Stefan Shaffer shares the latest US Private Capital Report for June 2023. The private credit markets are evolving from recession to resilience. While credit committees across the lending spectrum remain solidly in “risk-off” mode, there are expanding “green-shoots” of optimism that macroeconomic conditions might be improving, and that the long anticipated late 2023 recession may not actually materialize. Read the full report below.

Shifting Outlook in Private Capital Market

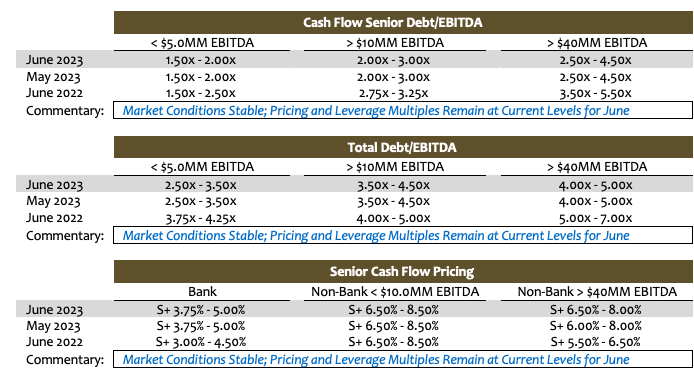

We are not making any changes to its pricing or leverage metrics for the month of June. To all outward appearances, market conditions have entered a period of stasis, characterized by higher pricing and less leverage capacity. Beyond the headline metrics however, lenders are acutely focused on capital structures (50% debt/total capitalization minimum), closer scrutiny is given to the use of proceeds (non-accretive dividend recaps are frowned upon), commercial bank hold levels have declined appreciably (anecdotal evidence suggests hold levels are ~60% of what they were a year ago), regional banks continue their retreat from their traditional base of family and entrepreneur-owned businesses, and non-bank direct lenders are migrating to larger EBITDA-generating issuers (increasingly to a >$10 million minimum LTM EBITDA cutoff).

Inexplicably, despite an increasingly adverse issuance environment, middle market loan issuance has actually surged in 2023 and, year to date, stands at approximately 200% of 2022 levels. Though loan issuance has spiked in 2023, loan balances on U.S. bank balance sheets continue to decline, dropping more than 3.7% since March. Strange times indeed.

A “Soft Landing” and Averting an Actual Recession

It is no secret that almost every lending constituency in the private capital markets entered 2023 underwriting to a recession scenario; in fact, the odds of a recession in January stood just below 70%, according to the NY Fed. With the Fed’s laser focus on reducing inflation, it raised the Fed Funds rate 10 consecutive times before pausing earlier this month. Consequently, the market has been characterized by higher interest rate costs (SOFR currently sits at ~5.05%), resultingly lower fixed charge coverage, and ostensibly increasing defaults and bankruptcies.

Earlier this month, Lincoln International said its proprietary private market database (which includes over 4,750 portfolio companies held by more than 145 sponsors) revealed that 45% of companies could register “notable and worrying” declines in fixed charge coverage ratios as of the first quarter, pro forma for a 5.5% base rate (a mere 45 basis points from where we sit today). Deutsche Bank predicts that the leveraged loan default rate will hit its highest level since the Great Financial Crisis (“GFC”) of 2008. To date, defaults in the syndicated leveraged loan market have in fact risen throughout the year (33.2 YTD), while defaults in the direct lending market have increased but at a much lower level (22 YTD). Bankruptcies have also increased (286 YTD in 2023 vs. 138 YTD in 2022).

As we enter the summer months it is not so much whether underwriting to a recession scenario was the right call in January (evidence suggests it was), but whether it is the correct underwriting strategy for the second half of the year. Recent macroeconomic reports suggest the Fed’s policy (as well as extraneous global economic forces) may in fact have succeeded in effecting a “soft landing” and averting an actual recession.

