the private market. As reported by Preqin, North American focused private debt funds raised $26.8 billion over Q3 2021, a 227% increase from a year earlier ($8.2 billion in Q3 2020). The non-bank direct lending constituency continues to attract more capital than any other lending strategy (distressed, mezzanine, venture, etc.). In Q3 2021, 19 direct lending funds reached a final close, totalling $28 billion. That number is more than twice as much as all other lending strategies combined.

Paraphrasing the Boss, this market is on Fire!

Tone of the market

The private capital market has recorded one of its most prolific years in history, with leveraged lending surpassing over $1 trillion since January. Market participants have reported that the frequency and magnitude of new deals continue unabated. While conventional wisdom suggests that a market with finite resources would become increasingly selective under the barrage of such unprecedented new deal activity, that is not the case in 2021. Credit spreads and leverage multiples have remained at their most aggressive levels for the year, and the amount of dry powder available for deployment has only increased. Currently, the non-bank direct lending strategy remains the most popular form of private capital fundraising, and the impact of non-bank direct lenders has intensified competition for commercial banks, BDCs, insurance companies and traditional mezzanine lenders. While the combination of escalating inflationary influences, Fed tapering, and anticipated interest rate hikes in 2022 suggest that these halcyon days of easy, low-cost capital are limited, the private capital markets remain on fire for the time being.

Contribución mínima de capital

Most lenders remain wary of thinly capitalized deals, and as a general proposition, a minimum aggregate of 50% base level equity (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack however, even supporting cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Inversión de capital y coinversión

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

Have questions?

If you have a current or prospective liquidity need, please reach out to our Mercados de deuda privada. team. You can reservar una llamada aquí.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Socio director y director

Stefan tiene más de 30 años de experiencia en el mercado privado que incluye cientos de transacciones en América del Norte, Asia y Europa. Antes de convertirse en director de SPP Capital, Stefan fue vicepresidente del Grupo de Colocación Privada en Bankers Trust Company, donde fue responsable de la originación, estructuración y fijación de precios de colocaciones privadas para el Grupo de Mercados de Capitales, tanto a nivel nacional como internacional.

[email protected]

Ph: +61 412 778 807