Stefan Shaffer, our New York Partner, shares the latest Private Capital Report for August 2022. Overall, liquidity conditions in the private market have changed little since July. Regardless of the data, private market institutional investors are solidly in “risk-off” mode, uniform in the belief that the U.S. is in the initial stages of a credit downcycle. Read the full report below.

Tone of the Private Market

The debate over whether the U.S. is in a recession, or if it is heading there shortly, continues unabated. Unfortunately, recent economic reports have provided little clarity on the situation. GDP has recorded negative growth for two consecutive quarters, bringing the economy, by definition, into a recession. At the same time, other key indicators, such as (i) the ISM manufacturing (52.0% in July) and services (56.7% in July) surveys, and (ii) non-farm employment (+528 thousand jobs in July) suggest sustained growth in the last few months.

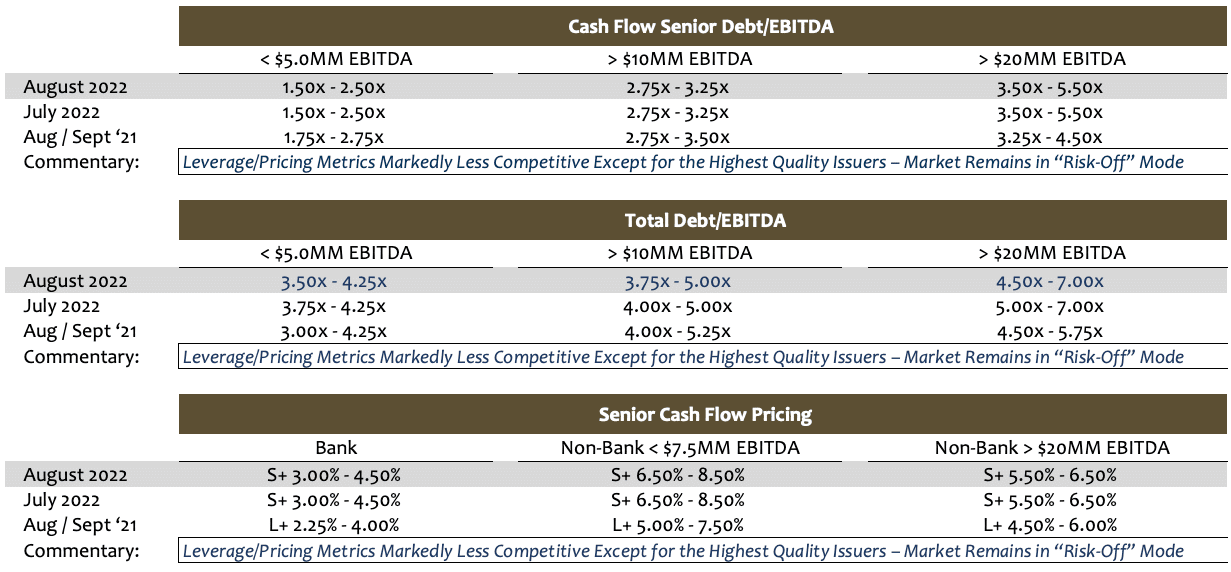

Regardless of the data, private market institutional investors are solidly in “risk-off” mode, uniform in the belief that the U.S. is in the initial stages of a credit downcycle. Overall, liquidity conditions in the private market have changed little since July. While higher quality issuers (i.e., (i) $20+ million of LTM EBITDA, (ii) Total Debt / EBITDA <4.0x, (iii) defensive sector focused, and (iv) utilizing an accretive uses of transaction proceeds) will find pricing and leverage multiples exceedingly aggressive, the overwhelming majority of issuers are finding (i) increased pricing (i.e., 50 – 100bps for Senior Debt, 1.00% – 2.00% for unitranche and mezzanine offerings), (ii) tighter leverage multiples (i.e., 1.0x – 1.5x EBITDA less leverage capacity), (iii) tighter covenants, and (iv) less expansive definitions of “Adjusted EBITDA.” Non-bank direct lenders are increasing their closing fees as well from 2.00% to 3.00%. Historically, August is the slowest month in the private market, and that will especially be the case in 2022 as post-Covid travel is peaking. Expect sluggish activity and response times until Labor Day.

Contribución mínima de capital

Minimum equity contribution levels required in leveraged buyouts have remained relatively consistent since 2017, ranging from a low of 44.5% in 2018 to a high of 44.8% in 2021. As a general proposition, lenders remain wary of thinly capitalized deals and that is especially true for 2021 vintage financings where enterprise multiples were elevated. Minimum aggregate base level equity of 50% (inclusive of any rollover) is likely required for most deals, with at least 30%-35% minimum new cash equity. The market remains relatively tolerant of “structured-equity” solutions below the debt stack, including cash-pay (or cash/PIK) preferred structures between the debt and common shares.

Inversión de capital y coinversión

Liquidity for both direct equity investment and co-investment continues unabated. Whereas opportunities for equity co-investment historically were limited by most traditional lenders or relegated to a small percentage of their aggregate debt commitment, interest in equity co-investment has boomed. In most cases, the ability to offer an equity co-investment (and the accompanying “upside” equity potential) will generate lower all-in borrowing costs, enhanced amortization flexibility, and more robust adjustments to EBITDA. Interest in independently sponsored deals also continues unabated, especially in those cases where an independent has secured an LOI at “value” pricing. Family offices are still the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

Liquidez de recapitalización

As M&A activity remains at a fraction of its 2021 levels, recapitalization activity continues to account for most new transaction volume. While recapitalizations for sponsored transactions are generally better received than those for non-sponsored transactions, significant liquidity remains for non-sponsored transactions with conservative leverage multiples (i.e., 2.5x – 3.5x total debt/EBITDA). For both sponsored and non-sponsored transactions, the aggregate proceeds generated by recapitalizations will be a function of perceived enterprise value, with leverage multiples reaching up to 50% of enterprise value for issuers with more than $20 million in LTM EBITDA.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Socio director y director

Stefan tiene más de 30 años de experiencia en el mercado privado que incluye cientos de transacciones en América del Norte, Asia y Europa. Antes de convertirse en director de SPP Capital, Stefan fue vicepresidente del Grupo de Colocación Privada en Bankers Trust Company, donde fue responsable de la originación, estructuración y fijación de precios de colocaciones privadas para el Grupo de Mercados de Capitales, tanto a nivel nacional como internacional.

[email protected]

Ph: +1 212 455 4502