Goldman Sachs’ Chief Operating Officer John Waldron recently noted at Bloomberg Invest New York 2023 that the U.S. may avoid the recession many economists predicted. “This is the best predicted recession that hasn’t happened yet and may not happen.” On June 20th, a New York Times headline read, “What Recession? The Economy’s Staying Power Poses Big Questions for the Fed.” The article went on to note, “Employers are hiring rapidly. Home prices are rising nationally after months of decline. Consumer spending climbed more than expected in a recent data release. America’s economy is not experiencing the drastic slowdown that many analysts had expected in light of the Federal Reserve’s 15-month, often aggressive campaign to hit the brakes on growth and bring rapid inflation under control.”

Liquidity Conditions Likely to Improve

It is clearly premature to suggest that liquidity conditions in the private capital markets are likely to improve dramatically in the near future; however, there are potential “green shoots” of optimism that seem to suggest the lock of the risk-off mentality that has dominated the private lending community thus far may be loosening. Already in the much more “reactive” publicly traded and 144A markets, there has been a well-defined spread compression between “BB” and “BBB” spreads (~75 basis points between March and June). Even in SPP’s anecdotal experience for deals in the market within the past 30 days, non-bank direct lenders are increasingly bidding higher quality unitranche facilities in the SOFR 6.25% – 6.50% range, down from a more uniform SOFR + 7.00% minimum in the March through May period.

While it remains to be seen whether current trends will continue, there is little doubt that, for the time being at least, these are very strange times.

Tone of the Market

Leverage and pricing metrics for the month of June have stabilized at their current levels, which is both good and bad news; good in the sense that there seems to be no further deterioration of liquidity dynamics, but bad in the sense that current market conditions remain at among their most conservative and illiquid levels in the last decade. While credit committees across the lending spectrum remain solidly in “risk-off” mode, there are expanding “green-shoots” of optimism that macroeconomic conditions might be improving, and that the long anticipated late 2023 recession may not actually materialize. Pricing has improved modestly in the more “traded” public and 144A markets, suggesting that a thaw in private market pricing and leverage conditions could soon follow. Nevertheless, two fundamental hurdles stand in the way of any substantive reversal of private market liquidity constraints: (i) regional commercial banks continue to battle a myriad of adverse influences (i.e., enhanced regulatory oversight, capital adequacy considerations, liquidity constraints, and depositary migration); and (ii) after 10 successive Fed rate increases, even with the June “pause”, SOFR base rates hover around 5%, driving even the most aggressive non-bank lending senior debt lending coupons to floating rates of ~11.5% – 12.5% (i.e., SOFR +6.5% – 7.5%). With capital costs at current levels, debt service ratios continue to be tested, increasing the likelihood of increased defaults and potential bankruptcies.

Contribución mínima de capital

Cash equity contributions have become the primary focus point for all leveraged buyouts in the private market. Almost regardless of the enterprise multiple, lenders are focused on a minimum 50% LTV (i.e., equity capitalization of 50%). More importantly, actual new cash in a deal should also constitute at least 75% of the aggregate equity account. For the foreseeable future, the days of 20% – 25% equity contributions are over. While lenders will certainly give credit to seller notes and rollover equity, the new cash equity quantum is the primary metric.

Inversión de capital y coinversión

Liquidity for both direct equity investments and co-investments continues to be robust in the new year, and in many cases, more competitive debt terms can be achieved where there is an opportunity for equity co-investment. Interest in independently sponsored deals continues to be strong as well, but investors will require that the independent sponsor has real skin in the game (i.e., a significant investment of their own above and beyond a roll-over of deal fees). Family offices remain the best source of straight common equity, and, continuing the trend established in 2020, credit opportunity funds, insurance companies, BDCs, and SBICs will actively pursue providing both debt and equity tranches.

*Securities offered through SPP Capital Partners, LLC: 550 5th Ave., 12th Floor, New York, NY 10036. Member FINRA/SIPC

Stefan Shaffer

Socio director y director

Stefan tiene más de 30 años de experiencia en el mercado privado que incluye cientos de transacciones en América del Norte, Asia y Europa. Antes de convertirse en director de SPP Capital, Stefan fue vicepresidente del Grupo de Colocación Privada en Bankers Trust Company, donde fue responsable de la originación, estructuración y fijación de precios de colocaciones privadas para el Grupo de Mercados de Capitales, tanto a nivel nacional como internacional.

[email protected]

Ph: +1 212 455 4502